The UK has been an unloved market since 2016, when the Brexit referendum caused money to flow out of the domestic market so intensively that today Simon Gergel, manager of the FE fundinfo five crown-rated Merchants trust, believes there is “almost no one left to sell” anymore.

This can be a curse and a blessing depending on how you look at it, but managers have been putting a more positive spin on the trend.

As Nick Train told Trustnet earlier today, “one day, there won't be any sellers left and the company will have retired all the stocks, so the next buyer will push the share price up a lot”.

For Gergel, that day might be not so distant.

“Everybody who wanted to sell has sold and the only people left are those who actually want to be there and are ‘volunteering’ to buy the UK stock market,” he said.

“At this point, any sign of improvement in sentiment could lead to a quite dramatic rerating, because there's no one left to sell really. Almost no one.”

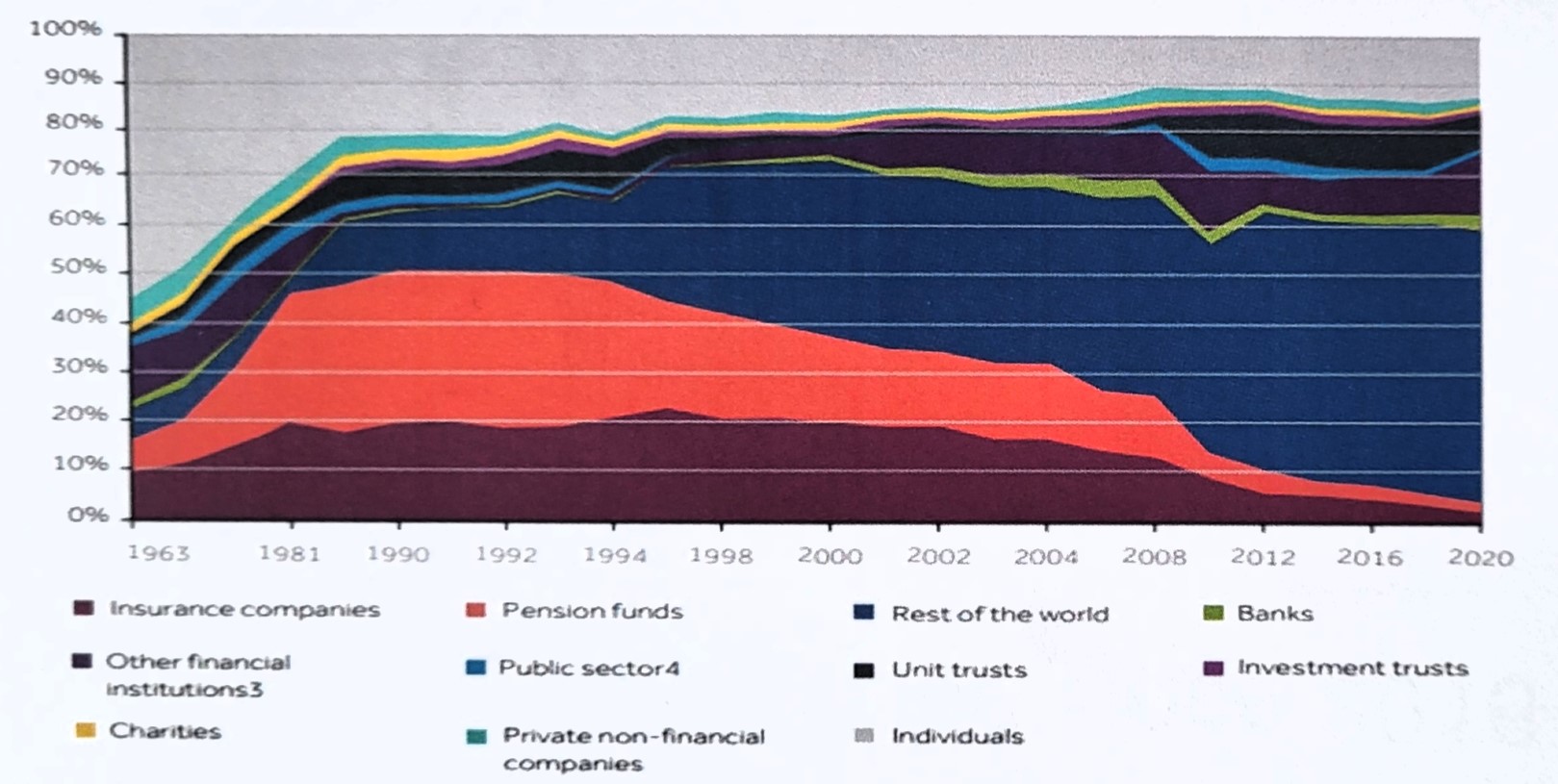

Ownership of UK incorporated companies shares listed on the UK stock exchange

Source: Allianz, FCA.

Who has left and who is still buying?

Back in the 1980s, half the stock market was owned by pension funds and insurance companies in the UK, which have gradually sold down and today own about 4% of the stock market between them, as the chart above illustrates.

“Pension funds have massively taken money out and moved into fixed income and overseas equities. Now half the market is owned by foreign investors,” Gergel explained.

