The defence sector has proven to be a rewarding investment, which implicitly suggests that the ‘peace dividend’ era that followed the end of the Cold war is now over.

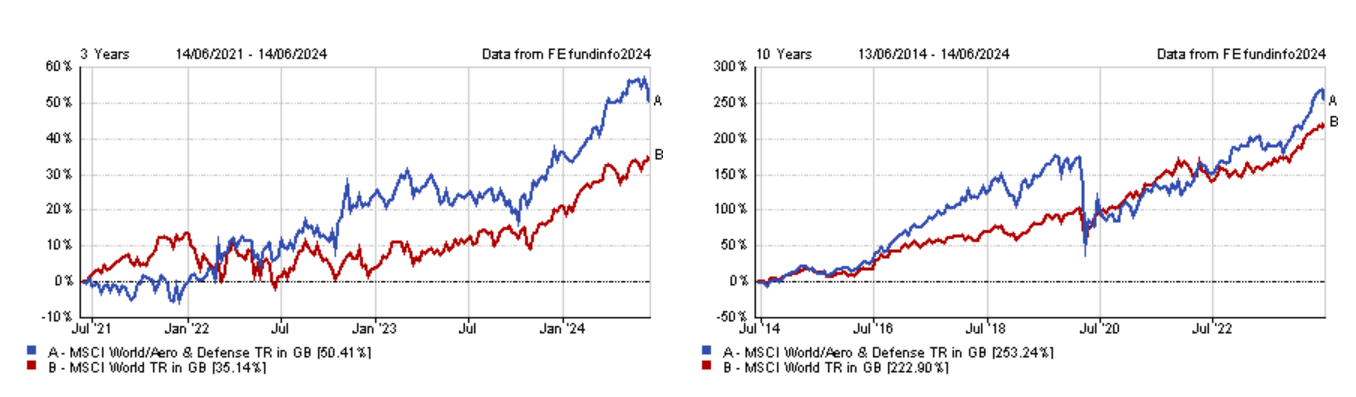

This has translated into outperformance for the MSCI World Aerospace and Defence sector compared to the broader market over the past three years, as well as over the past decade.

However, due to ethical and reputational considerations, it is a sector that fund managers are not always keen to delve into. Yet, with no signs that geopolitical tensions will abate in the foreseeable future, the defence sector may well continue to thrive.

Performance of indices over 3yrs and 10yrs

Source: FE Analytics

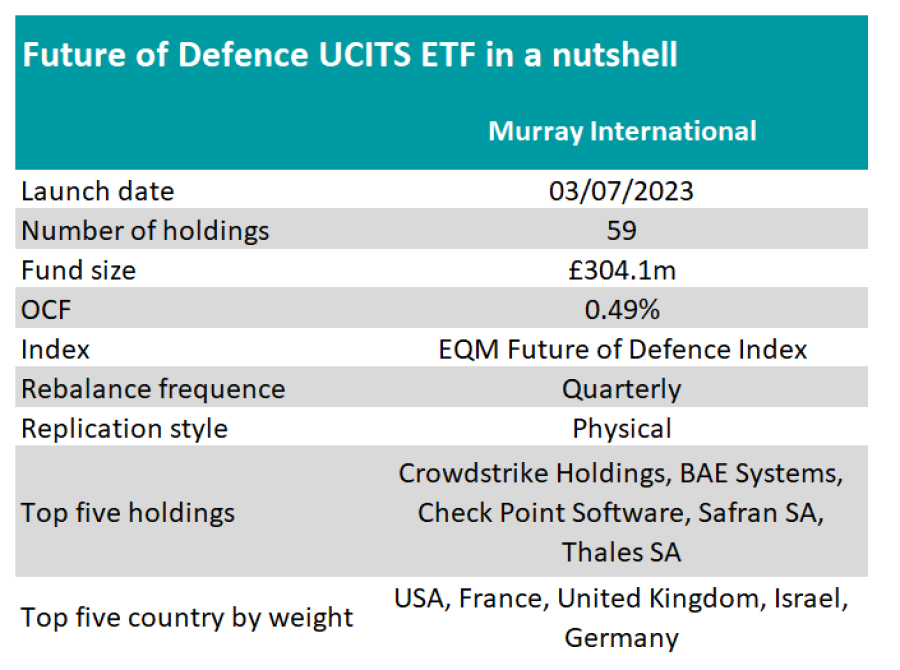

Therefore, HANetf launched the Future of Defence UCITS ETF in July 2023 for investors keen on gaining exposure to the sector but not comfortable with the idea of cherry-picking their own defence stocks. Despite the recent outperformance, experts believe this thematic ETF still has the potential to be rewarding.

