Value funds have thrived in the US over the past three years for performance, risk-adjusted returns and other closely watched metrics, research by Trustnet shows, but the style could be under renewed pressure from growth investing.

In this annual series, we are looking at the major Investment Association (IA) sectors through a variety of lenses to see which funds have consistently delivered for investors. This week it is the turn of the IA North America sector.

In this research, we have worked out the percentile rankings of each fund for: cumulative three-year returns to the end of 2023 as well as the individual returns of 2021, 2022 and 2023 (to ensure performance isn’t down to one standout year), annualised volatility, alpha generation, Sharpe ratio, maximum drawdown, and upside and downside capture relative to the sector average.

The 10 percentile rankings for these metrics are then collated into an average percentile score for each fund; the lower the score, the stronger a fund has been across the board over the past three years.

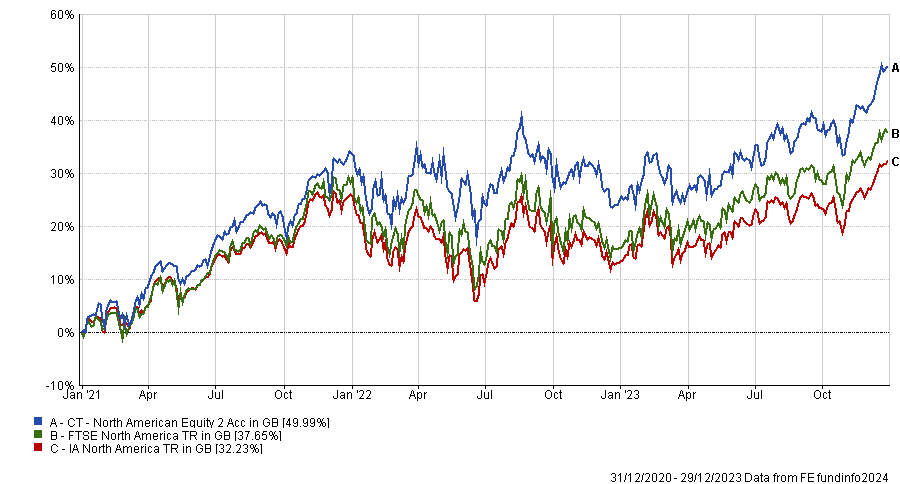

3yr performance of CT North American Equity vs sector and index over 3yrs to end of 2023

Source: FE Analytics

The fund that came in first place with an average percentile score of 19.2 is CT North American Equity, which made a 50% total return over the past three calendar years. It’s also towards the top of the peer group for alpha, Sharpe ratio and maximum drawdown.

The £82m fund is managed by Columbia Threadneedle’s systematic factor team and seeks capital growth with some income over the long term. While actively managing the portfolio, this team uses a systematic approach based on its bespoke ‘True ERP’ (equity risk premia) model, which aims to find attractively valued and growing companies with good quality financial statements.

CT North American Equity’s largest sector allocation is to technology, with a weighting in line with its FTSE North America benchmark. Alphabet, Apple, Microsoft and Nvidia are among its top 10; these are four of the so-called Magnificent Seven stocks that have surged in recent years.

