Government bond yields rose to their highest levels in more than a decade last week as investors sold out of them en masse.

Strong employment data from the US proved that the Federal Reserve’s (Fed) efforts to slow inflation were not as effective as anticipated, making it likely that interest rates would stay higher for longer.

Investors dropped their government bonds on the back of this news and bought others offering a greater yield, consequently lowering their prices.

The volatility from an asset class investors may have previously considered a reliable ‘safe haven’ could lead them to wonder how they can defend their fixed income assets within their own portfolio.

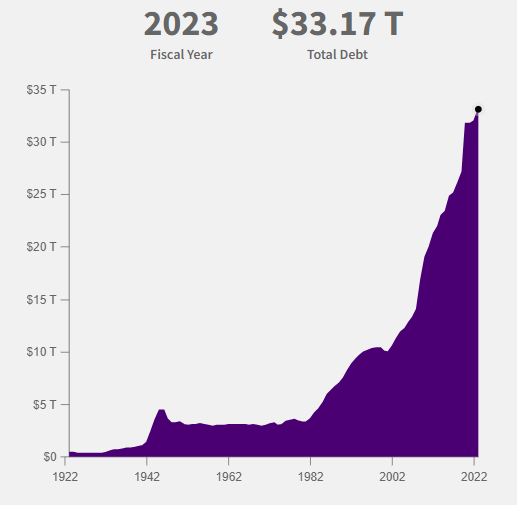

Indeed, with national debt levels already at high levels and a potential recession on the horizon, John Plassard, senior investment specialist at Mirabaud, said that this instability in bond markets is adding fuel to the fire.

US national debt over the past 100 years

Source: US Department of the Treasury

“Economies have shown resilience in the face of rising rates, but as post-pandemic liquidity reserves run out and loans locked in at low rates come due, businesses and households will be under increasing pressure in the months ahead,” he said.

“Rising bond yields threaten to exacerbate the turbulence, while slowdowns are already expected in the US and Europe next year.”

Even with further volatility ahead, investors can get exposure to fixed income that is shielded from market volatility with the Premier Miton Corporate Bond Monthly Income fund, according to Ben Yearsley, director of Fairview Investing.

He said investors who want reliable income should focus on the investment grade area of the fixed income market. While higher yielding bonds may pay more, they have a greater chance of defaulting when markets fluctuate as they have now.

“I think investment grade should be the focus for a durable fund,” Yearsley added. “I don't like gilt funds as you lose the tax breaks, otherwise they look good value today. The next best thing is investment grade bonds, with many yielding above 6% – some even offer 7% currently.”

Premier Miton Corporate Bond Monthly Income did not make the highest return over the past decade – up 13% versus the IA Sterling Corporate Bond sector’s 21.6% average gain – but it was one of the least volatile over that period.

Total return of fund vs sector over the past 10 years

Source: FE Analytics

Yearsley credits much of this consistency and risk management to FE fundinfo Alpha Manager Lloyd Harris, who joined the firm from Merian with co-manager Simon Prior in 2020.

He said: “Harris takes a much more active approach than many managers as he likes taking advantage of new issues and shorter-term opportunities. The overriding feature is that he wants his bonds to be high quality and very liquid.”

Likewise, investment analysts at RSMR also highlighted Harris’ expertise in the fixed income sphere, particularly his ability to protect from losses in downward markets.

“This is an important characteristic for any investor,” they said. “It has also demonstrated that it is a clear diversifier from an equity portfolio. We believe that [the managers] are capable, over the longer term, of delivering relatively consistent above average returns from this asset class.”

