Now that UK government bonds offer a yield above 4%, equity income strategies have to work harder to justify their existence.

The argument for an equity income strategy is clear: dividend payouts plus the prospect of capital growth and higher total returns than those available from the bond markets. And with many investment trusts trading on a discount, investors can gain access to a portfolio of shares for less than they are intrinsically worth and potentially make additional gains if the discount narrows.

In practice, however, the holy grail of yields plus capital gains has been hard to achieve, with only a handful of investment trusts delivering top-quartile returns over three years with a yield payout in excess of 10-year gilts (4.2% as of 10 July 2024).

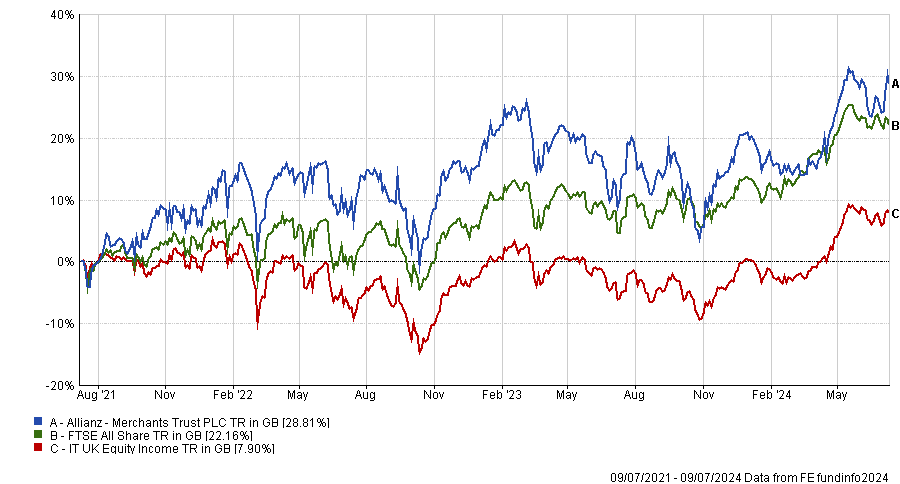

Within the Association of Investment Companies’ (AIC) UK Equity Income sector, Merchants Trust is the only one to make the mark with a yield of 4.9%. It is one of the AIC’s dividend heroes, having increased its dividend for 42 consecutive years.

Peter Hewitt, who manages the CT Global Managed Portfolio Trust and invests in Merchants Trust, said it can be relied upon to keep growing its dividend. “They will not drop the ball” he said.

The £859m trust is the third-best performer in its sector on a total return basis over three and five years. It is trading almost at par, with a very slight discount of 1.4% as of 31 May 2024.

Performance of trust vs sector and benchmark over 3yrs

Source: FE Analytics

Simon Gergel, chief investment officer for UK equities at Allianz Global Investors and head of the value and income team, helms the trust. RSMR analysts described its investment style as contrarian and value-orientated, with an income bias.

