Investors often buy global funds for exposure to a wide net of the world’s biggest companies, but some would argue that they are essentially getting US funds.

In an article about the assets that investors should avoid holding together, Bestinvest director Jason Hollands highlighted that US and global funds perform a very similar role.

The MSCI World index may appear global, but 69.7% of its assets are domiciled in the US, sharing all but one of its top 10 holdings with that of the S&P 500.

Global and US funds may seem a sensible pairing but Hollands warned that “there is a high chance that you will just be doubling up positions in many of the same stocks,” meaning caution is needed when allocating to each sector.

His solution for investors would be to get US exposure through cheap US tracker funds such as the Vanguard S&P 500 UCITS ETF, which has an ongoing charges figure (OCF) of just 0.07%.

By investing passively, investors who’d held the tracker over the past decade wouldn’t just have saved money, but made a higher return than the average active fund in the IA North America sector. The Vanguard S&P 500 UCITS ETF soared 284.7% over the past 10 years whilst the peer group trailed by 60.7 percentage points.

Total return of fund vs sector over the past 10 years

Source: FE Analytics

With a broad exposure to the US, Hollands said investors can then pick a more tailored global fund, such as WS Evenlode Global Income.

He highlighted the fund as an excellent diversifier to the US thanks to its focus on income investing – the biggest players in the US pay little to no dividends, leading FE Fundinfo Alpha Managers Ben Peters and Chris Elliott to a 28.4% weighting in American companies.

It has also led to an overweight in consumer staples, which account for 26.1% in the portfolio compared to just 6.6% in the S&P 500.

By taking a different approach to conventional IA Global funds, it made a total return of 58.1% since its inception in 2017, outpacing the 43.1% average generated by its peers.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

“While most global equity funds are two-thirds invested in US equities, the Evenlode Global Income fund’s focus on capital-lite businesses with sustainable real dividend growth results in less bias towards low (or non) dividend paying US mega-cap growth stocks,” Hollands said. “Consumer staples are also a key theme in the portfolio, providing a good counterbalance to the US market.”

Darius McDermott, managing director of FundCalibre, shared Hollands' view that pairing US and global funds alongside each other is a difficult task that investors often blunder.

He said: “It is very difficult to find a global fund that doesn’t have much exposure to the US and you might argue that, given it is the largest stock market in the world, global funds should have a reasonable exposure.”

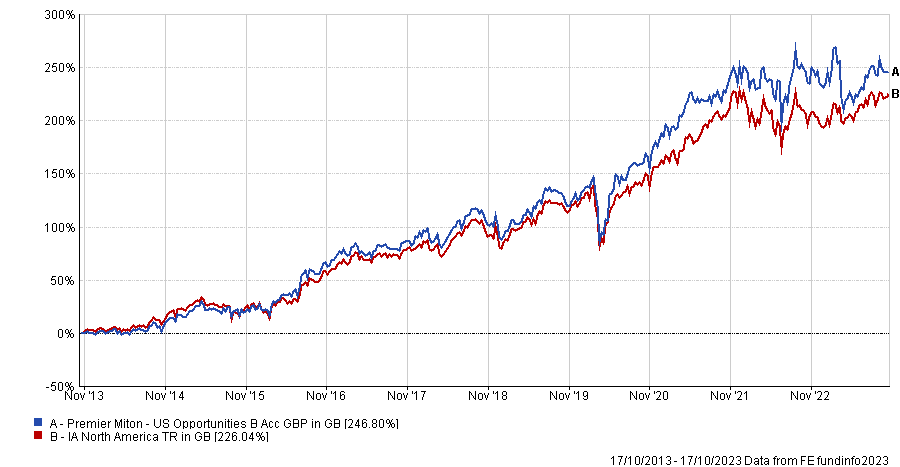

A good way to diversify away from this bias could be via the Premier Miton US Opportunities fund, thanks to its bias towards domestic companies.

Managers Hugh Grieves and Nick Ford therefore have no exposure to any of the S&P 500’s top 10 constituents that dominate 35% of the index. Despite not holding these leading names, the £1.3bn fund beat the IA North America sector by 20.8% over the past decade with a total return of 246.9%.

Total return of fund vs sector over the past 10 years

Source: FE Analytics

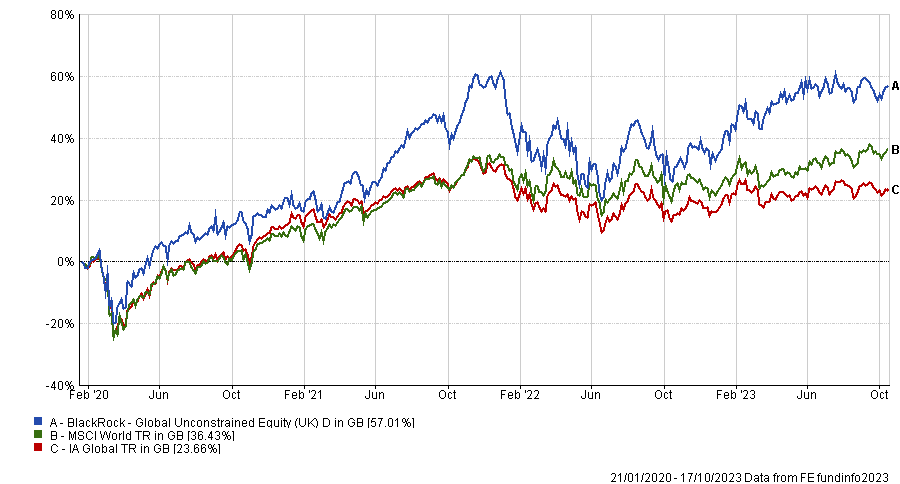

With this fund in their portfolio, McDermott said investors “could combine it with pretty much any global equity fund that has a bias towards mega-caps,” his preferred option being BlackRock Global Unconstrained Equity.

