The enthusiasm generated by lower headline inflation, especially in the US, has caused an inflow of money into mixed-assets funds with higher allocation to equities while more defensive portfolios have generally been shunned, a study by Trustnet shows.

By analysing the money that flowed into and out of three IA Mixed Investment sectors, a clear preference for the riskier IA Mixed Investment 40-85% Shares emerged. Below, we highlight the funds in each of three IA sectors that have attracted or shed more than £100m in the first half of 2023.

Portfolios with an allocation between 0% and 35% to shares were the least-liked by investors and none made it into the list. The biggest inflows here went into IFSL YOU Multi-Asset Blend Cautious, which added £94m over the period.

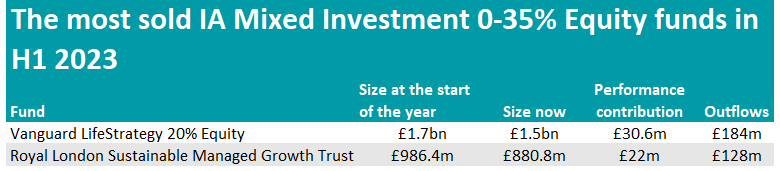

The two funds that suffered the most from investors’ withdrawals were Vanguard LifeStrategy 20% Equity and Royal London Sustainable Managed Growth Trust, as shown in the table below.

Source: FE Analytics

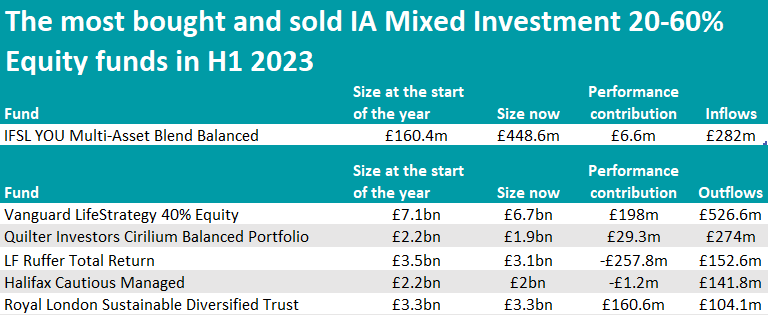

Another Vanguard LifeStrategy fund, Vanguard LifeStrategy 40% Equity, featured in list for the next bracket of funds, parting with more than half a million of investors’ money, despite having returned 3%)in the first six months of the year.

This fund is usually widely appreciated for its simplicity and cost-effectiveness.

Other IA Mixed Investment 20-60% Shares portfolios losing investor confidence were Quilter Investors Cirilium Balanced Portfolio, which came in second position, and LF Ruffer Total Return in third, a FE fundinfo five-Crown rated fund that is co-managed by FE Alpha Manager Steve Russell.

The £3bn strategy, usually appreciated for its absolute return focus, its unconstrained nature and its flexible investment approach, has managed to stay in the first two performance quartiles over the long term, but has been struggling recently.

On the other hand, only IFSL YOU Multi-Asset Blend Balanced convinced investors. It invests in a combination of growth- and income-focused strategies and in the six-month period more than doubled its size, as illustrated below.

Source: FE Analytics

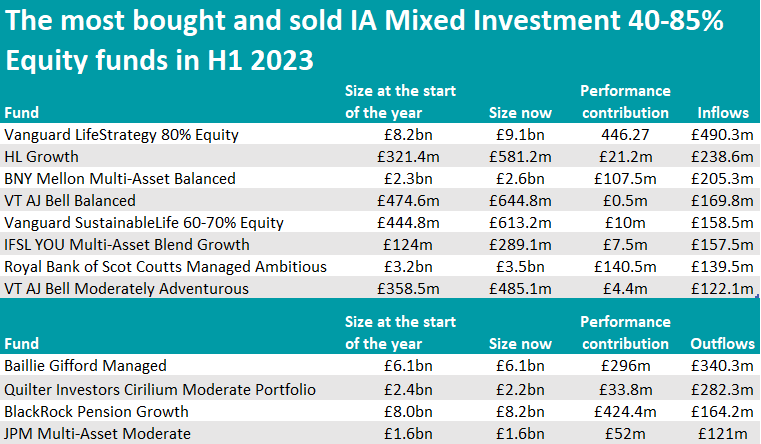

But it was the IA Mixed Investment 40-85% Shares sector that went through the more significant movements.

Vanguard LifeStrategy 80% Equity attracted the most money among the funds in the list and matched the amount with the same level of return, reaching £9bn of assets under management (AUM).

The sustainable member of Vanguard’s mixed asset range, Vanguard SustainableLife 60-70% Equity, was also among the favourites.

Source: FE Analytics

In second position was HL Growth, but it added less than half the amount of the top Vanguard fund.

Close behind was BNY Mellon Multi-Asset Balanced, a five FE fundinfo Crown-rated portfolio.

It has been highlighted by Square Mile analysts for the conviction-driven approach of the managers, the experience and tenure within the business of the lead manager Simon Nichols, and the “well-regarded” global analyst team. It pairs its equity exposures with assets which have historically shown a low correlation to equities and which should provide “a natural hedge”, namely government bonds and cash.

Among the remaining funds, IFSL YOU Multi-Asset Blend Growth and VT AJ Bell Moderately Adventurous stood out, both assigned five Crowns by FE fundinfo analysts.