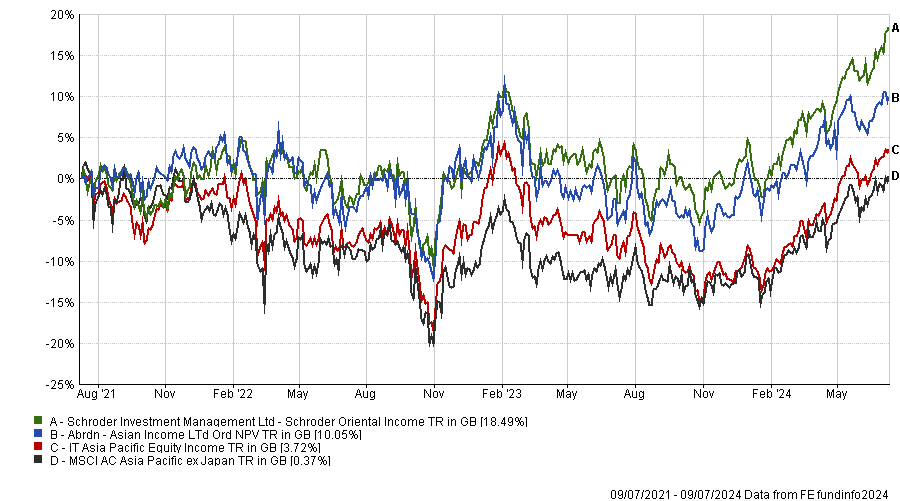

Two Asia Pacific equity income trusts achieved top-quartile returns over three years with a yield above gilts: abrdn Asian Income with a 5.7% yield and Schroder Oriental Income paying out 4.5%. The two trusts have grown their dividends for 15 and 17 consecutive years, respectively.

The abrdn Asian Income trust was trading on a 12.4% discount by 31 May and has a £348m market capitalisation. Richard Sennitt’s £690m Schroder Oriental Income trust sits at a 4.2% discount.

Performance of trusts vs sector and benchmark over 3yrs

Source: FE Analytics

Other equity trusts making the grade included BlackRock Latin America (a 6.4% net yield and a 12.9% discount), BlackRock Frontiers (a 4.4% yield and a 5.9% discount) and Schroders’ International Biotechnology Trust (a 4.5% yield and a 8.7% discount). The latter has committed to paying a 4% dividend from capital reserves.

Meanwhile, the Henderson High Income Trust is a top-quartile performer in the UK Equity & Bond Income sector and has a 6.4% yield. It is trading at a 9.7% discount.

For investors who prioritise income payouts, Henderson Far East Income has a 10.5% yield while the British & American Investment Trust boasts an 9% yield.

Two UK equity trusts paid an income over 7%: Chelverton UK Dividend Trust (7.8%) and abrdn Equity Income Trust (7.4%).

However, all four trusts underperformed their peer groups from a total return perspective over three years, which illustrates the difficulty of achieving both income and growth.

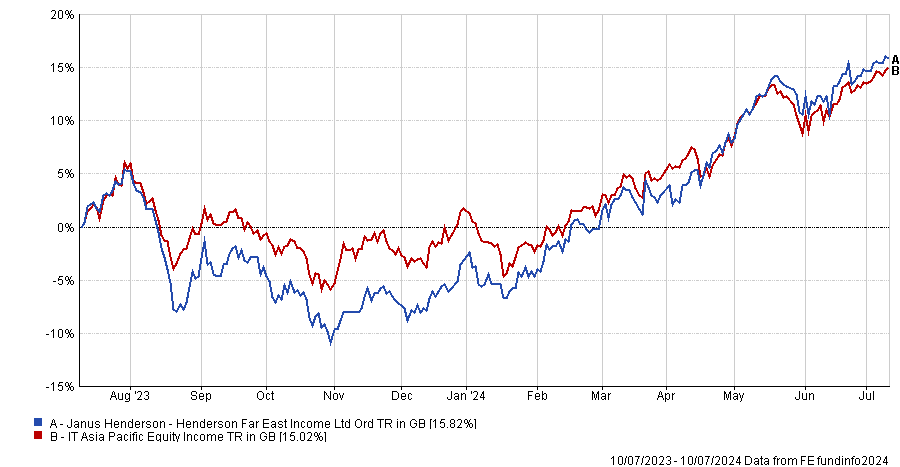

Henderson Far East Income’s performance has struggled, lagging its sector average over three and five years, but it changed hands last autumn when Mike Kerley retired and his colleague Sat Duhra stepped up to become lead manager. Since then, “it's really picked up”, Hewitt said. “He's sorted things out and I’m very impressed.”

Performance of trust vs sector over 1yr

Source: FE Analytics

The £376m trust has been consistently boosting its income by writing call options for a decade or more, Hewitt added.