It holds two-thirds of its assets (66.6%) in US assets, which has worked out well over the three years since launch. The fund is up 57% versus the peer group’s 23.7% gain.

Total return of fund vs benchmark and sector since launch

Source: FE Analytics

However, investors wanting something with a smaller allocation to the US may want to look at Schroder Global Sustainable Value and Murray International, according to McDermott, as they hold just 37.2% and 27.7% of their assets in the region respectively.

QuotedData senior analyst Matthew Read said investors should not shy away from global funds where the US is the highest regional allocation, as it is the largest market for a reason.

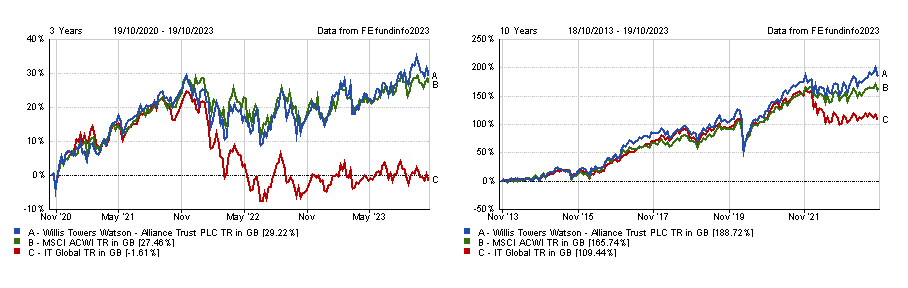

He said Alliance Trust provides the best exposure to global equities, even though it holds the majority of its assets in the US (55.4%). It is worth noting that this is still 14.3 percentage points less than the MSCI World’s allocation.

Despite its US bias, the £2.9bn trust provides a diversified range of assets due to the differing investment styles of its 10 management teams.

It beat the average IT Global trust by 79.3 percentage points over the past decade, but the benefits of its diversified approach are most notable over the volatility of the past three years.

The peer group struggled in the high inflation and interest rate environment in recent times, dropping 1.6% over that period, yet Alliance Trust made a 29.2% return.

Total return of trust vs benchmark and sector over the past three and 10 years

Source: FE Analytics

Read said: “The US is the largest market in the global equities universe and so will always be a significant allocation within any generalist global equities portfolio but the combined effect of the trust’s managers is a marked underweight to the US.

“Alliance Trust has benefited from having a mix of value and growth styles within its manager mix in recent years.”

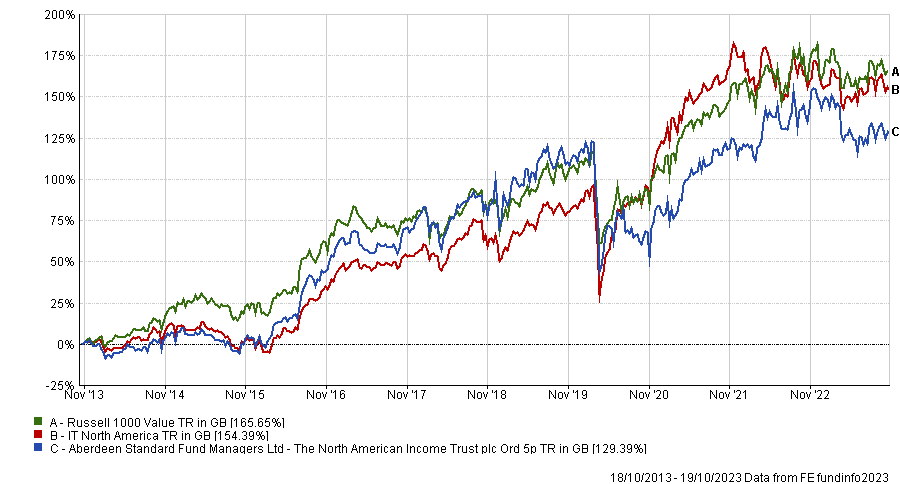

An ideal pairing to this would be the North American Income trust, according to Read. Manager Fran Radano’s value approach in a growth-oriented market means his £381m looks very different from most IT North America trusts.

For instance, technology stocks dominate the S&P 500 at a 27.5% weighting, yet Radano’s portfolio only has 8.2% in the sector.

Total return of trust vs benchmark and sector over the past 10 years

Source: FE Analytics

The trust’s 129.4% return over the past decade lingered 25 percentage points behind the peer group average, but Read noted that its 4.1% yield offers a higher income than most US funds.