Workplace pensions have contributed to more people investing for their retirement, but almost half of those who have them don’t understand the key benefits they bring, according to new research from TPT Retirement Solutions.

It emerged that some savers are unaware that they get tax reliefs on workplace pension contributions, that they can change their contribution levels and that they might be eligible for a higher employer contribution.

Another mistake often made is to never check whether the automatically selected pension funds align with one’s retirement plans or perform in line with the rest of the market.

Below, we look into Royal London’s mixed asset pension range and reveal which of its funds have been the best performers of the past decade.

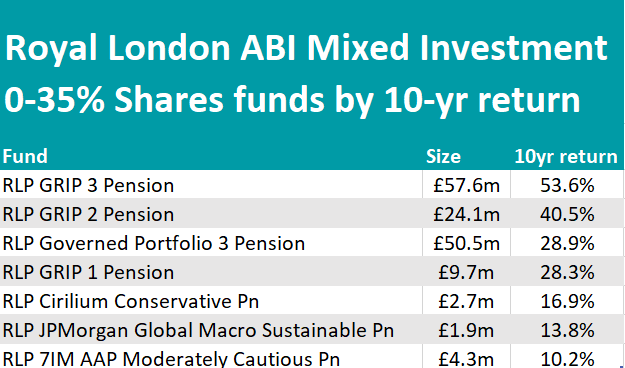

If your ABI Mixed Investment 0-35% Shares fund has made less than 21.8% over the past 10 years, you are getting below-average returns. With Royal London, that’s only the case for three small funds: RLP Cirilium Conservative Pn, RLP JPMorgan Global Macro Sustainable Pn and RLP 7IM AAP Moderately Cautious Pn, as shown in the table below.

Source: FE Analytics

All other Royal London funds in this sector have beat the average peer, with the highest return achieved by RLP GRIP 3 Pension.

The fund is part of the Royal London Governed Retirement Income Portfolio range, led by Trevor Greetham, where investors can choose one of five funds with increasing levels of risk based on their tolerance.

The first three versions of the fund all appear above and are differentiated by their exposure to fixed income – the lower-risk one has 23.8% of its portfolio in government bonds and 22.4% in corporate bonds, with these weightings progressively inverting in the second fund (20.8% and 15.3% respectively) and then making room for equities in the third fund, which has 16.1% in corporate bonds, 14.4% invested in North American equities and 12.5% in government bonds.

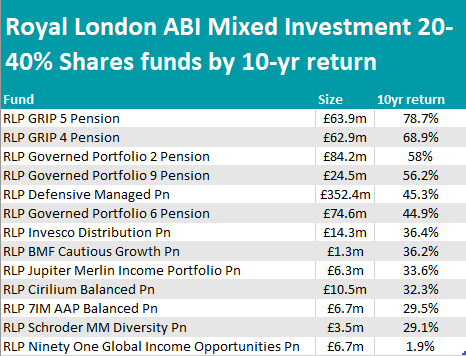

This fund range has also beaten the average return in the 20-60% Shares sector, where RLP GRIP 5 Pension and RLP GRIP 4 Pension have delivered 78.7% and 68.9% respectively, against the average 30.6%.

Source: FE Analytics

The biggest fund in this risk bracket, with £352.4m of assets under management (AUM), was RLP Defensive Managed Pn, which invests in other Royal London funds and aims to maximise real returns over a five year time period.

Among the funds managed for Royal London by third parties, Ciaran Mallon’s and Edward Craven’s RLP Invesco Distribution Pn strategy stood out with a 36.4% return. They focus on high-yield and investment-grade bonds, especially in the financial sector.

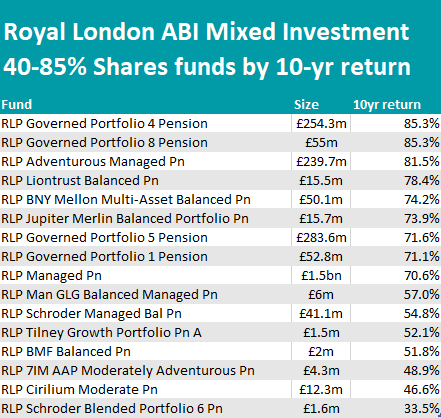

Source: FE Analytics

Third-party funds are more numerous in the ABI Mixed Investment 40-85% Shares table, but it’s again Royal London’s own RLP Governed Portfolio 4 and 8 Pension that deliver the best returns.

The Portfolio 4 aims to deliver above-inflation growth in the value of the fund at retirement and has lately been overweight equities, with the underlying macro picture “remaining supportive for the asset class”, as Greetham explained in the fund’s factsheet.

“However, following a strong year-to-date rally, and with our sentiment indicator showing that investors are at overly bullish levels, we have taken some profits,” he said.

“Elsewhere, we have added to commodities, moving overweight in the asset class, with inventories constrained and on-going geopolitical risks persisting.”

The two asset classes make up 72.7% and 3.9% of the portfolio, respectively.

This fund has beaten the more popular £1.5bn RLP Managed Pn, whose returns have been restrained by its fixed income exposure.

The only vehicle in the list with a FE fundinfo five-Crown rating and an FE Alpha Manager was RLP BNY Mellon Multi-Asset Balanced Pn, a strategy co-led by Bhavin Shah and a team of managers who have a bias to equities and employ a conviction-driven approach.

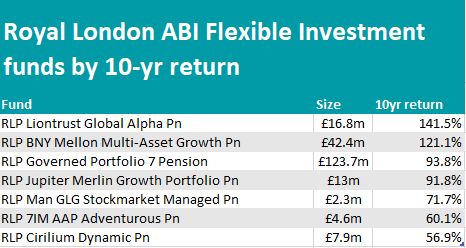

The growth-focused version of this BNY Mellon fund made it to the second position in the ABI Flexible Investment table below, but it was RLP Liontrust Global Alpha Pn, managed by Tom Record, to come out on top with a 141.5% performance against the 71.5% return of the whole sector.

Source: FE Analytics

The fund has 59 holdings and, when compared to its benchmark the MSCI All Country World index, keeps an overweight to consumer discretionary and healthcare and an underweight in information technology and financials.

RLP Jupiter Merlin Growth Portfolio Pn and RLP Man GLG Stockmarket Managed Pn also stood out.

This article is part of an ongoing series on best-performing pension funds by provider. In the previous instalments, we looked at Scottish Widows and Aviva funds.