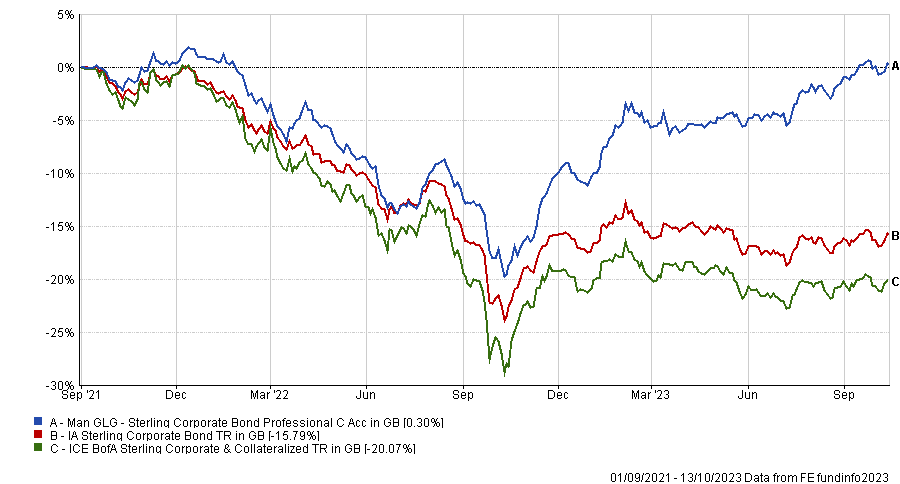

Tom Sparke, investment manager at GDIM, also highlighted a corporate bond fund that has shielded returns from market volatility – Man GLG Sterling Corporate Bond.

Since launching in 2021, it is one of two funds in the IA Sterling Corporate bond sector that generated a positive fund, climbing a modest 0.3% whilst its peers dropped 20.1%.

Sparke added: “The fund invests in fixed and floating rate securities from UK and non-UK companies, employing a highly selective bottom-up approach in a flexible mandate spanning various sectors.

“It has performed remarkably well over the recent turbulence in bond markets, managing to traverse a difficult time with positive returns.”

Total return of fund vs sector and benchmark since launch

Source: FE Analytics

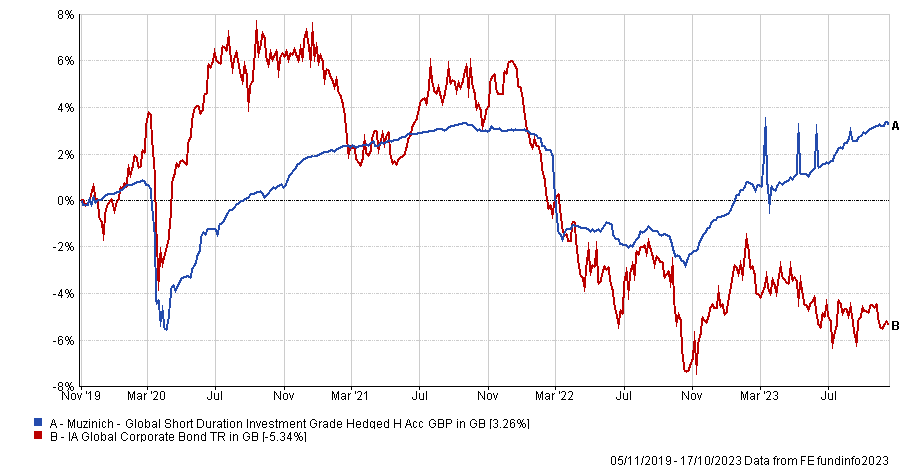

Likewise, investors may want to get exposure to corporate bonds through the Muzinich Global Short Duration Investment Grade fund, according to Adam Carruthers, collectives analyst at Charles Stanley.

He said this area of the bond market is perceived as making low, cash-like returns, but the outlook for them from here is strong.

“This is not a cash proxy,” Carruthers explained. “In the largely benign credit environment experienced since the global financial crisis, many have viewed short-dated investment grade funds as cash-like instruments.

“As we enter a new regime for rates and credit, this thinking should be discarded. Investors can now achieve attractive yields, even in this lower risk part of the credit market, but it is certainly not risk-free.”

Despite its reputation as a cash proxy, Muzinich Global Short Duration Investment Grade is up 3.3% since launching in 2019, taking a significant lead on the IA Global Corporate Bond sector’s 5.3% fall.

Total return of fund vs sector since launch

Source: FE Analytics

For investors willing to take on more risk, QuotedData senior analyst Matthew Read said CQS New City High Yield has delivered strong performance whilst being defensive against market volatility.

Offering a 9.3% yield today, the fund has made a total return of 68.4% over the past decade, although this came with more than three times as much volatility as the Premier Miton fund above (14.4% vs 4.6%).

Total return of trust vs sector over the past 10 years

Source: FE Analytics

Read noted that long-running manager Ian Francis, who has led the trust from launch in 2007, has “a strong focus on capital preservation and a core set of holdings that are well understood”.

He added that, although high yield bonds are at the upper end of the risk spectrum in fixed income, Francis spreads exposure across a diverse range of sectors in developed jurisdictions.