One has to be particularly optimistic to invest in high-risk asset classes in a time when there is very little visibility on how the macroeconomic environment may look like, with soft landing, recession and stagflation being all plausible options

However, being greedy when others are fearful can be a rewarding bet on the long term. Below, experts highlight funds investors with a tolerance for high volatility, a long-term horizon and the capacity to stomach short-term losses, should consider.

Speculative global growth

Alex Watts, investment data analyst at interactive investor, suggested Scottish Mortgage, one of the best performing investment trusts of the past decade, but which fell from grace as inflation resurfaced and central banks started their hiking cycle.

FE fundinfo Alpha Manager Tom Slater and Lawrence Burns seek to identify major drivers of change in the world and then invest in a select number of names that, they believe, are poised to capitalise on those themes.

As such, they are unconstrained in where and how they invest. For instance, the trust can allocate up to 30% of the portfolio to private companies, an allocation that is currently at maximum.

However, those private holdings are not early-stage companies, but rather businesses that have chosen to stay private for longer and with sizeable valuation, such as SpaceX, Bytedance or Epic Games.

Watts warned that the speculative nature of this investment trust means that it is bound to experience extreme upside and downside short-term performance.

He said: “Management themselves admit that smooth returns and exceptional outperformance are not mutually exclusive. What is more, an asset of the investment trust structure is the ability to borrow to enhance returns, though negative returns can be exaggerated on the downside also. Accordingly, this is a trust more appropriate for investors with further-out investment horizons (at least five years).”

Performance of trust vs sector and benchmark YTD

Source: FE Analytics

UK Smaller Companies

UK small-caps have been de-rating over the past two years and are now trading on a discount relative to both their large-cap and international peers. Meanwhile, 65% of the constituents of the Numis Smaller Company index are valued below their long-term averages.

As a result, Tom Hopkins, senior portfolio manager at BRI Wealth Management, believes the asset class now presents an attractive investment opportunity and called on investors to distinguish between short-term transitory factors and long-term fundamentals.

Moreover, a stabilisation in interest rates and inflation may reinvigorate the M&A activity in 2024, which means the best and highest quality companies will continue to be taken over.

Hopkins said: “As we reach the peak of interest rates in the UK and the economy continues to show its resilience, the IA UK Smaller Companies sector looks ripe for an accelerated recovery in 2024.”

Laith Khalaf, head of investment analysis at AJ Bell added that UK smaller companies have produced “exception returns” over the long-term, albeit being riskier than their large-cap cousins. Although things might get worse before they get better, he believes adventurous investors should consider some exposure to this area.

To tap into the opportunities presented by UK smaller companies, Hopkins picked WS Gresham House UK Smaller Companies, while Khalaf chose WS Amati UK Listed Smaller Companies.

The first fund, managed by FE fundinfo Alpha Manager Ken Wotton, was launched in February 2019 and sits in the top quartile of the IA UK Smaller Companies sector over three years.

Hopkins said: “The outperformance of the Gresham House UK Smaller Companies against the sector is a credit to the team’s effective and unique investment process. What gives Gresham House the edge is their private equity approach and resources in selecting the right companies for the portfolio.

“The fund’s less cyclical, high-quality businesses with stable and growing earnings streams, should continue to deliver strong returns through the market cycle.”

WS Amati UK Listed Smaller Companies is older, having been launched in 1998, and has made a top-quartile return over 10 years, although it has struggled over more recent periods.

Khalaf said: “Paul Jourdan has been running this fund for over 20 years and the whole team is steeped in experience when it comes to small-cap investing.

“They look for high quality companies with competitive advantages. They also have an emphasis on the AIM market, but they can invest in stocks all the way up to the FTSE 250.”

Performance of funds vs sector and benchmark YTD

Source: FE Analytics

US small-caps

For investors worrying over the size of UK small-caps, they might prefer their US counterparts which have larger market capitalisations. For example, Rambus Inc, the largest constituent of the S&P Smallcap 600, boasts a $7.5bn (£5.9bn) market capitalisation, which would be enough for a FTSE 100 listing if in London.