“In the short term, you can see the outflows from equity funds, which have been really dramatic in the UK compared to other markets. We just had this non-stop selling of equity by investors, which put a lot of strain on the market and has taken valuations down.”

There has been a number of reasons for that, according to the manager, who named a few, including Brexit, Jeremy Corbyn’s potential premiership and the pandemic, which hit the UK market “quite hard relative to some other markets”. Then, coming out of that, Russia invaded Ukraine and energy costs spiralled. Most recently, a year ago Kwasi Kwarteng’s mini-Budget instilled a feeling that somehow the UK has got a problem with growth.

“In our view, a lot that's been overdone,” he said.

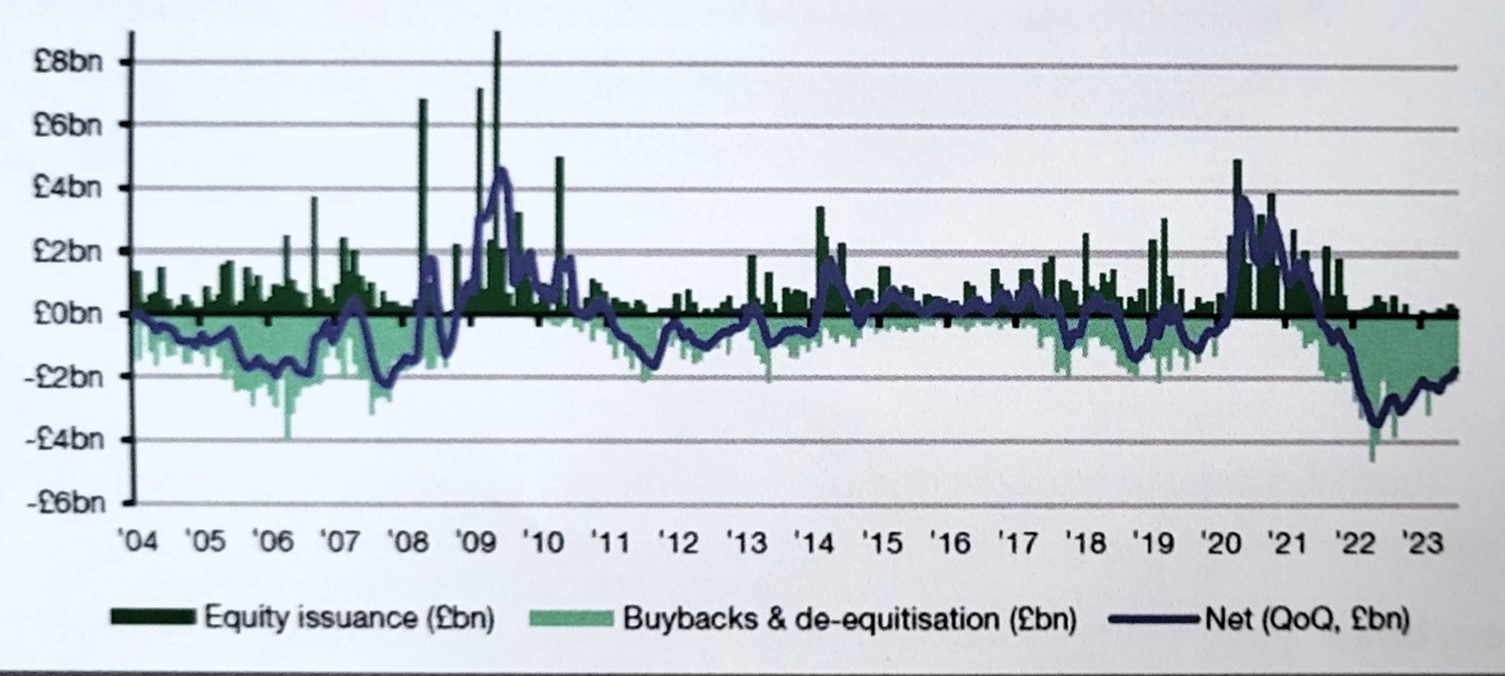

Net listed equitisation (£bn)

Source: Allianz, Liberum, Bloomberg, Bank of England.

The chart above shows who has been buying the market – the companies.

The green line shows company issuance of new equity, which has been high during Covid (as it usually is during crises), but recently they have been buying back shares instead.

“Companies are buying a huge amount of their shares, because many actually generated a lot of cash now and don't have that much to invest in,” said Gergel.

“We're seeing a lot of de-equitisation as companies spend their cash to invest in the market at cheap valuations. Companies are the marginal buyer in many cases of the stock that other people are selling.”

This should spell good news for UK investors – especially as the uncertainties that have caused people to sell could have been exaggerated.

“There's a real perception of the UK being problematic and having a particularly challenging economic backdrop. Sure, companies are having to deal with uncertain demand, interest rates have been rising, deglobalisation is expensive and labour costs have been rising quite rapidly, but it's easy to get too downbeat.

“We have seen commodity costs come down, as well as low unemployment and bond yields that look like they have peaked. Having had a long period where things were getting worse, it's getting easier now and the UK stock market is a rich opportunity set,” he concluded.