JOHCM UK Dynamic was dropped from the AJ Bell Favourite Funds list this month in an effort to “consolidate the list of UK equity funds”, the firm said.

The £1.2bn portfolio, managed by FE fundinfo Alpha Manager Alex Savvides, has been a top performer for investors over both the short and long term.

Savvides looks for companies going through periods of distress but that are solving the problems they face, taking advantage of low expectations and valuations.

He prefers companies with a path to growth but mainly buys dividend-paying businesses, as this implies management are more disciplined.

This classic ‘value’ style of investing has proven successful for the manager, despite the strategy as a whole being out of favour for much of the past decade, with investors preferring growth portfolios.

Over the past decade, the MSCI United Kingdom Growth index (up 84%) has beaten the MSCI United Kingdom Value index (45%) by almost 40 percentage points.

JOHCM UK Dynamic has been a top 10 performer in the IA UK All Companies sector over one and three years, above average over five years and made a top-quartile return over the past decade.

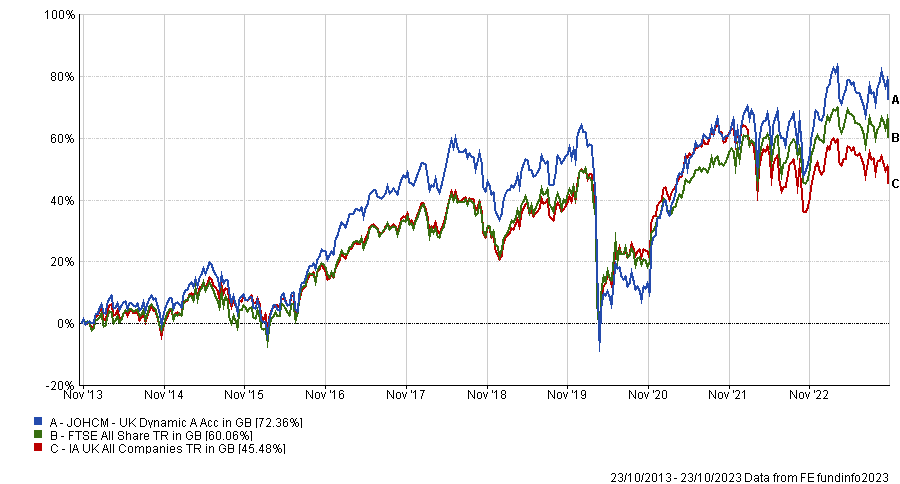

The 72.4% made over 10 years is 12 percentage points ahead of the FTSE All Share benchmark index and 27 percentage points ahead of its average rival, as the below chart shows.

Total return of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Other fund selectors disagree with AJ Bell’s prognosis.. Analysts at FE Investments continue to recommend the fund. “A restructuring or recovery process takes time to come to fruition and to be acknowledged by the market – therefore, this is a fund that requires investor patience,” they said.

“Savvides’ ‘dividend-recovery’ approach, active continued engagement with company management and sector diversification are all attractive and unique features of this fund. The focus on dividend-paying companies moderates the fund’s risky profile and can help to smooth out losses.”

The fund has an ongoing charges figure (OCF) of 0.8%, as well as a performance fee of 15% with any underperformance carried forward.

“This offsets the otherwise relative cheapness of the fixed management fee but we believe this fee is justified as this fund is unique in process and application, and has proved itself well,” FE Investments analysts said.

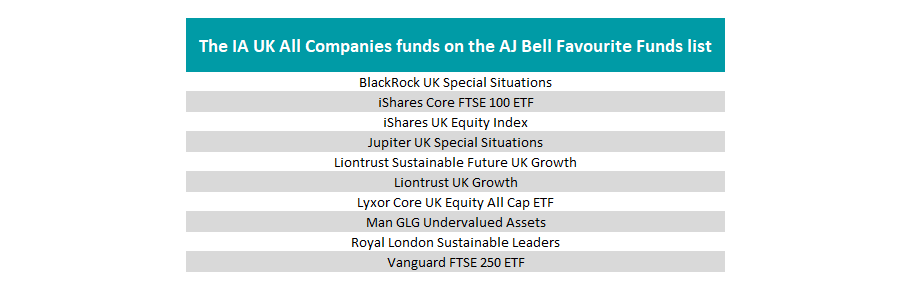

The removal of JOHCM UK Dynamic leaves 17 funds investing in UK stocks remaining on the Favourite Funds list. There are 10 from the IA UK All Companies sector, four from the IA UK Equity Income peer group and three IA UK Smaller Companies portfolios.

Source: AJ Bell