While US small-caps have trailed their large-cap peers over most of the past 10 years, Jack Roberts, investment analysts at IBOSS, believes that US small-cap equities are priced attractively relative to history.

To get exposure to this less well-known part of the US market, he selected the Federated Hermes US SMID Equity fund.

He said: “Mark Sherlock and his team's emphasis on balance sheet strength has steered the fund successfully through the strong headwinds faced by small-cap equities in recent years, resulting in very strong performance relative to sector.

“The fund's solid performance throughout diverse market conditions further underscores its resilience and our positive outlook for the fund.

“Adding to the positive momentum, the Federal Reserve's decision to pause interest rate hikes, coupled with the possibility of interest rate cuts in 2024 contribute to an increasingly favourable outlook for the fund.”

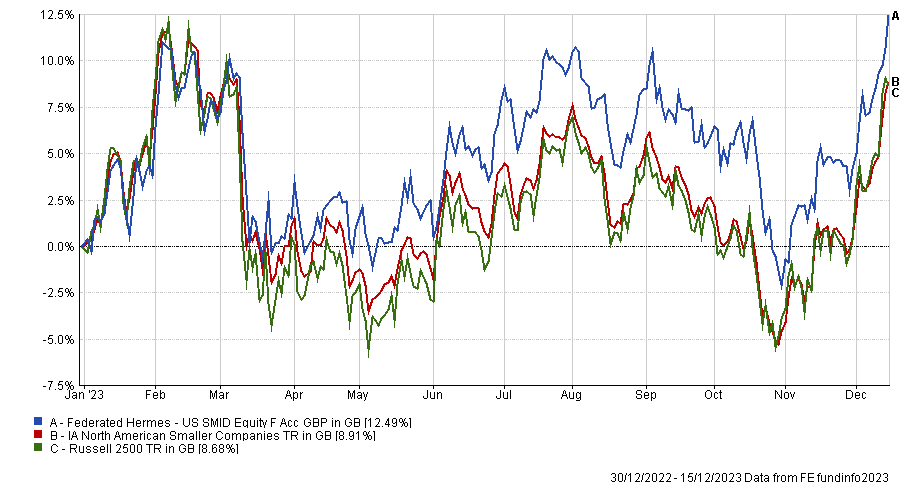

Performance of fund vs sector and benchmark YTD

Source: FE Analytics

China

The investment landscape in China has been challenging in recent years, with stress in the property sector, regulatory crackdowns and weaker than expected post-Covid macro data.

As a result, the MSCI China index has delivered negative returns for three years in a row and the rift between developed markets and Chinese valuations has widened.

While pessimism still abounds, Watts argued that this downward rerating has bred a ripe crop of attractive opportunities.

For adventurous investors believing in China’s rebound, he highlighted Fidelity China Special Situations. The manager, Dale Nicholls, has a clear bias towards the small- and mid-cap echelons of the market and is permitted an allocation of up to 15% in unlisted names.

The portfolio is heavily positioned around the theme of the rise of Chinese consumer and rising domestic consumption, but also aims to benefit from China’s pivot toward high-end manufacturing and production, as China is ambitioning to become a global leader in industries, such as electric vehicles, autonomous driving, renewable energy and healthcare.