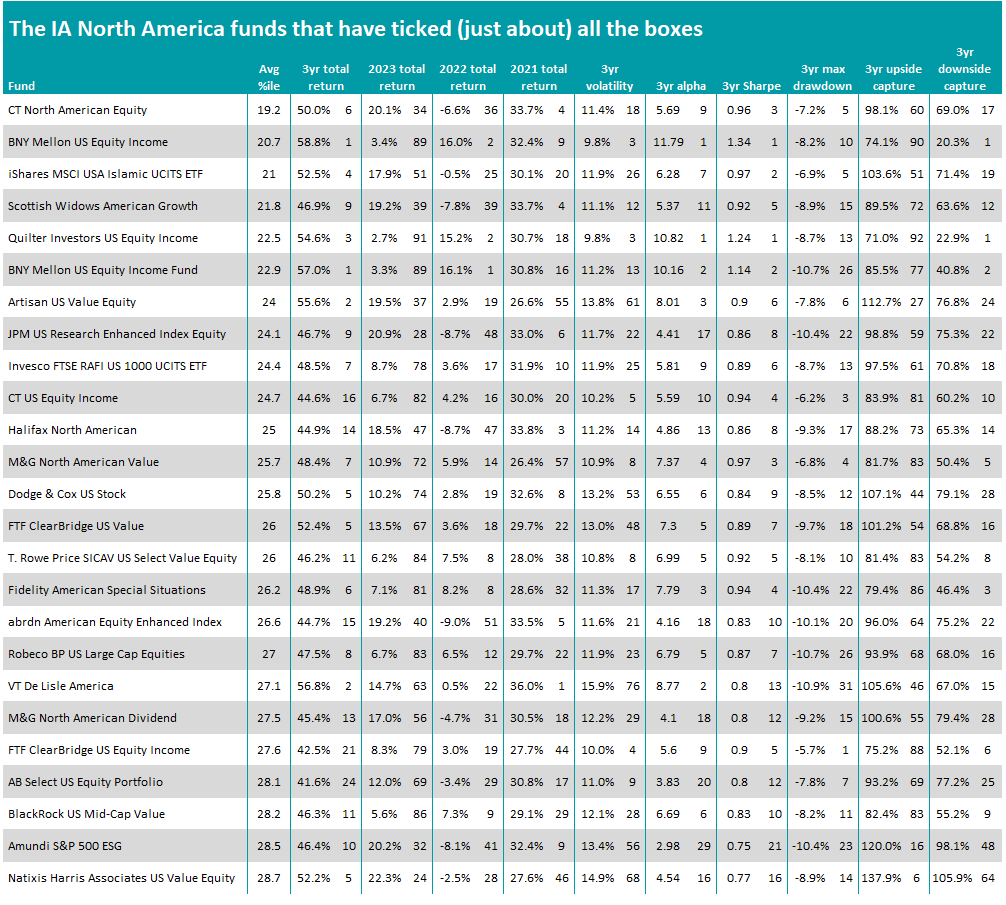

But the fund takes a blended approach, not leaning too heavily into the value or growth investment styles. A look at the full list of the 25 IA North America funds with the best scores in this research, however, shows that value strategies are winning.

Source: FE Analytics

The names of several funds in the above table make clear their allegiance to the value approach, such as Artisan US Value Equity, M&G North American Value, FTF ClearBridge US Value, T. Rowe Price SICAV US Select Value Equity, Fidelity American Special Situations, BlackRock US Mid-Cap Value and Natixis Harris Associates US Value Equity.

Meanwhile, funds investing in dividend payers often follow the value style; BNY Mellon US Equity Income and Quilter Investors US Equity Income are two such examples. Invesco FTSE RAFI US 1000 UCITS ETF and Dodge & Cox US Stock also follow this style.

The outperformance of value funds is a common theme in this year’s research. For much of the post-financial crisis bull market, growth stocks had led the way and most value funds struggled; however, the rise in inflation and consequential interest rate hikes soured sentiment toward growth and sent investors towards formerly unloved value stocks.

Only a handful of funds with a growth approach, such as Scottish Widows American Growth, JPM US Research Enhanced Index Equity, Halifax North American and Amundi S&P 500 ESG, were among the top 25 in this research.

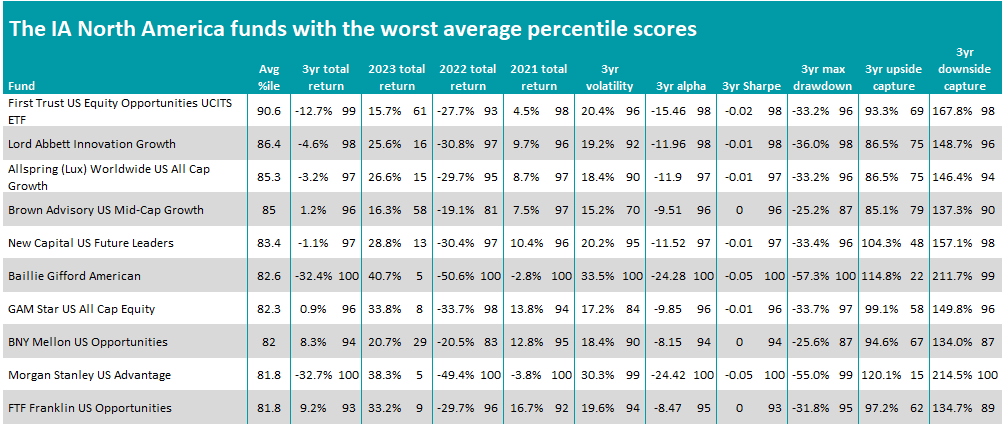

Source: FE Analytics

While growth funds are somewhat of a rarity in the list of this study’s best performers, they are much more common when we look at the IA North America funds with the worst average percentile scores.

All of the 10 listed above follow the growth approach and have produced some of the sector’s lowest returns in recent years; Baillie Gifford American is probably the highest profile of these funds, thanks to some spectacular returns when growth investing was in vogue then heavy losses when the tide turned.

However, the fund’s performance in each of the past three years starkly illustrates a trend that can be seen across both tables and should be kept in mind: funds that struggled in 2021 and 2022 tended to do well in 2023, and vice versa.

This is because growth stocks, especially US tech giants, rallied hard last year and reversed some of the gains made by value investing. With some investors tipping tech to continue to do well as interest rate hikes end and excitement around artificial intelligence remains strong, value’s lead could once again be under pressure.

To see the previous articles in this series, please click here.