Looking at the healthy state of the US corporate credit market today – the jewel in the crown of the global credit universe – one could be forgiven for forgetting about the heavy price paid by all fixed income assets to get to this point.

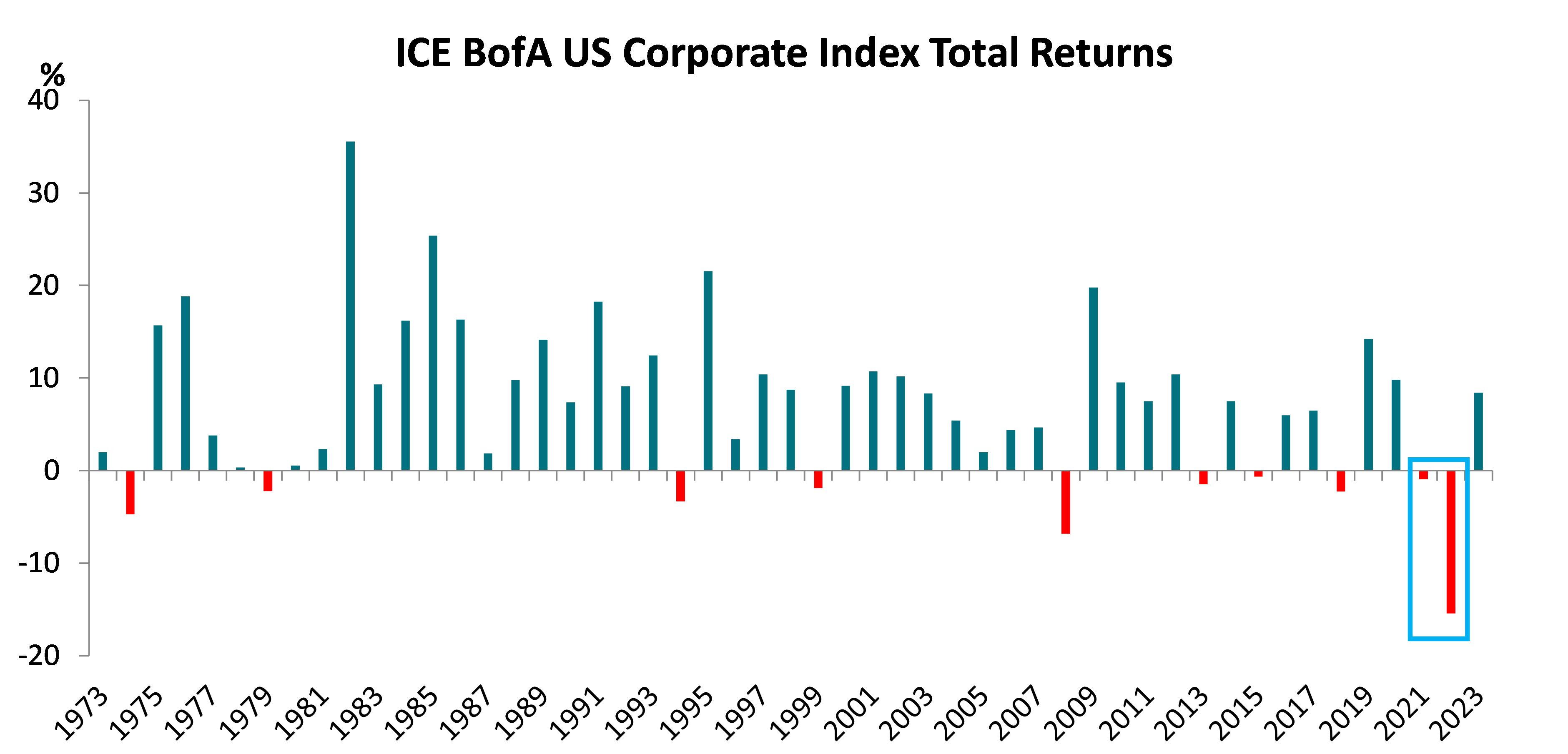

The recent inflationary spike and the Federal Reserve’s subsequent aggressive pace of policy tightening saw the ICE BofA US Corporate index suffer consecutive negative return years in 2021 and 2022 for the first time since records began in 1973.

Source: ICE BofA as at 31 Dec 2023

However, not only are negative years relatively rare in credit, but the market tends to bounce back following a downturn.

In a little more than two years, the market’s average par-weighted coupon has risen by 58 basis points (bp), and it should continue to rise significantly as more companies come to refinance old debt. According to JP Morgan, the average coupon of new investment grade issuers in the fourth quarter of 2023 was 6.2%, well above the 10-year average of 3.6%.

Yields move to 15-year high

The flip side of the negative returns in 2021 and 2022 is that investors can now access the US investment grade credit market at attractive all-in yields of 5.8%, levels not seen since 2009. Most of the increase, however, has been due to volatility in the risk-free rate, and for investors, usually attracted to credit for the spread that it offers above government bonds, current valuations have presented a conundrum.

Underpinning this quandary are the laws of economics, which dictate that rate hiking cycles of the magnitude recently witnessed should lead to a slowdown in activity, an easing in the labour market and potentially even a full-blown recession.

But there has been nothing typical about the resilience and continued exuberance of corporate America in response to the current squeeze in conditions, reflected by credit spreads which have continued to grind tighter.

Adjusting to a new norm

Although there have been some pockets of weakness within the US regional banking sector and commercial real estate, US investment-grade company earnings have broadly held up well.

Margins within most sectors have also stabilised and even improved for higher-quality issuers. Sticky inflation led to increased costs without revenues keeping pace but as inflation moderates, pricing action and efficiency measures undertaken by investment grade companies in the past two years should drive margin improvement.