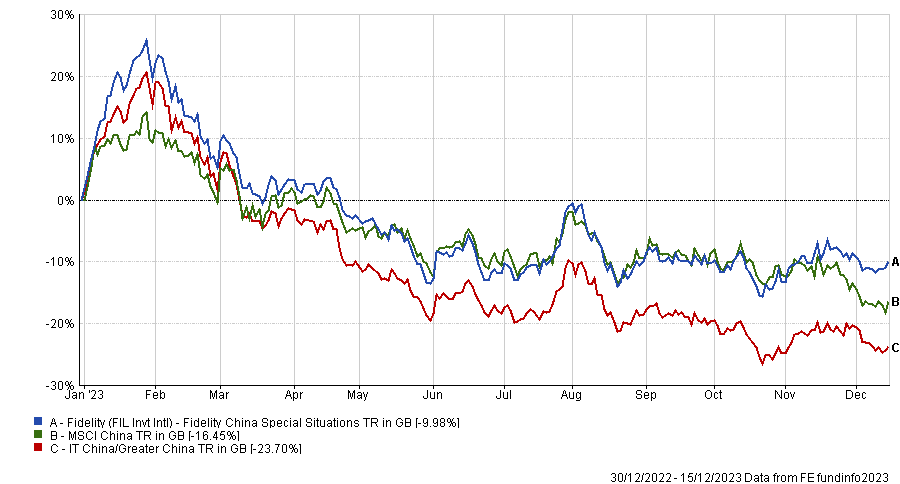

Performance of trust vs sector and benchmark YTD

Source: FE Analytics

Watts stressed, however, that investors must be aware of the heightened risk profile of this investment trust due to its high gearing levels, discount volatility, private company and small-cap exposure as well as the macro uncertainty associated with China.

Clean energy

Clean energy and related stocks attracted huge interests from investors in 2021 as low interest rates and a compelling narrative around the net zero target created something of a frenzy.

Sentiment collapsed, however, over the course of 2022 and 2023, following a spectacular re-rating of valuations, pressures from tightening financial conditions and slower than hoped demand.

Yet, this disenchantment for the clean energy thematic does not mean that the political and social will to decarbonise and electrify the world has gone away.

Rob Morgan, chief investment analyst at Charles Stanley said: “Spend in this space will still need to accelerate and structural demand for energy transition technologies will once again come through as consumers and businesses adjust to higher interest rates while technology costs continue to fall.

“The long-term opportunities for future earnings and cash flow growth as the world transitions to a cleaner and more sustainable economy are therefore still alive, though risks remain in this capital-intensive area.”

For investors willing to give the clear energy thematic a second chance, Morgan suggested the Schroder Global Energy Transition fund.

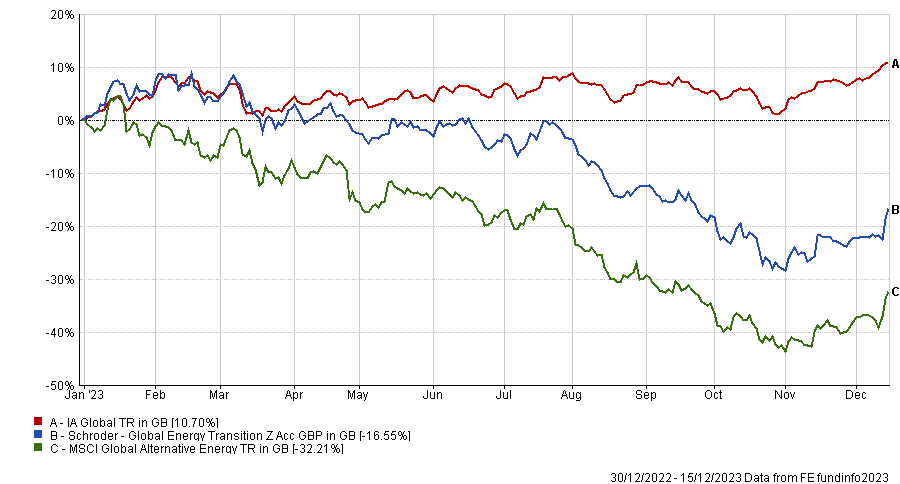

Performance of fund vs sector and benchmark YTD

Source: FE Analytics

Morgan added: “Manager Mark Lacey has taken a disciplined approach to investing in the theme, which has helped limit the inevitable losses over the past couple of years, and having moved from a high weighting in cash – close to the limit of 10% – the portfolio is now more fully invested and ready to benefit from any subsequent upturn.

“The diversified and disciplined approach adopted by the fund is well placed to identify longer term beneficiaries of this important structural trend and could provide decent recovery potential if sentiment picks up in this highly specialist and riskier space.”