Interest rates remain volatile and so do savings account rates, which is why savers need to check how much they are accruing and switch if they’re getting a raw deal, says Rachel Springall, finance expert at Moneyfactscompare.

The Bank of England’s base rate hikes have (or at least should have) a direct impact on how much you can make from savings, and despite the recent drop in inflation, we could see more increases going forward – meaning cash yields may rise yet again.

But the savings market is also benefitting from provider competition pushing rates up, so it’s “vital” consumers take time out to compare the latest offerings.

“Savers must ensure they keep on top of the changing market and switch if they are getting a raw deal,” said Springall.

“Inflation still has an eroding impact on savers’ cash, but they can at least secure a higher interest rate to mitigate its impact.”

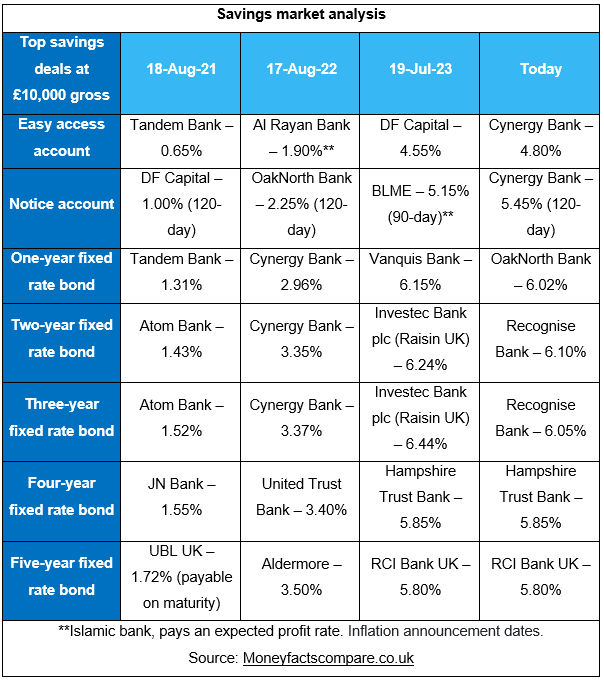

The number of deals able to outpace inflation has not changed since last month, with not one standard savings account that can match 6.8%. This was the case in 2021 and 2022 as well, as the chart above shows.

However, you can lock a 6% rate now, which will look much more attractive in the third quarter of 2024, when the projected rate for inflation is 2.8%.

“Savers looking to maximise the interest they earn on their savings will find one-year fixed rate bonds are currently paying the top rates. If you’re looking to supplement your income, you may then want to lock into a deal that pays monthly interest,” said Springall.

“Savers who want flexibility with their cash will find easy access accounts have continued to improve over recent weeks, due to a combination of Bank of England Base rate rises and provider competition. However, a few of the top accounts carry certain criteria, such as dropping the rate when someone breaches a set number of withdrawals, or that they pay a bonus for a year or so.”

Whichever the choice, the rate should be reviewed regularly to ensure it remains competitive.

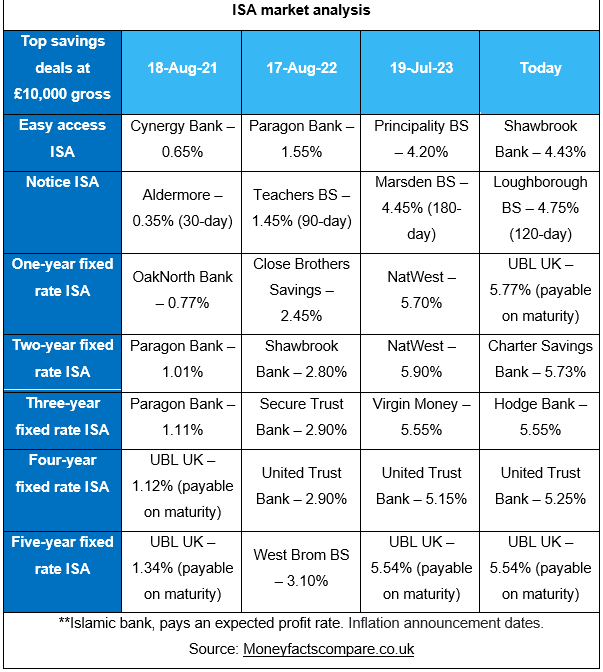

One area of market that improved has been the returns offered on cash ISAs, so those savers who are still able to use their ISA allowance may wish to compare the latest offers.

“As interest rates rise, savers may find they could breach their personal savings allowance, and an ISA is a way of protecting their cash from tax. There are even ISAs that allow savers to spread their cash across both easy access and fixed offers, ideal for those who want to chase the highest rates but also need a portion kept in a flexible pot,” Springall said.

“It is imperative savers keep an eye on the changing market and sign up to rate alerts and newsletters for awareness.”