Equity managers are investing in companies with strong balance sheets, low debt and durable competitive advantages that will continue growing even if a recession occurs next year.

Victor Zhang, chief investment officer of American Century Investments, said there is a “distinct and reasonably high probability” of recession in 2024, after central banks raised rates to decade highs this year to combat rampant inflation.

Although inflation has been coming down, the squeeze on consumers has caused economies around the world to slow, with many predicting most developed markets to drop next year.

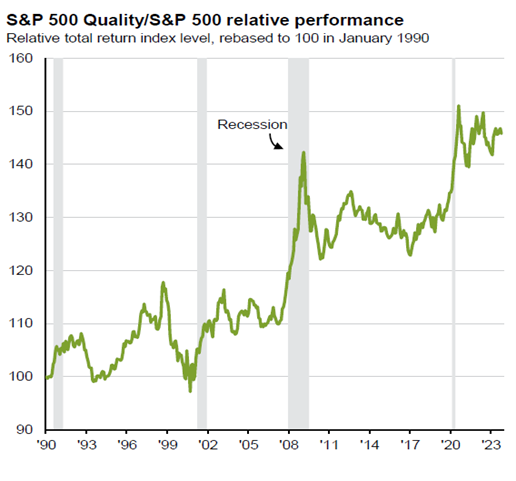

Hugh Gimber, global market strategist at JPMorgan Asset Management, said in a recession, quality should start to outperform as balance sheet strength “will be the most important metric for an equity allocation regardless of sectors or regions”.

Blue Whale Growth fund manager Stephen Yiu concurred, noting that companies with strong balance sheets won’t need to refinance their debt at higher rates. They should be the “last survivors” and “wouldn’t disappear in a severe recession”.

Quality outperforms in a recession

Source: JPMorgan Asset Management (periods of recession, shaded grey, are defined using US National Bureau of Economic Research business cycle dates)

Quality extends beyond quality growth

Gimber pointed out that focusing on quality should not pigeonhole investors into growth sectors. “Whatever sector or region you’re looking at, start with a quality screen,” he advised.

US technology is a key part of the quality story – mega-cap technology companies have strong balance sheets and a wealth of cash – yet the narrative does not end there. In fact, quality can be found within traditional value sectors such as financials, energy and healthcare.

James Knoedler, a fund manager at Evenlode Investment Management, said: “People mistakenly think that value is shorthand for cheap and quality is shorthand for expensive […] but the way we think about quality and the way we think about value are inextricable.”

Evenlode invests in high quality businesses that can compound their cash flows over time, at a good valuation, he explained.

The link between quality and income

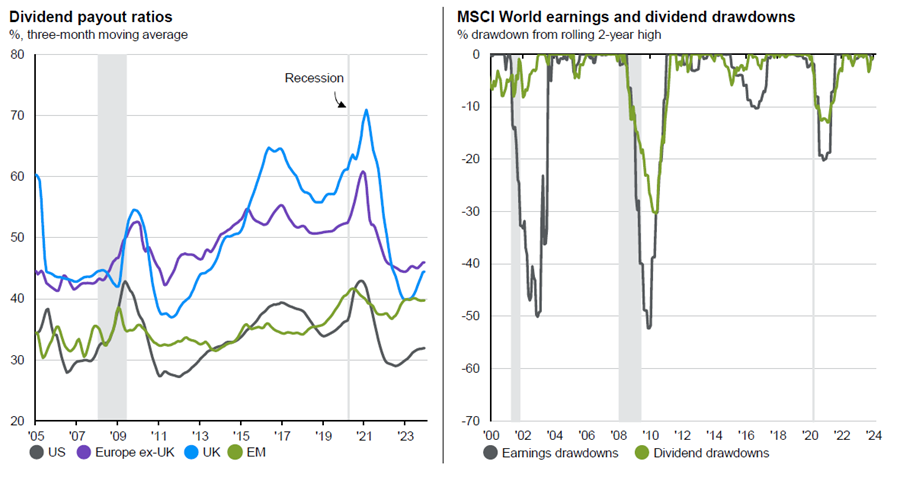

Gimber is also talking to clients about income, which is well aligned with the quality theme. Companies with strong balance sheets have the staying power to maintain dividend payouts, he explained. Dividends are well covered and payout ratios (the percentage of earnings paid out as dividends) are relatively low currently, as the charts below reveal, so even if earnings falter companies should still be able to pay dividends.

Dividend payout ratios are relatively low

Sources: JPMorgan Asset Management, Bloomberg, FTSE, LSEG Datastream, MSCI, S&P Global

Cameron Shanks, an equities investment analyst at Aegon Asset Management, also defines quality through the dual lenses of earnings and income. “The hallmark of a ‘quality’ company is earnings persistence – that is, companies with healthy levels of profitability that sustain over time. The dividend is a key proxy for this as, at a basic level, dividends are your share of the profits. Consistent dividend growth is a strong signal of earnings, which are sustainable through the cycle,” he explained.

Avoid the quality traps

Investing in good quality companies may sound like an obvious thing to do, but there are traps to avoid. The first is the “toxic interplay” between a company’s financials appearing to be at their all-time best and the company peaking, Knoedler said. This is an easy trap to fall into because most financial analysis is backward-looking.

If volume growth is slowing, the company does not need to invest in new capacity so its expenses are lower. For instance, tobacco companies might be cash rich but they have negative volume growth because consumer habits are changing and any innovation is margin negative.

Quality is not something a company possesses and gets to keep forever, Knoedler continued. Evenlode’s forward-facing valuation system gives companies credit for reinvesting to keep their competitive advantage so they can over-participate in market growth.

The second minefield is that quality alone is unlikely to generate high levels of alpha, Yiu pointed out. “We’re not interested in companies that just grow in line with GDP. We want to find companies that are high quality and at the same time can grow a lot faster than the world economy,” he explained.

The third risk is that the consensus forecast of slowing economic growth is proved wrong. Perhaps labour market resilience leads to a resurgence in demand or geopolitical tensions cause the oil price to surge, then inflation trends upwards and central banks start talking about rate hikes.

Ben Gutteridge, portfolio manager, multi-asset strategies at Invesco, suggested hedging against this eventuality by investing in both US and UK equities. The UK equity market has more energy companies, commodities and miners that would benefit from a higher oil price and inflationary resurgence and valuations are attractive, whereas high quality US large-caps have more defensive qualities if a recession does occur, he explained.