It has been 23 years since Nick Train took over the management of Finsbury Growth & Income, investing in what he deems to be “excellent” UK companies, and he has no plans to step aside any time soon.

Having managed the investment trust for more than two decades, it would be understandable for succession to be on the agenda, but Train said, if he had his way, he would only be “halfway through” his tenure, implying another 23 years at the helm. More realistically, he is hoping for another seven to 12 years at a minimum.

He said: “My personal aspiration is that I would only be about halfway in my tenure of this trust. I have not yet a quarter of a century running it, but it would be nice to get up to 30 or 35 years. Let's see.

“For good or for ill, we have a very long-term perspective on these investments. We have owned Diageo since 2002 and Sage since 2003. These are long-term core holdings and I take a similar perspective on my tenure with this investment trust.”

A caveat to this commitment is that Train and his team have to be retained to keep managing the Finsbury Growth & Income.

“The board will determine whether or not we continue. I sincerely hope that we do but that's the board’s call, not mine,” Train said.

However, he is far from alone, noting that there are people working closely with him on the strategy who are “more than competent” to run the strategy if he was unable to run it anymore.

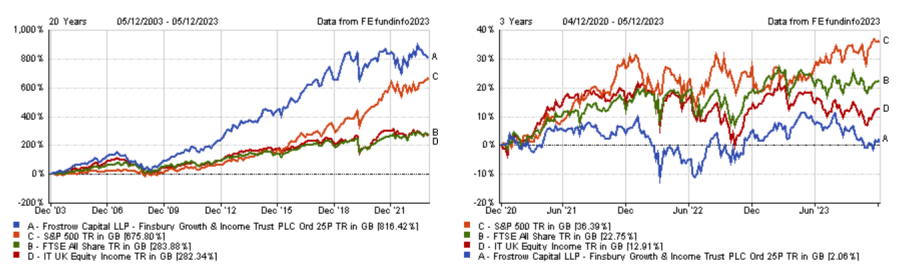

There is, however, one thing Train is not happy with, which is the trust’s performance over the past few years. Although Finsbury Growth & Income has outperformed both the FTSE All-Share and the notoriously hard-to-beat S&P 500 over the long-term, it has lagged its benchmark over the past three years.

Performance of the trust over 20yrs and 3yrs vs sector and indices

Source: FE Analytics

Train claimed at the trust’s annual general meeting in January of this year that he would turn around the recent poor performance by simply doing nothing.

Yet, he came back on his previous statement, saying that it is not entirely accurate as he has in fact introduced three names in the portfolio since 2020.

“It's not nothing, but that’s not very active by most people's standards,” he said.

One of those additions is Experian, a data analytics and consumer credit reporting company Train sees as a major beneficiary of large language models and artificial intelligence.

He said: “That is now a 10%, holding in the trust and one of the top 20 biggest companies in the UK. If we're right about Experian, that 10% position is going to create a lot of value for shareholders.”

The most recent addition is Rightmove, an online real estate property portal, although it is still a small position in the portfolio for now.

Train said: “It is a FTSE 100 company that is valued at a very material discount to similar companies listed on other markets around the world. As long as I can continue to find opportunities like that, I'm not going to despair about the potential returns we can get out of the London stock market.”

The cheap valuation of UK equities in comparison to their global peers is something Train is well aware of. He sees two mechanisms that could help them to rerate on the upside.

One is driven by global investors recognising the value of UK equities and becoming more significant shareholders than domestic institutions. An example of a company benefiting from this dynamic is Diageo.

Train explained: “Diageo has changed its currency of accounting from sterling to dollar. A reason for this is because it can see that there is an increasing number of US institutions on its shareholder register. In fact, well over 40% of Diageo's shares are now held by US investors.”

The other mechanism involves companies choosing to buy back their own shares.

Train said: “If a board makes the correct analysis that their equities are undervalued and then persistently buys back shares for cancellation, then it is hugely accretive for the remaining shareholders who haven’t sold.

“One day, there won't be any sellers left and the company will have retired all the stocks, so the next buyer will push the share price up a lot.”

An example of a company pursuing this policy is Sage. Train suggested that the announcement of share buyback plans coupled with the “reassuringly strong” double digit growth of the software company are likely explanations for the performance of the share year-to-date.