Equity income funds need to achieve a delicate balancing act. They are required to pay out a decent stream of dividends, with many of their investors relying on this income to maintain their lifestyles, especially if they are retired. Yet at the same time, the portfolio needs to deliver enough capital growth to replenish the pot, so savers’ wealth doesn’t shrink due to hefty pay-outs or a failure to keep pace with inflation.

Trustnet scoured through the IA UK Equity Income sector to find funds ranking within the top 25% for cumulative income pay-outs over the five years to the end of 2023, which also grew investors’ capital and delivered top-quartile total returns from 31 December 2018 to 13 June 2024.

Just four UK funds achieved this rare feat: Courtiers UK Equity Income, JPM UK Equity Income, Man GLG Income and Octopus UK Multi Cap Income.

To illustrate how hard it is to maximise income and growth, no funds in the IA Global Equity Income sector ranked top-quartile for both elements. Here, investors had to choose between high income or the best total returns.

An investor who put £10,000 into each of the aforementioned UK funds on 31 December 2018 would have received cumulative pay-outs ranging from £2,670.13 from Courtiers to £3,104.73 from Man Group during the subsequent five years.

The funds grew their underlying capital at the same time, so investors’ stakes would have increased over five and a half years, even after dividend pay-outs, to between approximately £12,585 and £13,110.

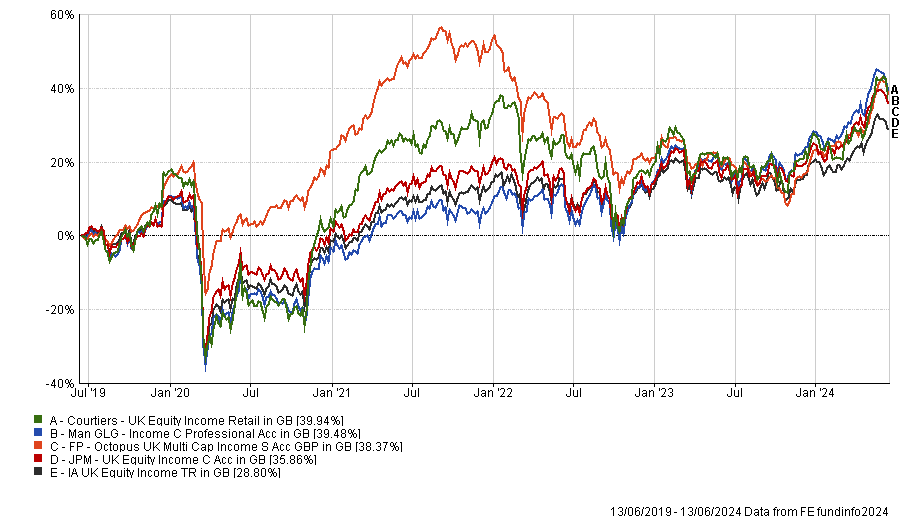

Performance of funds vs sector over 5yrs

Source: FE Analytics

Octopus UK Multi Cap Income and Courtiers UK Equity Income are much smaller than the other two strategies with just £37m and £60m, respectively, under management.

Their performance trajectory has been bumpy, with both funds soaring in 2021 during the post-Covid recovery, then dropping back in 2022 as interest rate hikes bit into small and mid-cap companies and growth stocks.

As such, these funds fell into the fourth quartile of their sector for three-year performance but achieved top-quartile returns over five years to 13 June 2024. They also charged back into the first quartile for the past 12 months.

Their holdings differentiate them both from larger UK equity income funds. Courtiers owns recruitment and technology consultancy FDM Group, homebuilder Persimmon, Direct Line Insurance Group, iconic footwear brand Dr. Martens and Marks & Spencer.

Octopus, which reaches throughout the market capitalisation spectrum for opportunities, has taken large positions in two marketing and communications businesses, Next15 and Gamma Communications, alongside engineering services company Renew Holdings, construction group Galliford Try and pharmaceutical giant GSK.

Small-cap specialist Chris McVey leads Octopus UK Multi Cap Income, supported by deputy managers Dominic Weller and Richard Power. At Courtiers, chief investment officer Gary Reynolds helms the UK Equity Income strategy, seconded by Jake Reynolds.

The largest fund of our cohort is Man GLG Income, with £1.8bn under management. Led by FE fundinfo Alpha Manager Henry Dixon, it is the ninth best performer in the IA UK Equity Income sector over five years, the third best in three years and fourth over 12 months, judging by total returns to 13 June 2024.

The fund’s top five holdings by size are GSK, HSBC, BP, Barclays and Shell. Its largest active overweight positions versus the FTSE All Share are GSK, Barclays, Imperial Brands and the insurers Beazley and Lancashire Holdings.

Square Mile Investment Consulting & Research has given Man GLG Income an A-rating. “We believe a yield of 110% of the FTSE All Share index, income growth of 5% per annum, and index outperformance of 2% per annum over rolling five-year periods are reasonable expectations for this fund,” Square Mile’s analysts said.

“What we appreciate here is both the manager's focus on providing an attractive income profile for investors, illustrated clearly by the fund's yield and dividend growth objectives, as well as its monthly distribution payments, and also the manager's desire for the fund to meaningfully outperform its benchmark over time.

“However, whilst there is a clear focus on income with this strategy, we believe that the manager and his investment process will not allow for capital to be placed at risk in the pursuit of income.”

Meanwhile, the £250m JPM UK Equity Income fund delivered top-quartile returns over five and a half years but was second quartile for five years to 13 June 2024, likewise for three years, although it popped back into the top quartile for 12 months.

The fund aims to generate a yield after fees in excess of the FTSE All Share index and to provide capital growth over the long term. It is helmed by Katen Patel and Anthony Lynch, and its largest holdings are Shell, AstraZeneca, HSBC, BP and GSK.