Investment consultancy and research company Square Mile has added investment trusts to its Academy of Funds recommended list for the first time, with 18 trusts gaining ratings at the first time of asking.

Previously focused on open-ended funds exclusively, the analyst team had assessed investment trusts as part of its consultancy services, so has decided to include these portfolios in the firm’s coverage.

The goal, said Square Mile’s Strategic Relationships Director Jock Glover, is to “make more informed decisions over which investment trusts are compelling propositions, with the list of rated trusts set to expand over the coming months”.

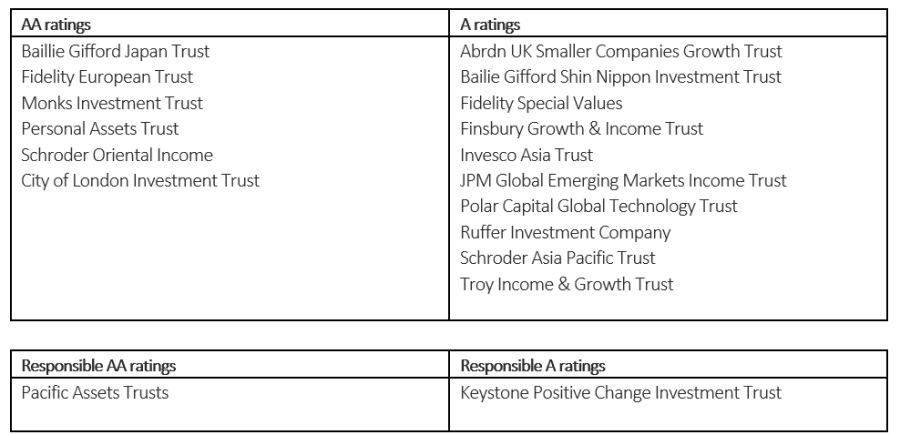

At launch, 18 vehicles made it to the list across four categories – AA ratings, A ratings and the corresponding responsible versions, as illustrated below.

Investment trusts awarded Square Mile ratings at launch

Source: Square Mile

As more trusts join the ranks, AAA ratings will also be available, together with Positive Prospect (P+), which is awarded to investment trusts considered as “having the potential to be highly compelling propositions, while some elements relating to the strategy that the analysts need more time to assess”.

Responsible ratings are awarded to investment trusts “with a responsible outcome or target incorporated into their objectives or mandate”.

As for the methodology, areas that the analysts consider before making a decision include board composition, discount control mechanism, gearing, and income.

Square Miles assesses boards for independence, relevant skill set, diversity, experience, alignment with shareholders and competence, as well as the efficacy of its actions to control the balance between the supply and demand of shares.

Gearing is taken into account for its impact on potential returns and levels of risk, and at least 85% of an investment trust’s annually accrued income must be distributed to investors, enabling the board to transfer excess income into a revenue account, which can augment future dividends.

Glover called it “a natural evolution of our research” to include closed-ended investment vehicles within the Academy of Funds.

“The ratings reflect our analysts’ conviction in the strategies’ potential to meet their investment objectives consistently. The 18 investment trusts that enter the Square Mile Academy of Funds at launch are all compelling propositions, offering investors access to a range of assets and geographies,” he said.

“This list will steadily expand over the coming months as our analysts award ratings to other investment trusts and companies providing exposure to a broader spectrum of investment opportunities.”