Clients often ask why we have a large exposure to the healthcare sector within our funds, and whether this poses a risk.

In principle, this is a valid question. Conventional wisdom holds that a diversified portfolio balanced across a range of sectors will reduce the impact that a downturn or shock in a particular sector has on the performance of the fund.

This is the view of ‘top-down’ allocators, who argue that managing sector exposures provides sufficient diversification to lower risk, which they equate to volatility.

Diversification is not that simple. When constructing portfolios, our belief that earnings drive share prices is what matters, and this belief is why we instead take a ‘bottom up’ approach to allocation, to ensure these earnings come from as diverse a set of sources as possible.

For example, we look at how much exposure a portfolio might have to the Chinese luxury consumer, or to value-based healthcare reform in the US.

Intuitively, this sounds like the logic of the top-down sectoral approach favoured by many managers. But this similarity only holds true if the categories used to assess diversification adequately group together companies with similar earnings drivers, and therefore similar sources of risk. In our view, they do not.

Categorisation: A nuanced problem

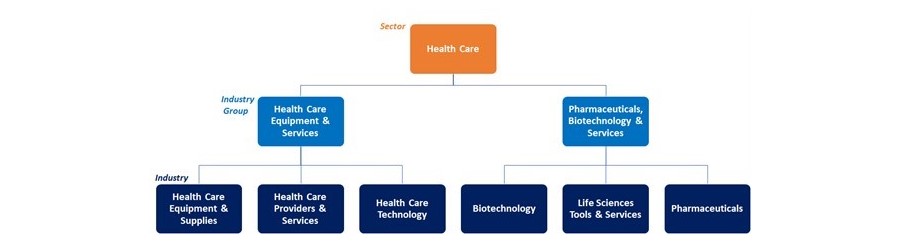

The Global Industry Classification Standard (‘GICS’), is the most widely used industry framework for sector-based portfolio management. This framework groups companies into a multi-tiered classification system according to their principal business activity, with revenues the key determining factor.

The drawback is that many companies do not neatly fit into a single industry or sector. By focusing on ‘principal business activity’, the totality of a company’s exposure, the nuances of its business model and the long-term secular growth drivers that may be spread across different industries and sectors are all lost.

This means that categories alone can tell you very little about what a company does or how it makes money, and thorough research is still non-negotiable.

In the case of massive, diversified conglomerates with earnings spread across multiple industries and markets, the challenge of categorising by principal business activity is obvious. But more importantly, even the narrowest subcategories frequently fail to distinguish between very specialised, very different businesses.

Sunglasses, pets, and sub-sub-sectors

To illustrate these points, let’s explore the healthcare sector as defined by the GICS system. As mentioned, this is the largest sector allocation across our funds. But although these companies may be classified as ‘Healthcare’ they all have different growth drivers and risks, meaning the earnings of these companies are a lot more diversified than this blunt labelling suggests.

According to the GICS framework, the healthcare sector can be broken down into two industry groups, with six industries beneath this, as the below chart shows.

Source: Seilern Investment Management

But even within one of these six industries, companies can possess markedly different growth drivers and business models. To illustrate, let’s consider two companies in our investment universe, IDEXX Laboratories and EssilorLuxottica.

These are both classified in the healthcare sector, the same industry group, ‘Healthcare Equipment & Services’ and the same industry, ‘Healthcare Equipment & Supplies’.

IDEXX is the global leader in companion animal diagnostic tests and services and provides the veterinary industry with the tools to help treat animals effectively, diagnose illnesses and to raise the standard of care.

The company’s long-term growth drivers are linked to the increasing rates of pet ownership and the ‘humanisation’ of pets whereby “pet-parents” increasingly see their pets like children, and subsequently spend more of their disposable income on their health.

EssilorLuxottica, on the other hand, is the global leader in the eyewear industry. It designs, manufactures, distributes and retails corrective prescription lenses, spectacle frames and sunglasses.

One of its main long-term growth drivers is the increasing prevalence of short-sightedness due to prolonged exposure to screens such as phone and tablets, as well as in emerging markets, where rising wealth and a large pool of people with unaddressed visual issues, are also driving growth.

Same sector, different fundamentals

A purely top-down, sectoral interpretation would hold that having both these stocks in a portfolio would provide no diversification benefits, and in theory, they should perform similarly.

But if we compare their share price performance their very different growth drivers are evidenced by their five-year correlation coefficient of just 63%. This is a seemingly low figure for two companies who, even at one of the most granular levels of the GICS categorisation, supposedly belong to the same industry.

This illustrates the limitations of using a top-down approach to manage risk. Different growth drivers mean the risks to these companies are also very different. For IDEXX, the risk to its earnings would be if the demand for animal healthcare was to falter, whereas for EssilorLuxottica it would be if rates of short-sightedness decrease.

So, if one were to be affected and the share price suffer, it would be highly unlikely that the other stock would also see its share price affected.

A bottom-up approach

Given this, a top-down sector allocation framework is not a true reflection of the concentration of risk within a portfolio. Instead, investors should look at ‘bulk risk’ – that is, how closely correlated the earnings of companies are. This approach can only be implemented by analysing each business model in detail from the bottom-up perspective of core earnings drivers, not the top-down view of which industries and sectors a company nominally operates in.

Akash Bhanot, research analyst at Seilern Investment Management. The views expressed above should not be taken as investment advice.