Less than half (48%) of alternative trust boards are well set-up and effective, according to wealth asset manager Quilter Cheviot.

Board composition and effectiveness are two of the three main factors used to assess alternative investment trusts within Quilter Chievot’s engagement programme.

The wealth management business gave a green, amber or red score to each investment trust in the private equity, infrastructure, multi-asset, macro and music royalties sectors, with less than one in two achieving a green light for both categories.

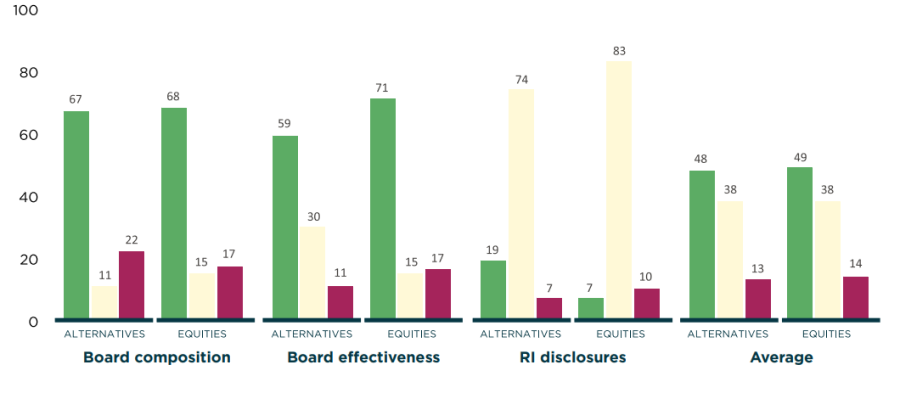

Board composition, which measures the degree of independence, diversity and skillset within the board, had both the highest percentage of green ratings (67%) and the largest proportion of red ratings, with nearly a quarter (22%) of trusts showing a lack of independence, manager representatives, poor oversight or little diversity.

The second factor is board effectiveness, or the ability and willingness to challenge the investment adviser and be open to shareholder feedback. Here, fewer than three in five (59%) trusts received a green rating.

This is an area in particular need for improvement, according to Quilter Cheviot’s head of investment fund research Nick Wood, with communication around gearing, discount management and performance fees atop the issues.

“We want to see trusts communicate clearly and effectively with us, especially around issues pertaining specifically to their structures,” he said.

“It isn’t the case that alternatives are opaque on these sorts of themes, but shareholder communication needs to improve to ensure investors understand exactly what it is they are buying in to and how they expect it to perform.”

The third factor was responsible investment disclosures, especially real-life examples of how the trust approaches stewardship and the integration of environmental, social and governance (ESG) factors within its investment process.

In this category, alternative trusts were found to be ahead of the wider market, with just 7% being given a red grade. However, only 19% of boards scored a green rating and the overwhelming majority (74%) were crossing the line on amber.

This is a result of the disconnect between responsible investment processes and the disclosure of such activities, said head of responsible investment at Quilter Cheviot, Gemma Woodward, who however noted that the direction of travel in this space is good.

“There is room for improvement when it comes to the corporate governance practices of alternative investment trusts. Investor expectations change over time with a fast pace of change, some can be left behind,” she said.

“Nevertheless, we have already seen some very positive improvements from some boards and we look forward to working closely with the 27 we have engaged with here to help them improve where possible.”

With all the three categories combined, only four investment trusts qualified for a triple-green rating.

The report on alternatives follows a first part that was carried out on the broader equity trust sector in September 2023.

The comparison of the two is illustrated with the chart below, which highlights some discrepancies in the factors assessed but a similar performance on average.

Comparison of alternatives versus equity trusts

Source: Quilter Cheviot