AJ Bell has chosen Man GLG Income to replace Jupiter UK Special Situations in its model portfolio solutions (MPS).

The decision to remove Jupiter UK Special Situations came when lead manager Ben Whitmore announced his departure to launch Brickwood Asset Management and was replaced by Alex Savvides from J O Hambro Capital Management.

AJ Bell's £2.6bn range of model portfolios are numbered one through six, with one being cautious and six being the highest risk and described as 'global growth'. The platform has added Man GLG Income to portfolios two through six, with an allocation of between 3.5% and 6%, depending on the risk level.

Ryan Hughes, interim managing director of AJ Bell Investments, said: “Ben Whitmore brought a specific value focus that blended well with the rest of the portfolio, helped by his clear investment philosophy and consistent implementation of his process, which led to strong returns. The characteristics are well shared by Henry Dixon and Man Group with a similar value bias.

“There is high correlation between the two funds, making Man GLG Income the natural replacement for Jupiter UK Special Situations, and it is a fund already well known to the investment team as it has been used in the AJ Bell Income MPS for a number of years.”

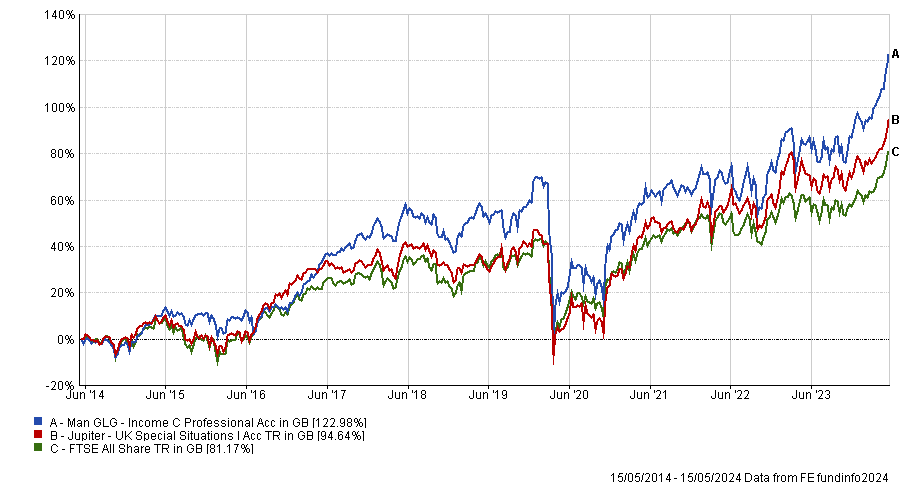

Performance of funds vs benchmark over 10yrs

Source: FE Analytics

Dixon, an FE fundinfo Alpha Manager whose £1.9bn Man GLG Income fund has achieved top-quartile returns over one, three and five years, invests with a “willingness to look across the market-cap spectrum and comfort in investing away from the index”, Hughes explained.

Square Mile Investment Consulting & Research has awarded the fund an A rating and praised Dixon’s contrarian approach. “The manager and his team are entirely focused on uncovering out of favour opportunities in order to provide both an attractive income and total return for investors. The manager ultimately has to have high conviction in a company's recovery potential, as well as the temperament to invest when others are fleeing,” Square Mile’s analysts said.

“There is definitely an ethos of exploring where others fear to tread and given the contrarian nature of the process and the willingness to invest in medium and smaller sized companies, as well as company debt and overseas stocks, the fund is likely to look and act very differently to its peers and benchmark at times.”