More than 60 UK funds are boasting three-year returns higher than the average tech fund, data from FE Analytics shows, as the domestic market comes back into favour.

Tech stocks have been the darlings of the market for an extended period, with the so-called Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms and Tesla) surging in recent years. At the same time, the UK market has been unloved as investors were put off by Brexit, a lacklustre economy and political infighting among multiple Conservative governments.

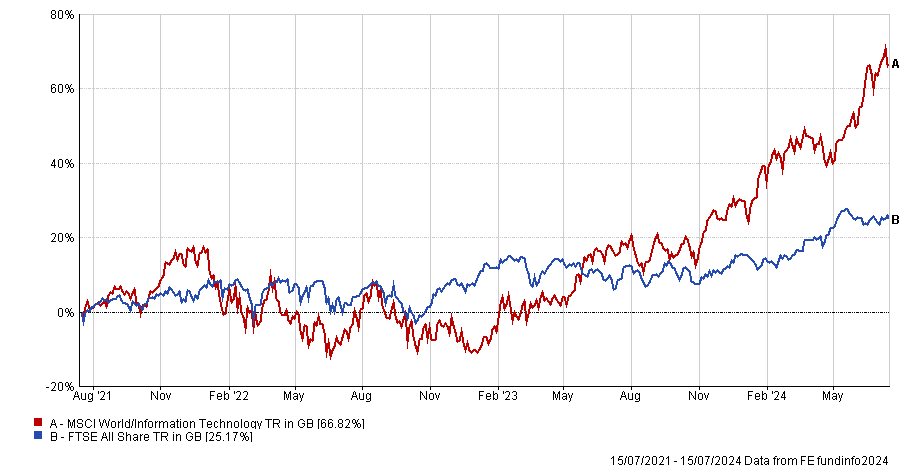

Given this, it should come as little surprise that the FTSE All Share is far behind the likes of the MSCI World Information Technology index. Over the past three years, the FTSE All Share made a total return of 25.2% while the global tech index gained close to 67%.

Performance of UK equities vs global tech over 3yrs

Source: FE Analytics

However, the Investment Association sectors focused on these stocks paint a different picture.

IA Technology & Technology Innovation is still in the lead, with its average member sitting on a 25.8% total return over the past three years. But the IA UK Equity Income sector isn’t too far behind with a 21% average return. IA UK All Companies is up 10.1% while the average IA UK Smaller Companies fund is down 13.2%.

Within the UK equity sectors, quite a few funds have managed to beat the average IA Technology & Technology Innovation strategy over three years: 65 out of 346 funds (or 18.7%) with a long enough track record.

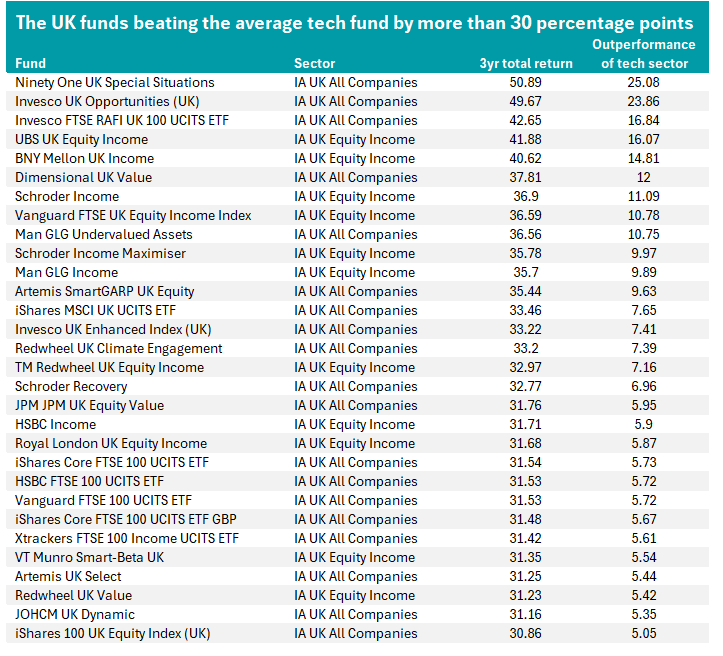

The 30 UK funds that have beaten the IA Technology & Technology Innovation sector by at least 5 percentage points can be seen in the table below. At the very top is Ninety One UK Special Situations; its 50.9% three-year return is 25 percentage points ahead of the average tech fund.

Managed by Alessandro Dicorrado and Steve Woolley, the £485m fund has a value approach that looks for ‘cheap’ companies. These tend to be stocks that are down 50% from their peak relative to the FTSE All Share over the past seven years.

Analysts at Rayner Spencer Mills Research said Ninety One UK Special Situations is a good option for investors seeking exposure to value stocks but should be paired with a growth fund rather than being the only UK holding in a portfolio.

“This is a concentrated fund with a significant bias towards value stocks,” they added. “It is likely to underperform in markets driven by growth-orientated companies, particularly when sentiment is less valuation sensitive. When there is a rally in value stocks, this fund should be a major beneficiary and outperform the market and peer group.”

Source: FE Analytics. Total return in sterling between 16 Jul 2021 and 15 Jul 2024

Although value investing was out of favour for an extended period following the global financial crisis, it has had moments of strong outperformance in recent years. The MSCI United Kingdom Value index is up 43.2% over three years, compared with a 17.8% gain from the MSCI United Kingdom Growth.

This dynamic means that many of the funds at the top of the above table follow the value style, especially as the UK market tends to have a value tilt thanks to high allocations to sectors such as banks, energy, consumer staples and industrials.

Indeed, all of the funds that have beaten the IA Technology & Technology Innovation average by more than 10 percentage points – Invesco UK Opportunities, Invesco FTSE RAFI UK 100 UCITS ETF, UBS UK Equity Income, BNY Mellon UK Income, Dimensional UK Value, Schroder Income, Vanguard FTSE UK Equity Income Index and Man GLG Undervalued Assets – as well as many of those that follow have a value bias.

A general uptick in the UK market, thanks to attractive valuations, improving macroeconomic data and the expectation of political stability, could also explain why some UK funds have been able to beat the average tech fund.

BlackRock – the world’s largest asset management house – recently went overweight UK equities, saying: “We see the Labour Party’s landslide UK election victory increasing the likelihood of a two-term government. The potential for long-term policy implementation should bring relative political stability, in our view.

“We think perceived stability can help improve sentiment – especially among foreign investors who own more than half of UK shares.”

The divergence in performance among underlying tech stocks is also a factor: not all parts of the tech market are soaring.

The bulk of the gains in recent years have been driven by the Magnificent Seven, so funds that avoided these companies have struggled. In recent months, some of these companies have even started to underperform.

Within the IA Technology & Technology Innovation sector, the best fund over three years is up around 85% (iShares S&P 500 Information Technology Sector UCITS ETF) while another four made total returns in excess of 60%. However, the worst performer is down more than 35% (WisdomTree Cloud Computing UCITS ETF) and another three have lost over 10%.

This diverging performance has had the effect of dragging the sector average down to the level that some UK funds have been able to beat, although no UK funds have been able to outperform the best tech funds.