There aren’t that many direct and obvious replacements for Jim Leaviss, the veteran fixed-income manager of the M&G Global Macro Bond fund, who announced his retirement earlier this month.

The news that he will be leaving the industry on 1 August, will be a blow to many investors who have trusted him with their cash over a sterling career and they may be scratching their heads trying to identify established or even up-and-coming bond managers with a stance comparable to his.

Without Leaviss, the field is left short of big-profile managers, as most big names have struggled in the past year, according to director of Farview Investing Ben Yearsley.

This was true, for example, of the Janus Henderson Strategic Bond and the Jupiter Global Macro Bond funds, he said. Both got the US hard-landing investment case wrong and whose performance suffered accordingly, as illustrated in the chart below.

Performance of funds against benchmarks over 1yr

Source: FE Analytics

“Many macro bond managers have got their big calls wrong of late and I wouldn’t say there are many up-and-coming stars to look out for,” he said.

The Janus Henderson fund may also be under review based on a manager retirement as John Pattullo is leaving in March next year, although his long-time co-manager Jenna Barnard remains in place.

This makes the question of whether investors should keep holding the M&G fund or walk away “a difficult one” to answer, as Yearsley isn’t finding many alternatives, although the new lead manager at M&G, Eva Sun Wai, is “good and has been prominent on this fund for a while”.

On Yearsley’s radar is Nick Hayes, who, together with FE fundinfo Alpha Manager Nicolas Trindade, is in charge of AXA Global Strategic Bond, a “lesser-known” fund, but one that has been around “for quite a while”.

It was launched in October 2020, to build upon the success of another similar unconstrained, total return, AXA mandate that had been in the offshore market for nine years already.

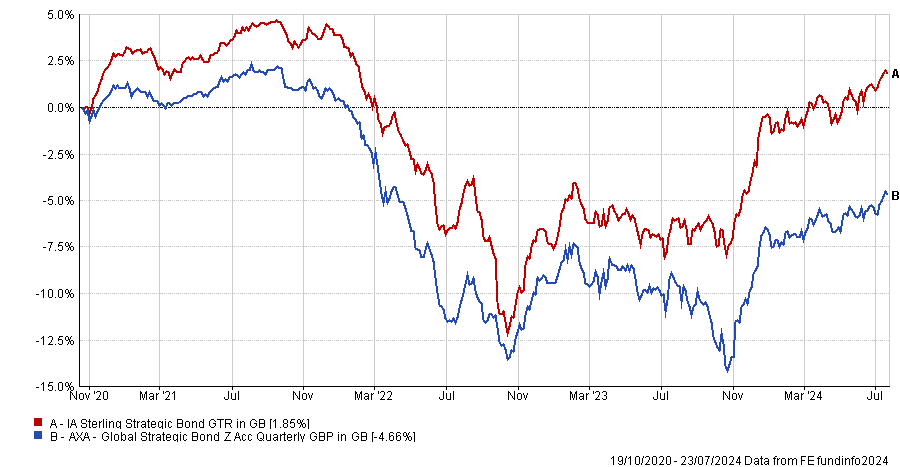

Performance of fund against sector since launch

Source: FE Analytics

However, this isn’t a direct replacement for M&G’s fund, as its team is refraining from making any of the bold macro calls that Leaviss was renowned for, Yearsley noted.

That’s also the case for other funds that are doing well, such as Pimco Income, the $78.8bn strategy with a FE fundinfo Crown rating of five, managed by Alpha Manager Dankiel Ivascyn and Joshua Anderson, with Alfred Murata as deputy – and the trend is spreading across the board, with no one emerging as a leading figure in the space.

“The whole industry seems to be moving away from the funds that make big macro calls. Who needs to be a hero in the bond world, when it’s so easy to achieve high single-digits returns through gilts at 4% and investment grade at 6%?” he said.

A more straightforward solution to the conundrum came from FundCalibre managing director Darius McDermott, who opted to stay with M&G.

With Sun Wai set to become the lead manager and Rob Burrows’ promotion from within the business to support her, the transition “underscores the strength and depth of the fixed income team at M&G, and suggests that investors should continue to hold this fund”, he said.

“Although this was very much a macro-focused bond fund, it could be argued that all bond managers must pay close attention to macroeconomic data.”

McDermott also identified a few other options outside of the M&G fund. The Invesco Tactical Bond fund, for example, managed by Stuart Edwards and Julien Eberhardt, is “worth considering”.

The managers use an active style, continually adjusting risk according to market conditions, and the fund has the flexibility to invest across the entire fixed-income spectrum.

Another “excellent” option is Nomura Global Dynamic, managed by Richard Hodges, who “has repeatedly demonstrated his ability to accurately read economic environments and select individual investments accordingly”.

“Nomura Global Dynamic is a great choice for all market conditions, offering both yield and capital return,” McDermott concluded.

Performance of funds against sector over 1yr

Source: FE Analytics

Finally, Charles Stanley’s Rob Morgan said it is difficult for any manager to consistently get macro calls right and to combine that with good stock selection. One “appealing” option is Morgan Stanley Global Fixed Income Opportunities, a similarly benchmark-agnostic and flexible fund that utilises the “deep research resources at Morgan Stanley, crucial in running a flexible strategy”.

The approach is “truly global” and will always maintain a minimum of 50% investment grade bonds to maintain a good overall credit quality.

“However, there is willingness to invest sizeable allocations to emerging markets sovereign bonds and currencies, as well as opportunistic investments in asset backed securities,” he said.

“The ‘go anywhere’ approach makes it an all-weather vehicle and a possible ‘one stop shop’ for investors’ fixed income exposure. It continues to perform well and is appropriately costed with a 0.45% annual management charge.”