In his annual letter to shareholders in 2021, Berkshire Hathaway’s Warren Buffett urged investors to “never bet against America”.

History is on the side of the Sage of Omaha and US dominance has become particularly overwhelming since the global financial crisis.

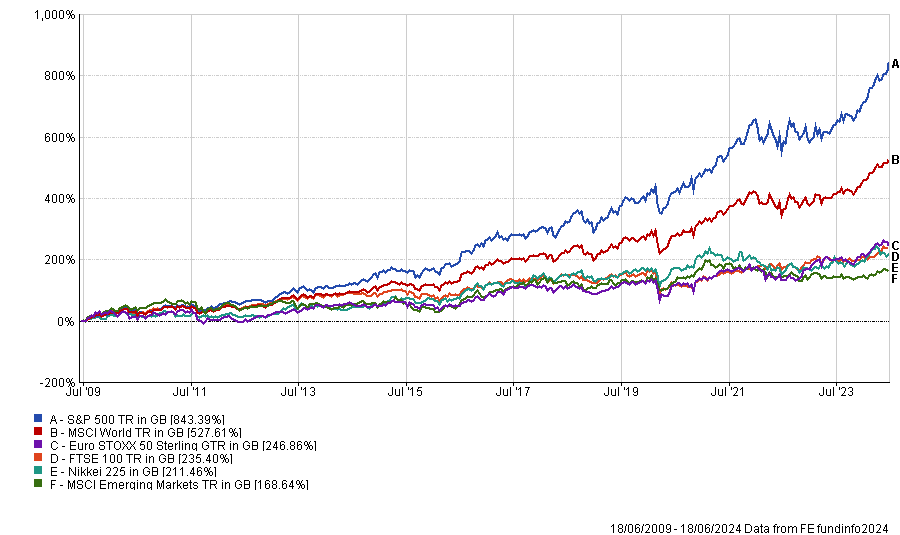

Over the past 15 years, the S&P 500 has exceeded the Euro STOXX 50, FTSE 100, Nikkei 225, and MSCI Emerging Markets indices by roughly 600 percentage points, as the chart below shows.

Performance of indices over 15yrs

Source: FE Analytics

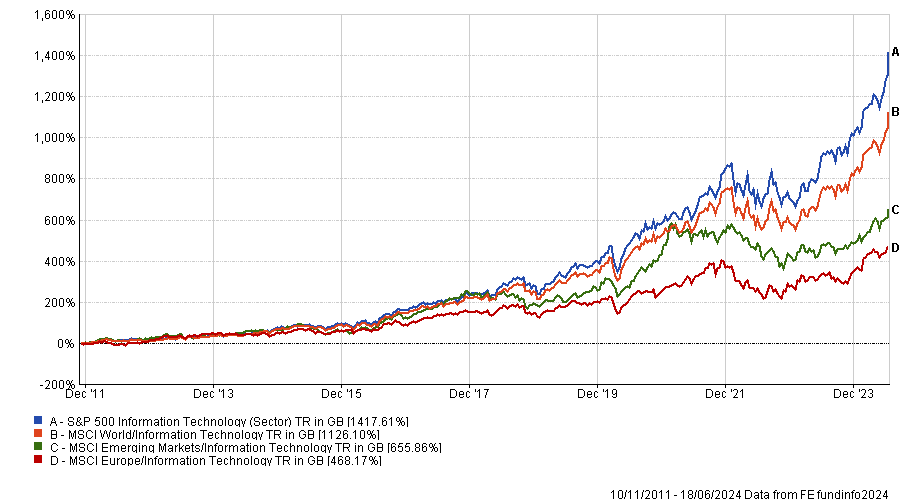

US exceptionalism has been underpinned by the technology sector, which is almost entirely dominated by American companies.

Ayesha Akbar, portfolio manager at Fidelity International, said: “The US is home to the majority of the largest and fastest growing tech companies in the world and this has helped propel US equity markets.

“Tech has fantastic margins and earnings growth, so even though the information technology sector has often looked expensive on valuations measures, earnings growth has always been there to deliver returns.”

Most non-US tech companies do not boast the same scale and significance as the Silicon Valley giants.

Gerrit Smit, manager of Stonehage Fleming Global Best Ideas Equity, noted that Europe only has one major technology company: ASML.

He said: “In America, you get the best of the new technology. We invest for future performance and it seems logical that it is going to come from technology. However, apart from China, there's no other region that really competes with America on that front.”

Performance of indices over 15yrs

Source: FE Analytics

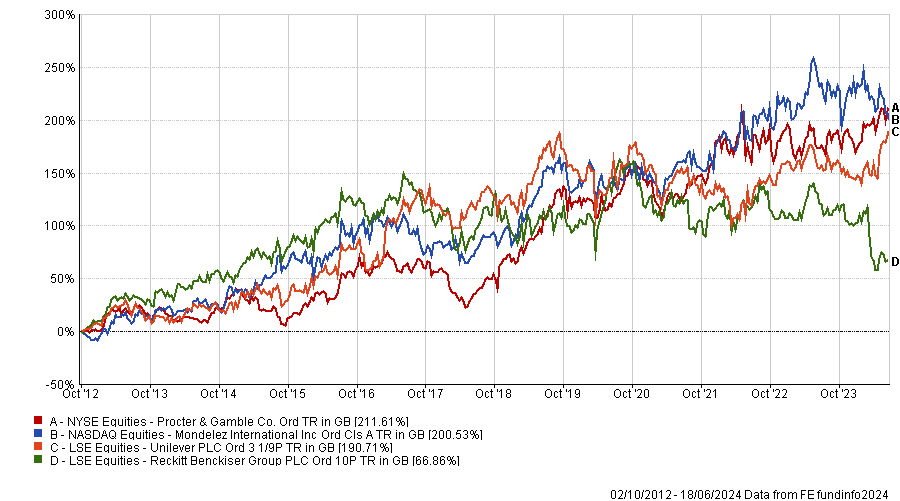

US equities have outperformed their global peers in non-technology sectors as well.

