The managers of Capital Gearing Trust have expressed concerns about the outlook for US equities, noting that they have rarely been so expensive.

The cyclically adjusted price-to-earnings ratio for the US equity market currently stands at 34x, which is close to the 38x valuation seen during the ‘everything bubble’ of 2021.

In the investment company’s latest annual report and financial statements for the year ended March 31, 2024, Peter Spiller, Alastair Laing and Chris Clothier warned against justifying these high prices with the outperformance of US earnings, both compared to the rest of the world and their own historical performance, as they believe that ‘American exceptionalism’ is only part of the explanation for this outperformance.

They said: “More significant in recent years has been the contribution from collapsing interest expenses and corporation tax rates. Having termed out their debt, it may be some years before interest expenses rise meaningfully, but it seems unlikely they can fall.

“With the US running ever larger fiscal deficits, we would not expect corporation tax to continue to fall. But with the possibility of a Trump presidency, nothing should be ruled out. In any event, it seems that this large tailwind to earnings will become a headwind.”

The managers of the investment company are also wary of the shrinking of the market breadth, as returns are increasingly concentrated in the ‘Magnificent Seven’ (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla).

Those seven stocks, viewed as beneficiaries of the artificial intelligence revolution, are currently trading at particularly high valuations. This has led several experts to believe that the only direction for these tech shares is downward.

Spiller, Laing and Clothier used Microsoft as an example to illustrate their concern. The US tech behemoth, which trades on a free cash flow yield of 1.7%, would need to grow its free cashflow between 8-10% per annum in perpetuity to deliver acceptable returns from its starting valuation, they said.

While their stance on US equities is bearish, the managers are bullish on investment trusts thanks to the wide discount across the market.

They said: “Discounts on investment trusts are the widest they have been since the global financial crisis. Furthermore, these discounts are broad based and include the larger, more liquid high quality trusts.

“In response we have added to our investment trust holdings, partly financed by sales of ETFs and partly from cash. We are optimistic that these holdings will provide better returns than broader equity markets.”

In addition to US equities, Spiller, Laing and Clothier are also bearish on the outlook for nominal bonds, as they believe the world will stay in a structurally more inflationary environment and are worried about the fiscal situation in developed countries.

They said: “The average budget deficit across the G8 is forecast to be 4.6% in 2025, so the supply of bonds will increase while central banks continue to reduce their balance sheets.

“Added to which there is no imminent sign of recession, nor any discernible term premium in longer dated bonds.”

Their outlook for index-linked bonds is more nuanced. Although the sustainable growth rate of the US economy has significantly increased, suggesting that US real yields above 2% across the length of the Treasury curve are close to fair value, they consider the fiscal position to be poor and set to deteriorate.

They said: “Real interest rates at these levels will not be sustainable if there is no prospect of bringing fiscal deficits under control. Left unchecked, financial repression – characterised by negative real interest rates – will be necessary.

“What is less certain is the path. Index-linked bonds trade in sympathy with nominal bonds. If nominal bonds are weak, as seems plausible, index-linked will most likely suffer with them. Yet the long-term prospects look fair or, should financial repression be enacted, excellent.”

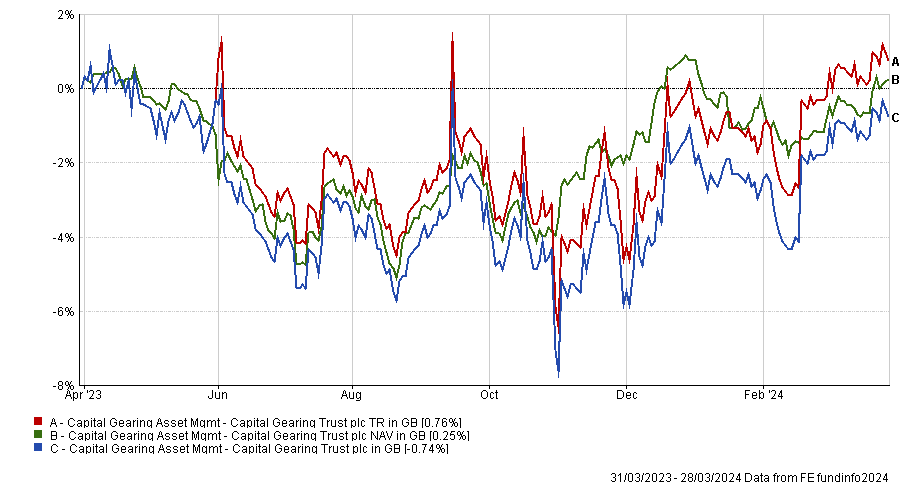

Performance of the trust over 1 year (to 31 March 2024)

Source: FE Analytics

Although the trust’s net asset value and total return appreciated over one year, they were both outpaced by the rise in the UK Consumer Price Index. As a result, Jean Matterson, chairman of Capital Gearing Trust, assessed the performance as “far from satisfactory”.

Although the trust paid an additional special dividend to shareholders in the previous year, Matterson highlighted that the company intends to continue to pay a single annual dividend in July of each year.

The company is proposing a dividend of 78p per share payable on 5 July 2024 to shareholders on the share register as at 6 June 2024, subject to approval at the investment company’s annual general meeting.

At the year end, the share price discount to net asset value per share reached 2.4%.