Mark Barnett, who manages the TM Tellworth UK Income and Growth fund, is stepping down at the end of this month following Premier Miton’s acquisition and integration of Tellworth Investments.

Barnett joined Tellworth as a fund manager in April 2021 from Invesco, where he was head of the UK equity team. He spent 24 years at Invesco and managed several UK equity income strategies, including replacing Neil Woodford when he set up his own eponymous boutique.

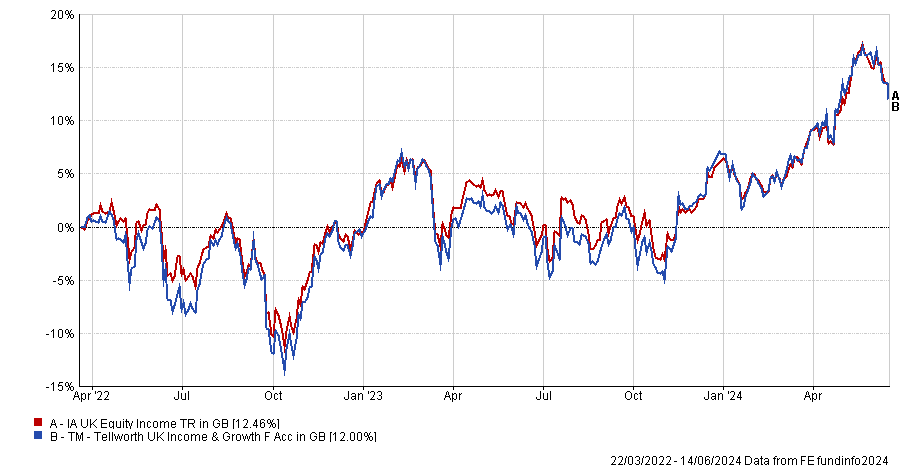

Upon joining Tellworth, Barnett launched the Tellworth UK Income and Growth fund, which has performed more or less in line with its sector average since inception in 2022, as the chart below shows.

The £16.5m fund has struggled to gather assets amidst a tough environment for UK equity funds, which have faced relentless outflows, although it has yet to reach its three-year track record – a milestone after which many asset allocators feel more comfortable committing to a fund.

Performance of fund vs sector since inception

Source: FE Analytics

Barnett will be replaced by Premier Miton’s Emma Mogford and assistant fund manager, Mahgul Ansari. They already run the £430m Premier Miton Monthly Income fund, which is a top-quartile performer over one and three years, as well as the £98m Premier Miton Optimum Income fund.

Premier Miton Monthly Income vs sector and benchmark over 3yrs

Source: FE Analytics

Mogford joined Premier Miton in November 2020 from Newton Investment Management and previously worked for Neptune Investment Management.

Elsewhere, Tellworth co-founders Paul Marriage and John Warren, who run the TM Tellworth UK Select and TM Tellworth UK Smaller Companies funds, remain at the firm.

Mike O’Shea, chief executive officer of Premier Miton, said the integration “brings together the two UK equity teams’ impressive experience, expertise and passion for active management”.