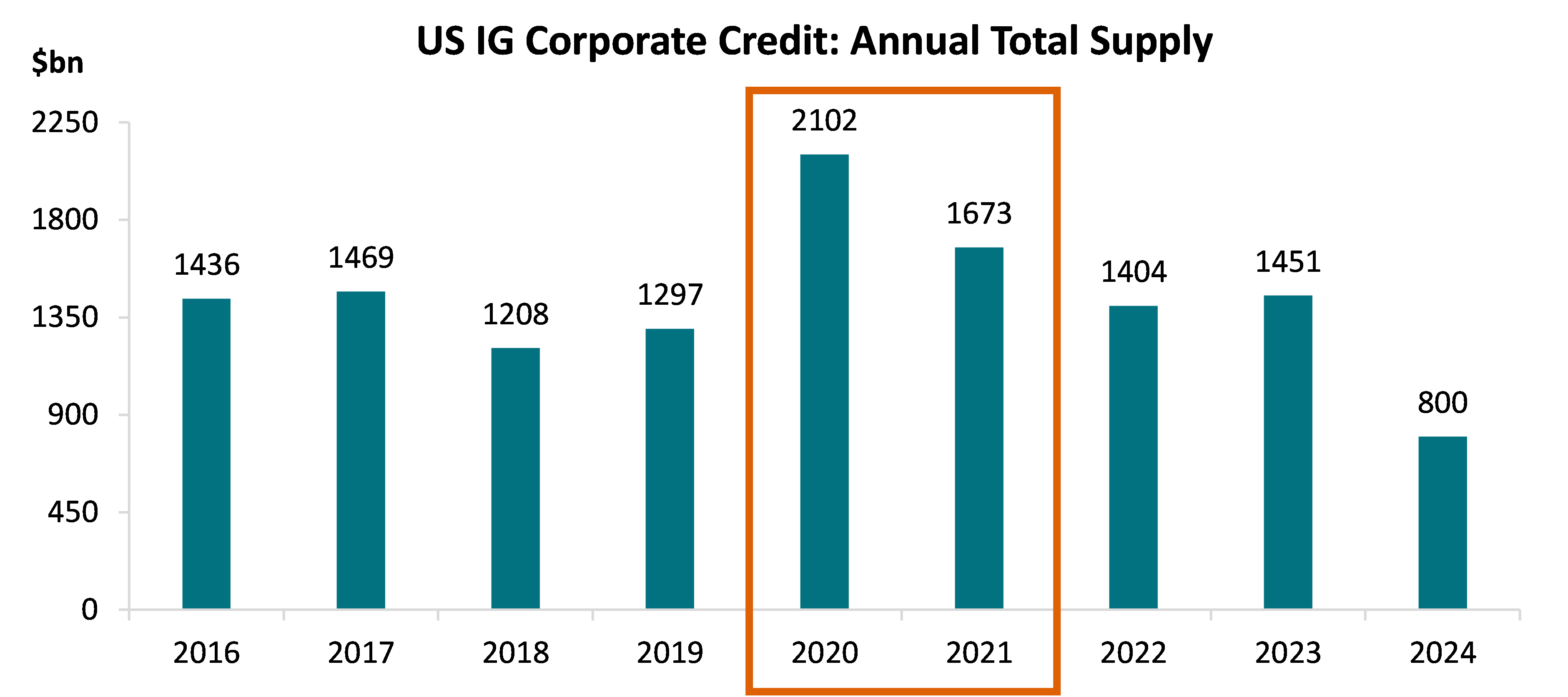

In the primary market, many companies took advantage of very low rates in 2020 and 2021 to refinance debt and lock in low interest expense costs on long maturity bonds. As a result, comparing the end of 2018 with 2021, the market’s average maturity increased from 10.4 years to 11.8 years – its highest point since 1999.

Source: Barclays Live Report, 30 Apr 2024

For an asset class like US credit, which has a longer duration than its European counterpart and less callability than high yield (meaning more bonds are retired at their original maturity date), the proactivity of companies in adjusting their capital structures while rates were low has afforded them time to adjust to this period of higher rates. US companies’ large balance sheet cash reserves have helped them manage their debt profiles comfortably.

Now that quantitative easing is no longer keeping a virtual ceiling on how high yields can go, management teams have the real incentive to keep leverage low so that the overall interest burden today is not so much higher than when rates were low.

Technical tailwinds

After such a strong run, primary market forecasts are, on average, down for 2024 as companies grapple with higher borrowing costs. That said, there continues to be robust demand for high-quality credit, meaning that the market is not struggling to absorb current volumes. This in turn is providing technical support, particularly from the strong ratings momentum across the full credit continuum.

Last year saw a record upgrade volume in the US investment grade market of $791bn (11% of market size). This included $101bn of rising stars from the high yield universe, of which Ford, the largest rising star ever, accounted for 40%. Downgrades totalled $225bn (3%), of which just $25bn fell to high yield. This equated to an upgrade/downgrade ratio of 3.5x, well above the past 15-year average of 1.1x.

Dawn after dark

While the fundamental and technical picture looks healthy, the biggest tailwind of all would come from the macro story and Fed cuts, which remain very much on the table for 2024. Fed cuts would initiate a decline in short-term deposit rates and create better entry points for spread buyers. A potential steepening in the yield curve after persistent inversion would also present more attractive opportunities further along the curve.

Risks remain. But the market is starting to look through the current impasse, recognising that although the price has been high, the potential for attractive total returns from high-quality credit is now back.

Jack Stephenson is a US fixed income investment specialist at AXA Investment Managers. The views expressed above should not be taken as investment advice.