Experts are selling the Allianz Strategic Bond fund after its lead manager Mike Riddell jumped ship to Fidelity International.

Allianz Global Investors (AllianzGI) has appointed Julian Le Beron to take over with an “enhanced” team-based, co-led approach, which “will be beneficial in terms of expanding the inputs into strategies,” the firm said.

This development didn’t convince experts, who all agreed the fund is a sell.

Having shot the lights out in 2020, as 8AM Global’s Andy Merricks noted, Allianz Strategic Bond is “at least consistent now, achieving fourth quartile returns regularly”.

Performance of fund against sector and index over 5yrs

Source: FE Analytics

“I would assume that those still holding it are doing so because of Mike Riddell in the hopes that he can recapture the spark of 2020. Now that he’s moved to Fidelity I would imagine Riddell supporters will follow him,” he said.

“For those who remain, it will be interesting to see whether the ‘enhanced’ investment process means that it will find a way of yielding even less than it does now compared to cash and eroding capital or whether they will stem the tide and see better performance in the coming months.”

Ben Yearsley, investment consultant at Fairview Investing, agreed with Merricks that the fund is “quite unique and very specific to Riddell”, making it “difficult to stay put after he's gone”.

Investors won’t be able to follow Riddell to Fidelity directly either, as he won't take over the Fidelity Strategic Bond fund until 2 January 2025 at the latest.

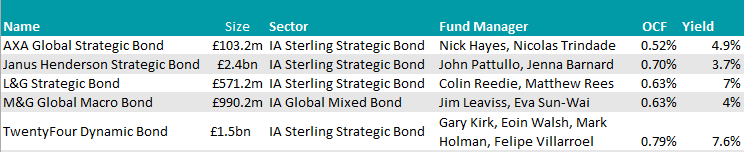

It’s also likely that the new AllianzGI managers will dial down the risk, according to Yearsley. He recommended that investors “sell now and go for a new choice”, possibly splitting the money between AXA Global Strategic Bond and the M&G Global Macro Bond fund.

“They blend well together as the AXA fund has core allocations to the main bond asset classes while the M&G’s product is more specialised, with currency returns being a big part of the decision making process,” he said.

It is managed by Jim Leaviss, who Yearsley considers “one of the premier bond managers”.

Jason Hollands, managing director of Bestinvest, also leaned towards selling, indicating the TwentyFour Dynamic Bond fund and the Janus Henderson Strategic Bond fund as two possible replacement candidates.

The former is a concentrated best-ideas fund with a flexible mandate to roam across the fixed income markets. It has performed “incredibly well” in a variety of very different market conditions.

“It is also able to use interest rate and credit derivatives to optimise exposure, as well as take short positions for hedging purposes,” he said.

On the other hand, the Janus Henderson vehicle invests across global bond markets focusing on total return rather than income.

“Managers John Pattulo and Jenna Barnard take a cautious approach to risk, not for example buy any emerging market bonds, only developed markets. They also have an aggressive selling mindset to protect the fund’s value, with company profit warnings or management change potentially triggering a review,” Hollands added.

Finally, Andy O’Shea, an investment director at Pharon Independent Financial Advisers, said he was never a fan of the AllianzGI fund as it did not provide enough risk diversification from equity exposure.

“There have been a number of funds that aim to provide a catch-all diversifier for clients through access to multiple sources of alpha, but using them all at once just introduces additional volatility with little quantifiable benefit. Therefore whilst Mike Riddell is undoubtably a very intelligent manager, I would not follow him across to Fidelity, nor stick with Allianz Strategic Bond,” he explained.

“I would suggest considering the L&G Strategic Bond fund instead. This fund slips under many radars but has provided IA Sterling Strategic Bond sector-beating performance and comprehensively outperformed the Allianz fund since the arrival of Colin Reedie in January 2019.”

Source: FE Analytics