Dan Coatsworth, investment analyst at AJ Bell, said: “The launch of a thematic ETF often signals the top of the market for a niche. All the easy money might have been made by the time an ETF provider recognises a hot theme and launches a product.

“There is the odd exception and the Future of Defence ETF’s performance since launch implies it might be one of them.”

Performance of ETF since launch vs index

Source: FE Analytics

Andy Merricks, fund manager at 8AM Global, believes this ETF should be considered as a core holding within a portfolio, provided the investor’s ethics allow for it.

He said: “With the world in the shape that it is in at the moment, it is difficult to envisage another sector that is virtually guaranteed to attract increased spending across all regions than defence.

“Europe has suddenly woken up to the threats to its borders from Russia while at the same time contemplating the re-election of Donald Trump later this year who has made it perfectly clear that the US will not subsidise NATO spending as it has done previously.

“This will inevitably lead to more being spent on defence in the short and medium term, which will benefit the companies that form the basis of this ETF. It is not a pleasant sector, but sadly it is a necessity.”

Europe is not the only part of the world where countries are ramping up military spending.

The tensions between Mainland China on one hand, and Taiwan and the US on the other, are another potential flashpoint.

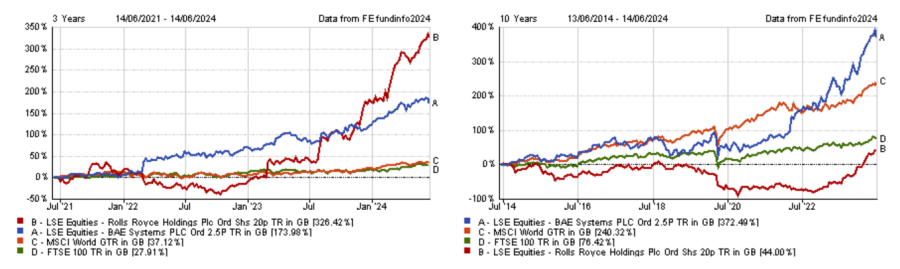

A further example illustrating the global scope of this rearmament process is Australia, which announced a partnership last year with the US and the UK known as 'AUKUS' to develop its first fleet of nuclear-powered submarines. This initiative has benefited UK defence companies such as BAE Systems and Rolls Royce.

Performance of stocks and indices over 3yrs and 10yrs

Source: FE Analytics

Jason Hollands, managing director at Bestinvest, said: “The investment case for owning aerospace and defence companies is therefore about tapping into a global pattern.

“And a feature of defence order books is that they are multi-year in nature and therefore relatively insensitive to the economic cycle, which makes defence (excuse the pun) ‘defensive’ in uncertain economic times.”

There is another factor that makes this ETF a particularly attractive proposition, according to Merricks: the fact that it is not solely allocated to ‘traditional’ defence names, but also has 44% invested in technology companies.

He said: “One of the main threats to national security comes not from traditional weaponry but from the modern weapon of cybercrime.

“Rarely a week passes without some new major attack being reported, often blamed upon hostile or malicious actors, and with so many elections occurring across the world this year there will be plenty more claims regarding outside interference of the democratic process.

“Just under half of the companies included in this ETF are those dealing with cybersecurity and, as with the defence sector itself, I can only see spending on this increasing in the years to come.”

Coatsworth noted, however, that the exposure to technology – and hence to cybersecurity – has decreased from 54% last summer to 42% currently.

Source: FE Analytics, HANetf

While Hollands also believes that the Future of Defence ETF is a good option for investors seeking global exposure to the defence sector, he is, nonetheless, wary of the valuations defence stocks command.

He said: “The price-to-earnings multiple for the EQM Future of Defence Index – which this ETF replicates – is over 22x earnings and has a hefty price-to-book ratio of 3.7x.

“As a general principle, I don’t think most investors should be buying narrow sector-specific funds as long-term buy and hold investments. But these can be useful for very active investors who want to exposure to a particular market theme for a period of time.”