The healthcare sector has been a story of two halves recently. Novo Nordisk and Eli Lilly, which dominate the weight loss drug market, have returned 78.1% and 103.9% in the year to 8 July 2024, respectively. Meanwhile, the biopharmaceutical industry has been dealing with a supply chain hangover and earnings downgrades following excessive spending during the Covid pandemic.

Many fund managers agree that the healthcare sector should benefit from the long-term trends of ageing populations, increasing demand and innovation, especially in biologics (a term encompassing vaccines and antibodies, among others).

Yet managers also concur that healthcare has not lived up to its potential over the past year. The broad MSCI World Health Care index (which has 15.4% in Eli Lilly and Novo Nordisk combined) has returned 14.8% for the year to 8 July, lagging the tech-fuelled MSCI World (up 25.5%).

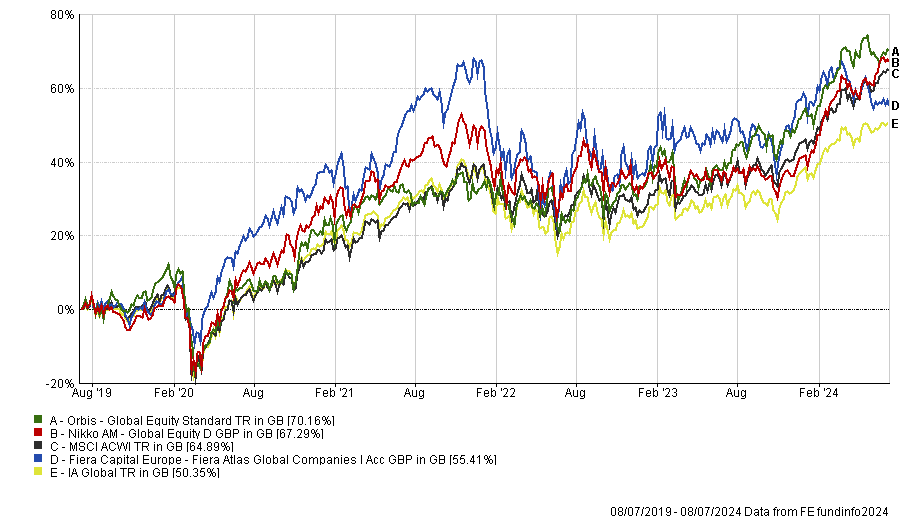

Nonetheless, over the past five years, an allocation to healthcare would have delivered significant diversification versus the broader market, as the chart below illustrates.

Performance of the healthcare sector vs MSCI World over 5yrs

Source: FE Analytics

Below, Trustnet asked three global equity managers how they are approaching the healthcare sector.

Nikko AM: Still overweight despite a disappointing year

Will Low, head of global equity at Nikko Asset Management, said healthcare has been one of the most challenged areas of his portfolio during the past 12 months but the $827m Nikko AM Global Equity fund remains overweight (a 17.6% allocation to healthcare versus 10.9% for the MSCI All Country World Index).

During and after the Coronavirus pandemic, healthcare providers ordered excessive amounts of diagnostic equipment and other stock, which led to a build-up of inventory, Low said.

Several healthcare companies did not experience the revenue growth that investors and analysts had expected last year because their customers were not replacing equipment as quickly as usual, which had an impact on profit margins, and as a result, their earnings disappointed.

Now there are nascent signs that inventories are clearing and the run rate of orders is normalising, Low said.

Nikko holds Danaher, the life sciences and diagnostics company, whose share price peaked in September 2021 then fell until late October 2023 but has since rebounded.

One of his fund’s largest holdings is Encompass Health, which owns and operates rehabilitation hospitals in the US. In contrast to life sciences and diagnostics, healthcare facilities have performed well in recent months on the back of supportive utilisation trends. Encompass Health's share price has risen strongly since November 2023.

Fiera Capital: Don’t take drug-specific risk

The share of biologics in research and development budgets is increasing each year and the number of biologics drugs coming to market is growing annually, said Simon Steele, head of the Fiera Atlas Global Companies team.

He does not want to take drug-specific risk so has been looking for companies with exposure to biologics and processing that are agnostic about which drugs become successful.

Veeva Systems, a cloud-based software provider for the life sciences industry, was one of the $1.3bn Fiera Atlas Global Companies fund’s top 10 holdings as at 31 March 2024.

The fund also counts Edwards Lifesciences (which makes heart valves) and pet care specialists IDEXX Laboratories and Zoetis amongst its top 10.

One aspect that Fiera Capital analyses from a diversification perspective is “who pays our cash flows”, Steele said. “That enables us then to understand whether this is a consumer play”, as with pet care, or if a particular healthcare stock is more exposed to the public sector.

Performance of funds over 5yrs vs sector and MSCI ACWI

Source: FE Analytics

Orbis: Managed care providers are a contrarian bet

The Orbis Global Equity fund’s largest position, worth 4.7% of the portfolio, is UnitedHealth – an American health insurance and services provider. It also has about 2.5% in Elevance Health.

These managed care companies benefit from growing demand, limited supply and high barriers to entry. Over the long term, they have grown their earnings much faster than the average US company, said Ben Preston, head of Orbis Investments’ global sector research team.

However, UnitedHealth has come under fire recently due to several factors that Orbis’ healthcare analysts do not expect to have a material long-term impact. For example, it was the victim of a ransomware attack and the full impact on earnings is not yet known.

Orbis – a contrarian investor – has been increasing its exposure to UnitedHealth this year as the share price has dipped.

“When you ask us why we own something, we normally give you the reasons why everybody else hates it. We like to buy stuff when it’s cheap and the reason it gets cheap is when nobody else wants to own it,” Preston explained.

“We like stuff that’s got a core, solid, strong foundation but there are a few question marks around it because it puts off everybody else and allows us to buy it.”