Matthew Page, manager of Guinness Global Equity Income, compared Mondelez and Procter & Gamble — two US consumer staples companies — with their UK equivalents, Reckitt Benckiser and Unilever. Over the past 15 years, the US duo has outperformed.

“I'm not entirely certain to what extent this is due to them being US-listed businesses or them having better management teams and benefiting from a more favourable market environment,” Page said.

“There are two things that tend to distinguish those US businesses relative to the European ones: growth and margins. American companies tend to deliver more top line and bottom line growth and they manage to do that with relatively high margins.”

Performance of stocks over 15yrs

Source: FE Analytics

Can the rest of the world catch up with the US?

The prolonged outperformance of US equities has opened up a valuation gap with the rest of the world. As a result, one could argue that American exceptionalism may stall, prompting investors to move to cheaper markets.

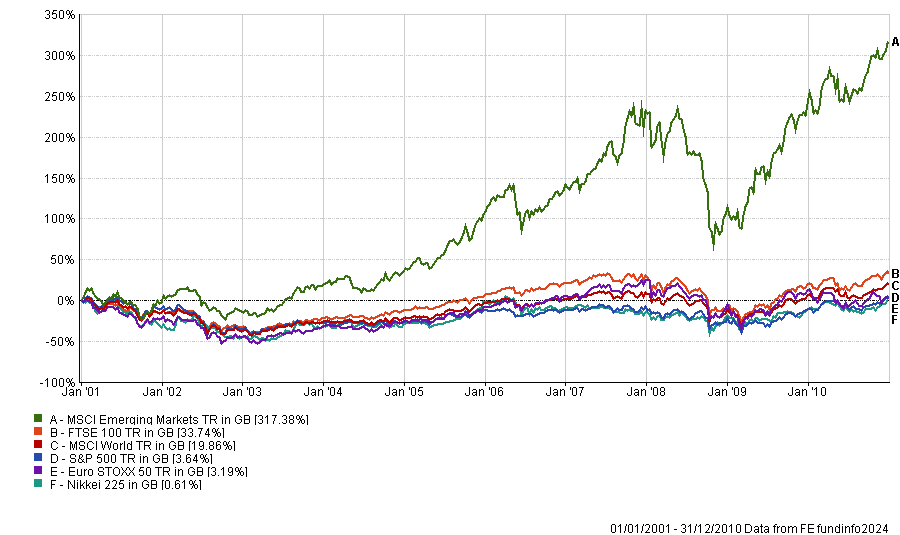

This would not be unprecedented. For instance, the S&P 500 did poorly in the 2000s, severely underperformed the MSCI Emerging Markets index and even lagged UK equities.

Performance of stocks between 1 Jan 2001 and 31 Dec 2010

Source: FE Analytics

Smit disagrees with the view that US equities are overpriced.

“We expect earnings growth for the S&P 500 to be close to 10% per annum over the next three years. If you divide that growth into the P/E ratio, you get a PEG ratio of 2.4. Against that, the PEG ratio for the MSCI World Index is 2.7. So, from a valuation perspective, despite the higher P/E multiples, I can also make a case for investing in America rather than in other regions,” he explained.

Page added that higher valuations for American companies are justified because they generate more profits per dollar invested. “Whether American companies are overvalued has been a constant question from investors over the past 15 years, but if you took the view that they were, you have missed out on some exceptional performance,” he said.

There are also macroeconomic factors that should benefit corporate America, such as better demographics.

Chris Iggo, chief investment officer for core investments at AXA Investment Managers, said: “There has been a surge in the US population in recent years. Between 2024 and 2054, the population is expected to rise from 342 million to 383 million. This is important because net immigration tends to mean a healthy growth rate in the working age population.”

Moreover, as the largest oil and gas producer in the world, the US is self-sufficient in terms of natural resources. Additionally, the US dollar is strong and close to a 20-year high against other major currencies.

The willingness to provide significant stimulus, as has been the case under the Biden administration, is another tailwind for US equities.

What could derail American exceptionalism?

Although valuations could be a concern in the short term, Akbar does not believe it will be enough to dethrone US equities.

The upcoming elections are causing some concerns, although Smith highlighted that both Republicans and Democrats are business-friendly.

Iggo said: “Any social unrest like the disorderly transfer of power seen in the wake of the 2020 presidential election could be harmful to economic growth.

“The geopolitical situation is also uncertain and the trade war with China could easily worsen.”

Iggo also raised concerns about persistent inflation in the US, which may prevent the Federal Reserve from cutting interest rates as quickly as anticipated, along with worries about the US federal government borrowing and the increasing cost of servicing debt.