The Nasdaq 100 index has climbed an impressive 47% this year but the rally in technology stocks is only just getting started, according to Liontrust Asset Management.

Its global innovation team believes Nvidia, Microsoft and Tesla are undervalued on a five-year view given their growth prospects and that a new multi-year tech cycle, fuelled by artificial intelligence (AI), will boost productivity across a vast swathe of industries.

James Dowey, who co-heads the team, said: “We believe we’re right at the start of a new tech cycle. It’s based on AI. We believe it will create a lot of value and a lot of opportunities.”

The magnificent seven are undervalued for their growth potential

Despite this year’s rally in tech stocks, especially amongst the ‘magnificent seven’ (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) the global innovation team argued that the market is undervaluing their potential.

Nvidia’s share price has risen 234% year to date, but it is on track to grow its earnings by 440% this year compared to 2022, so Nvidia’s valuation – high as it appears – has actually failed to keep pace with its growth, said Storm Uru, co-head of the global innovation team.

Rather than focusing on a company’s price-to-earnings (P/E) ratio to ascertain its valuation, Liontrust has been looking at the ‘PEG’ ratio – the P/E ratio divided by the earnings growth rate. The PEG ratio for the median stock in the S&P 500 index is currently 1.46x. Nvidia’s is significantly lower at 0.47x.

Liontrust's Global Technology fund has exposure to all of the magnificent seven, but prefers some to others. “After this year’s strong price returns across all seven stocks we maintain large weightings in Nvidia, Microsoft and Tesla but only small positions in the other four companies,” Uru said.

Nvidia has a 90% market share for AI chips and a 10-year lead on its peers, he added. Its graphics processing units (GPU) chips have unlocked accelerated computing, which is 10 times faster than traditional computing, three times more energy efficient, five times smaller and 90% cheaper.

Microsoft’s Copilot tool for software developers is improving productivity by 33-55%, saving developers up to two hours a day, while costing a competitive $20-55 a month per user. As such, Copilot is providing a return on investment on day one, which is virtually unheard of, Uru said.

Tesla is also far ahead of its competitors. “In the next decade, cars are poised to become computers on wheels. The Tesla Model Y epitomises this transformation. It is faster, safer, more cost-effective, and offers a superior driving experience compared to traditional combustion vehicles, evidenced by becoming the world’s top-selling vehicle in the first quarter of this year,” he explained.

“Over the past decade, Tesla has carved out a dominant position in this cutting-edge market, with incumbents only recently awakening to the magnitude of their shortfall. Tesla’s ascendency stems not just from its unique production processes and direct-to-consumer distribution strategy, but also from its innovative software operating system, Tesla OS, which is comparable to Apple’s iOS and Nvidia’s CUDA.”

Anatomy of the new tech cycle

All that said, the new tech cycle is a much broader story beyond the magnificent seven. Within the Liontrust Global Technology fund, 32 different companies have contributed at least 50 basis points to performance year to date.

Technology is one of the highest quality sectors now that companies have emerged from 2022’s recession leaner and more efficient.

“Last year, the stock prices of numerous technology stocks declined significantly in tandem with earnings, typically falling between 50% and 90% from their recent highs. This convergence of an earnings recession and a precipitous drop in stock prices has prompted management teams in the technology sector to shift their focus towards profitable growth, moving away from the previous strategy of pursuing growth at any cost,” Uru said.

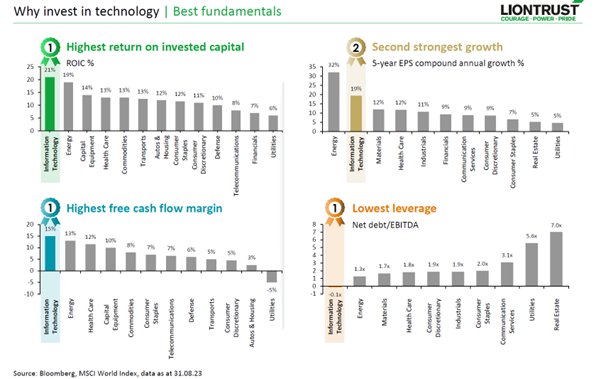

As the charts below show, technology has the highest return on invested capital of any sector, the highest free cash flow margin and the lowest leverage.

Dowey added: “What does a new cycle need? A new cycle needs a recession to wash off the excesses and get started again. They have not wasted the crisis.”

Given that the tech sector went through a recession before other industries and cut costs and headcount, Dowey said tech now has a first mover advantage, evidenced by performance this year, with 60% of stocks in the MSCI World Technology index beating the broader MSCI World.