Investment trust discounts are at their widest since the global financial crisis thanks to the rise in passive investing, investors’ weak sentiment – particularly for illiquid assets – and the broader malaise around the UK, according to AJ Bell’s Laith Khalaf.

Yet their prices do not reflect the wider market, he argued. Calling the current discounts “bizarre”, the head of investment analysis said in 2008 the whole financial system looked like it could collapse, but this time around the risks are far lower.

“The apparent extreme level of discounts in the investment trust universe can be explained by a perfect storm of factors, some recent, others which have been building up for some time,” he said.

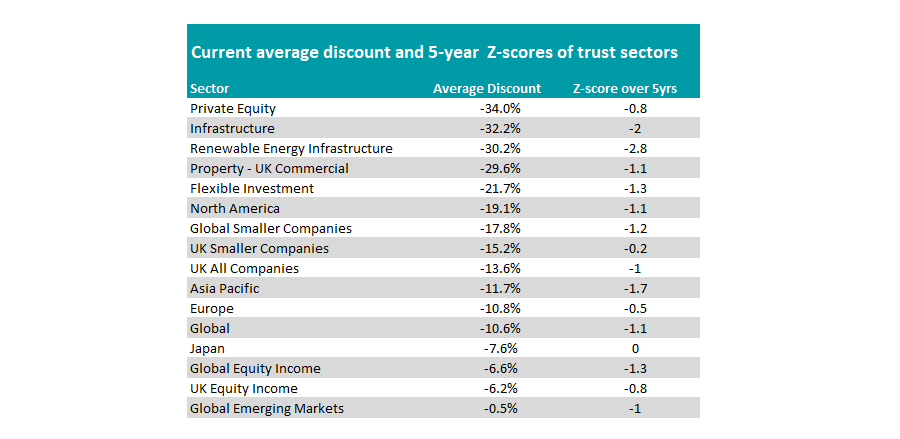

One useful metric to analyse just how far discounts have reached is the ‘Z-score’ which measures how far away a trust’s discount or premium is relative to its historical average.

A negative score means below average, with 0 to -1 cheap, but not hugely so, -1 to -2 meaning it is some way of its average, and anything below -2 suggesting it is significant cheaper than usual.

Source: AJ Bell

“The table above shows average Z-scores across selected sectors based on the past five years of pricing data. The average trusts in almost all sectors are trading at discounts below their longer-term average. Many have an average Z-score of between -1 and -2, which suggests it’s a decent entry point for these sectors, and when you come to sell, chances are you will do so closer to the net asset value of the trust,” Khalaf said.

However, he warned that it is not a catch-all metric, particularly in the current climate of rising interest rates, as the scores in sectors particularly sensitive to central bank monetary tightening such as property and infrastructure could be adversely affected.

“The average trust in both the Renewable Energy Infrastructure and Infrastructure sectors is trading at a five-year Z-score of below -2, but this partly reflects the high premium put on income streams from this sector when interest rates were near zero,” Khalaf said.

“Today’s very pronounced discounts are clearly at the other end of the spectrum, and the contrast here explains the extreme level of Z-scores currently at play in these sectors.”

So why are trust discounts so wide?

The apparent extreme level of discounts in the investment trust universe can be explained by a “perfect storm” of factors, both new and that have been bubbling under the surface for some time, Khalaf said.

Firstly, trust discounts can be used as a barometer for UK investor sentiment, which has been low in recent months as the cost-of-living crisis has reduced the disposable income available to invest.

This is compounded by an “apathy” for UK stocks, which has been ongoing since the Brexit referendum in 2016. As trusts are listed entities, they could have been swept up in this, Khalaf noted.

The rise of passives has also hampered the actively managed trust sector. Just 10 years ago tracker funds only accounted for 9% of total assets in the UK. Today this stands at 22%.

Lastly, a number of investment trusts have used the benefit of the structure to invest in areas of the market that do not lend themselves to passive or open-ended strategies.

The use of illiquid assets such as property, private equity and infrastructure – among many others – has its benefits, offering investors diversification, but tends to come with risk.

“Investors need to be particularly cautious about bargain-hunting in the illiquid market, because such wide discounts probably mean the market is expecting write downs in the underlying assets,” Khalaf warned.

This area of the market has been growing for some time however, with numerous new launches over the past decade. Indeed, none of the trusts in the IT Renewable Energy Infrastructure existed in 2008.

“The mix of the investment trust universe has shifted and very wide discounts in illiquid asset classes are exerting a greater gravitational pull on the average figures for the investment trust market,” Khalaf said.

“The upshot is investment trust buyers can today gain access to portfolios trading significantly below their net asset value, though care does need to be taken when bargain hunting.”