Global dividends reached a new record of $339.2bn in the first quarter of 2024, the latest Janus Henderson Global Dividend Index revealed today.

This was driven by strong underlying growth of 6.8%, although headline growth was slower (2.4%) due

Most (93%) of companies globally have either increased or maintained their payouts.

In the US, where companies have traditionally preferred to reward shareholders through buybacks instead of dividends for tax reasons, payouts reached an all-time record high of $164.3bn.

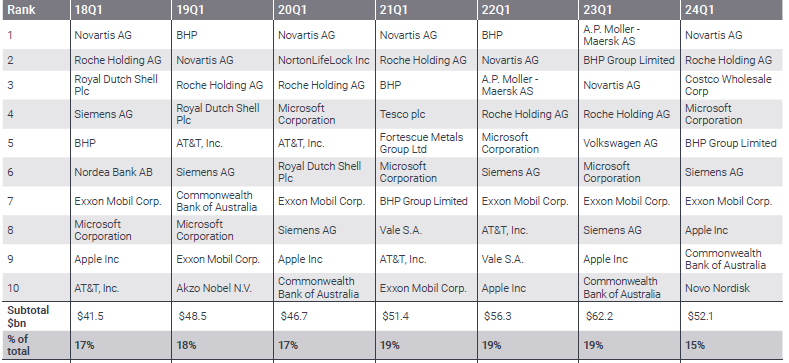

At the single stock level, Meta and Alibaba announced their first-ever dividends during the quarter and boosted the global total by 1.2 percentage points.

Banks, which have prospered during a higher rate environment, accounted for a quarter of the global growth (up by 12%).

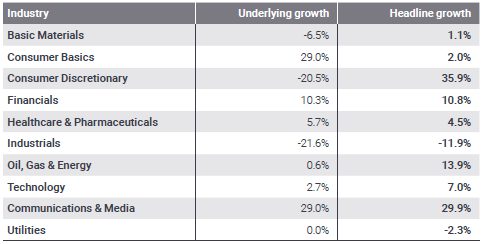

Q1 2024 annual growth rate by industry

Source: Janus Henderson

Beyond banks, most sectors made progress, with oil, retail and media also achieving double-digit headline growth.

Only six of the 35 sectors covered in the report reduced their payouts, with the biggest faller in the first quarter being transport. Much of this was due to the dividend of Danish shipping and logistics company Moller Maersk being cut.

Janus Henderson Investors’ head of global equity income Ben Lofthouse said dividend growth had made “a strong start to 2024”, sustaining the momentum it achieved towards the end of 2023.

“The broad picture is one of continued resilience, especially in Europe, the US and Canada,” he said.

“We continue to expect companies to distribute a record $1.72 trn to their shareholders this year, a headline increase of 3.9% year-on-year, equivalent to a rise of 5.0% on an underlying basis.”

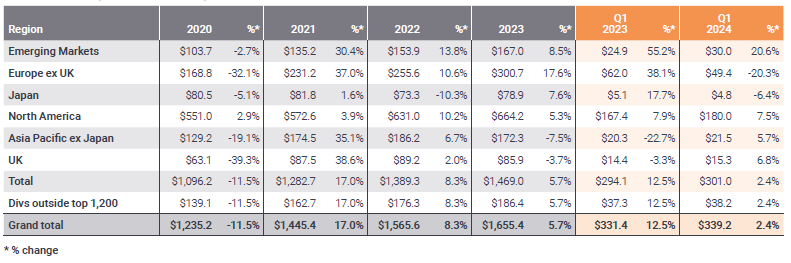

From a geographical perspective, North American companies increased their dividends by 7% on an underlying basis, the most generous increase anywhere.

Wholesaler Costco gave out the most in special dividends, but one-off payments were fewer in number. Disney also restored its dividend for the first time since the pandemic.

On this side of the ocean, Switzerland led the continental European pack, accounting for two-fifths of the regional total, while UK dividend growth was somewhat muted.

“The seasonal absence of banking dividends, which will provide much of the growth in UK payouts this year, and of mining dividends, which will do the opposite, meant that the first quarter was relatively quiet in the UK, with most companies delivering flat payouts or low single-digit increases,” the report read.

Domestically, dividends amounted to $15.3bn – a 2.4% growth. The figure, however, was largely determined by one-off payments, as Trustnet previously reported.

They included a higher payout by Associated British Foods, which traded strongly over Christmas, and the positive impact of a stronger pound.

Many companies, with Shell being the prime example, have bought an extensive amount of their own shares over the last year, impacting dividends.

Annual dividends by region (US$ bn)

Source: Janus Henderson

Further afield, emerging markets have displayed very strong growth rates in the first quarter, which were heavily influenced by a handful of companies and are unlikely to be repeated as the year progresses, Lofthouse said.

The inaugural payment by Alibaba made a big splash, distributing $2.6bn – enough to boost China’s annual total for 2024 by almost five percentage points.

World’s biggest dividend payers

Source: Janus Henderson