Investment styles go in and out of favour and funds’ performance ebbs and flows accordingly. Within the natural swings of the market, however, fund houses have specific sector expertise that will shine through at times when another segments of the offering may languish.

In this new Trustnet series, we aim to explore just that, highlighting the strengths and weaknesses of different asset managers in specific areas. This week, we begin with Jupiter.

On a company level, latest results haven’t been particularly encouraging, with pre-tax profits falling by £48m to £9.4m in 2023 on the back of £2.2bn in net outflows, as the firm announced in February.

Money has flowed out of Jupiter’s most recognised vehicles, with Jupiter UK Special Situations shedding £300m and Jupiter Global Value £115.7m, as star manager Ben Whitmore announced his departure from the company, leading analysts to drop these strategies from their best-buy lists.

People also withdrew £263.8m from the Jupiter Income Trust, as Trustnet highlighted before, and the departure of Chrysalis Investments and its managers Richard Watts and Nick Williamson also led to an £800m reduction in Jupiter’s assets under management (AUM).

These departures hit the company hard, despite hiring veteran names such as Adrian Gosden and Chris Morrison, who joined Jupiter from GAM at the start of the year, and FE fundinfo Alpha Manager Alex Savvides from JO Hambro Capital Management, to take over Whitmore’s funds.

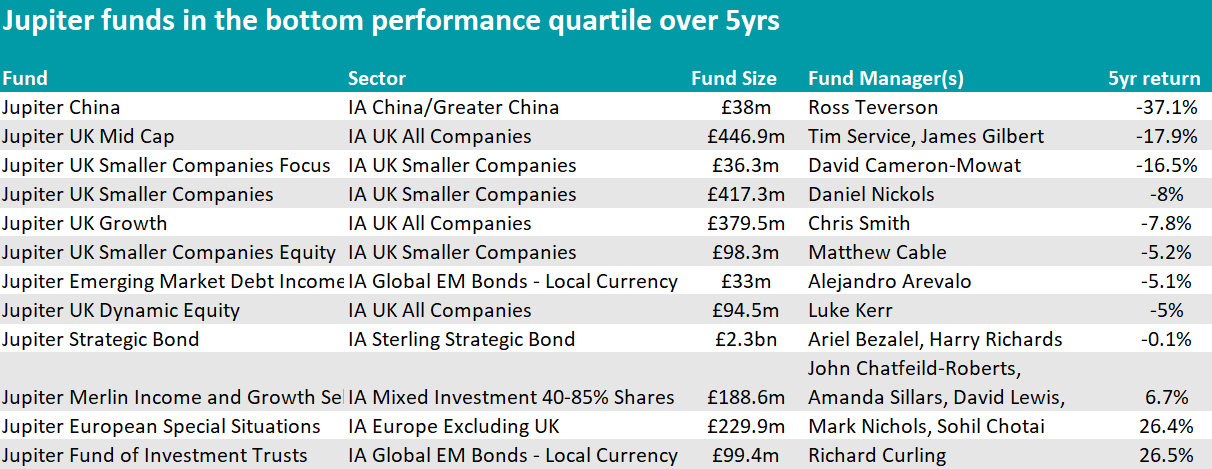

From a performance perspective, it is in the UK where Jupiter’s funds have struggled the most. Whitmore’s Jupiter UK Special Situations is the only domestic fund in the asset manager’s suite to have outperformed the market over the long term, while all other IA UK All Companies and IA UK Equity Income strategies in the Jupiter stable have underperformed their peers.

Facing a particularly harsh environment, the UK small-cap team, who ran the sector’s most popular fund back in 2021, have suffered from outflows ever since, as investors turned their back on UK equities in general and UK small-caps in particular.

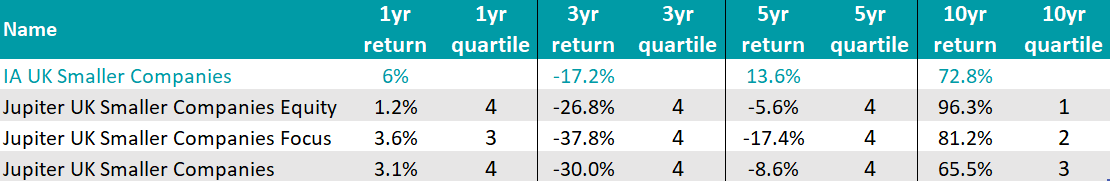

The Jupiter UK Smaller Companies, UK Smaller Companies Equity and UK Smaller Companies Focus funds have underperformed both the IA UK Smaller Companies sector and the Numis Smaller Companies index over the past 12 months, three and five years.

Jupiter UK Smaller Companies Equity and UK Smaller Companies Focus did surpass the average peer in the past decade, however, as the table below illustrates. They are managed by Matthew Cable and David Cameron-Mowat, respectively.

Source: FE Analytics

All three strategies also featured in Trustnet's 'bang for your buck' series, where they stood out with the lowest alpha scores of the past five rolling years, meaning that they haven’t been able to add extra returns on top of their benchmark.

The biggest of the three funds, Jupiter UK Smaller Companies, is run by FE fundinfo Alpha Manager Daniel Nickols and used to be the most popular fund in its sector, peaking at £1.5bn in assets under management (AUM) in September 2021 and then going on to experience significant outflows.

According to Rob Morgan, chief analyst at Charles Stanley Direct: “The fund became a bit of a victim of its own success.”

