GAM fund managers Adrian Gosden and Chris Morrison will join Jupiter Asset Management in January, taking their £406m GAM UK Equity Income fund with them.

Gosden moved to GAM in 2017 from Artemis, where he co-managed the £10bn UK equity income franchise alongside Adrian Frost.

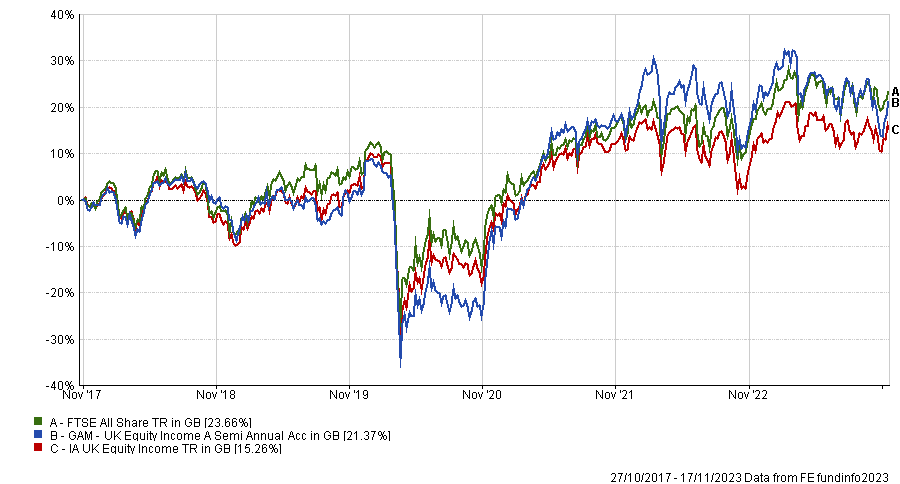

He launched the GAM UK Equity Income fund in November 2017, since when it has made 21.4%, underperforming the FTSE All Share index but beating the average peer in the IA UK Equity Income sector.

Total return of fund vs sector and benchmark since launch

Source: FE Analytics

Initially, Jupiter will manage GAM UK Equity Income under a sub-advisory agreement until it is transferred to Jupiter’s platform later in 2024, subject to customary approvals.

Gosden said: “UK equities have not been in favour with investors in recent years but the United Kingdom is home to many companies which are leaders in their field, with strong balance sheets and resilient business models.

“Valuations are low and, with the combination of strong dividends and enhanced share buybacks, I believe we will see increased appetite for the asset class from both domestic and international investors.”

Gosden and Morrison will also take charge of the £1.6bn Jupiter Income Trust, currently run by Ben Whitmore, at some point in 2024, although no date for the transition has been announced.

Value specialist Whitmore has managed the fund for more than a decade. During his tenure it has made 100.9%, beating both the IA Equity Income sector average and the FTSE All Share.

Total return of fund vs sector and benchmark during manager tenure

Source: FE Analytics

The fund is currently recommended by Hargreaves Lansdown and is included in the platform’s Wealth Shortlist. Emma Wall, head of investment analysis at the firm, said any manager change would trigger a review.

“It is positive to see Gosden find a new house which has a long track record of supporting managers who run money in a franchise style. We previously backed Gosden when he was part of the duo with Adrian Frost at Artemis but during his time at GAM his performance track record has not been sufficient to pass our quantitative analysis process for inclusion on the Wealth Shortlist.

“Any manager change for a fund on the Wealth Shortlist triggers a review process and will lead to a proposal to either remove or retain the fund. Our conviction is with Whitmore but we look forward to meeting with Gosden again in due course and conducting analysis on his attributes as a fund manager.”

Whitmore will continue to manage the £2.1bn Jupiter UK Special Situations fund as well as co-run the Jupiter Global Value and Jupiter Global Value Equity strategies alongside Dermot Murphy.