Known for his “multi-cycle experience and intimate knowledge of the UK small-cap market”, Nickols has endured “an exceptionally tough period”.

Performance problems mostly stemmed from a wretched year in 2022, when growth-orientated smaller companies faced the sudden and significant headwind of much higher interest rates.

Bestinvest managing director Jason Hollands said that “in large part, this was down to the strong growth style bias being hit hard during a period of rising interest rates and borrowing costs”.

“It is also a relatively concentrated portfolio for a small-cap fund, with circa 56 holdings, which does leave it more vulnerable to stock-specific risk than more diversified products.”

In this respect, the fund was impacted by its exposure to fashion brand Boohoo and e-commerce retail company THG, formerly The Hut Group, as their previously stellar performance went into reverse gear, Hollands explained. Neither are in the portfolio any longer.

Morgan remained positive on the strategy, however, which is now running “a more manageable level of assets”. With £400m under management presently, the fund has become “a lot easier to manoeuvre”.

“The managers have a good opportunity to turn performance around in a UK smaller companies market where there are surely bargains to be found. It is understandable that investors are disillusioned with the fund, but the manager’s experience remains a significant attribute, and I would not be at all surprised to see performance turn around,” he said.

The other Jupiter smaller companies funds are run by the same team and have experienced similar performance issues, though again Morgan thinks this could turn around.

“A lower interest rate environment might favour the strategies, for instance, and over a multi-year period stock selection could once again add value.”

However, for investors considering adding to the sector, Morgan preferred the BlackRock UK Smaller Companies trust.

The £2.3bn Jupiter Strategic Bond managed by FE fundinfo Alpha Manager Ariel Bezalel was also a chink in Jupiter’s armour, failing to rise above the fourth quartile of performance over the past decade.

Nonetheless, it remained popular among investors and consumer platforms, with Hargreaves Lansdown, interactive investor and Barclays all rating it in their respective best-buy lists.

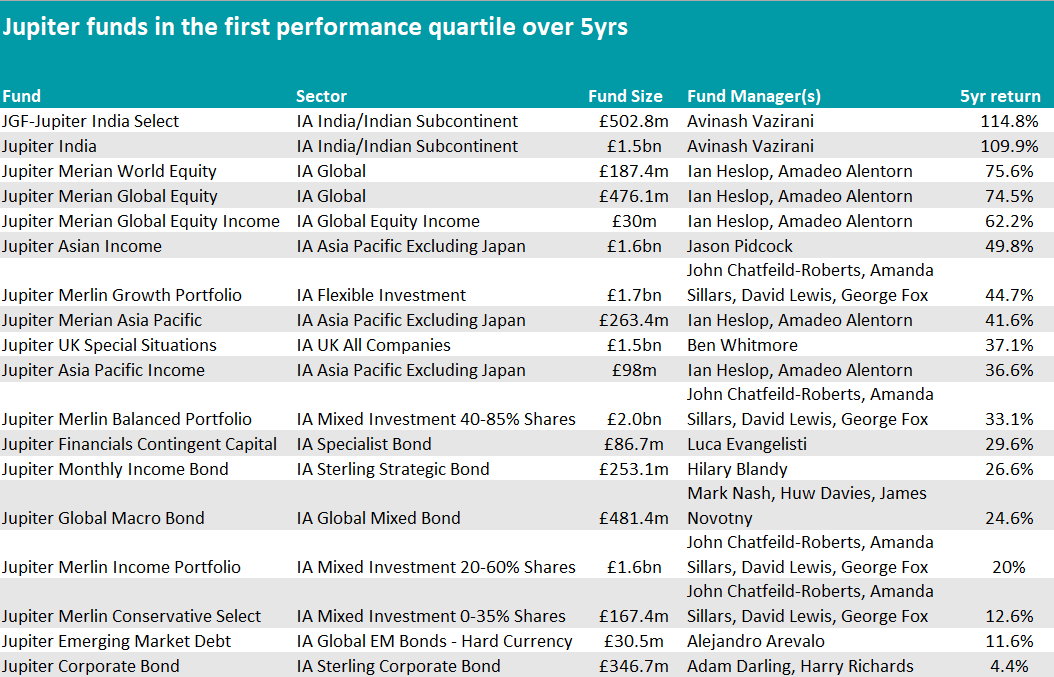

The performance of the Strategic Bond fund was the exception in an otherwise successful suite of fixed income products, which has so far been a success story.

The Jupiter Monthly Income Bond fund in particular has never fallen below the first performance quartile over one, three, five and 10 years, with the Jupiter Financials Contingent Capital and Jupiter Emerging Market Debt fun also standing out positively, as the table below shows.

Source: FE Analytics

Another area where Jupiter has gone from strength to strength is Asia, particularly the India desk, with the Jupiter India Select and Jupiter India funds consistently anchored in the top performance decile of the IA India/Indian Subcontinent sector and alternating each other as the first and second best performer of the whole peer group in the past five and three years as well as 12 months.

Hargreaves Lansdown analysts recognised Avinash Vazirani, who is in charge of both strategies, as one of the few managers with a long record of investing in India and were impressed with his commitment and willingness to invest in areas of the Indian market overlooked by others.

The multi-asset Merlin range has also been more successful than not, with many winners, such as the Jupiter Merlin Growth and the Balanced Portfolio, and only Jupiter Merlin Income and Growth Select in the bottom quartile of its respective sector.