Investors would be forgiven for being stunned by Joe Biden’s sudden decision to step down from the presidential race this weekend, which has added further unpredictability to an already divisive campaign and brought greater volatility to the global market.

Biden’s decision to leave the race is not necessarily historic, in the 20th century, three sitting presidents chose not to stand for a second term. What is unique about Biden’s exit is the timing; with only four months left until polls open, it is unusual for an incumbent to withdraw this late into the campaign.

Although Biden has endorsed his vice president Kamala Harris as the Democratic party candidate, her nomination is unlikely to be confirmed until the party convention in August.

This period of uncertainty over the Democratic ticket will bring a new wave of volatility to the election campaign and give pause to those investors who had begun to regard former president Donald Trump's victory as inevitable.

With a potential Harris-led campaign now set to change the election, markets are reconsidering the consequences of a potential Democrat victory.

According to Kristina Hooper, chief global market strategist at Invesco, in the short term, Biden’s decision to withdraw will lead to four months of market volatility, as investors consider what could benefit from Harris’ success.

On the one hand, Biden’s endorsement of Harris avoids any large-scale market panic, and in the event of her victory, she brings continuity from the existing administration that may prove reassuring to existing investors.

However, in this period of enhanced volatility, the composition of the rest of the Democratic ticket will shape the campaign's overall market impact, particularly in terms of the choice of vice president.

While Harris provides continuity with Biden, she is also considered more left-wing by independents, meaning a potential vice president would need to attract the independent swing state voters.

Hooper suggested that an out-of-the-box pick such as billionaire Mark Cuban, an independent and fiscal conservative, may fit this bill, appealing to independents but also indicating to voters that this election season is more than just "politics as usual".

In turn, this greater enthusiasm will likely shape a much stronger market reaction to some of Trump’s statements, as the potential for a republican victory becomes less clear-cut.

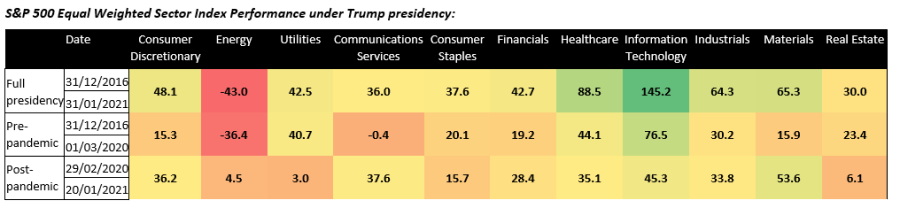

The so-called ‘Trump trade’ such as defence, cryptocurrency and tech had been doing quite well for the past few weeks, as investors planned for his victory.

Source: Shore Capital

However, Harris’ entry into this race is unlikely to reverse these market developments fully, even if she wins.

Indeed, Lindsey James, investment strategist at Quilter Investors, said: “Markets will be unlikely to reverse the recent rotation for now given the signal for rate cuts is unchanged and it is still Trump’s election to lose. However, this news brings uncertainty and potential instability which investors crave more than anything.”

“Trump is favoured but if Harris, or another nominee, makes inroads then the recent rotation may lose legs and that volatility could take over.”

Forget the election

However, it is important to remember that most investors should not change their portfolios too drastically in response to political developments.

As Garret Melson, portfolio strategist at Natixis IM, stated: “At the end of the day, political impacts on markets are typically short-lived. There are indeed both upside and downside risks to consider… but corporates have proven their dynamism time and again.”

For Hooper, the more interesting developments affecting US markets over the next few months will be the potential for interest rate cuts, set to be discussed at the upcoming Federal Reserve meeting.

While cuts are not expected to occur next week, if the upcoming Personal Consumption Expenditure Report (PCER) finds evidence of economic deterioration, analysts believe it could lead to interest rate cuts as early as September, which would have long-term impacts on the US market.

James claimed: “For now, however, the expectations of rate cuts will remain the driving force for market returns, rather than a noisy election campaign.”

Additionally, the announcement of the earning growths of S&P 500 companies in the past quarter has further demonstrated the other underlying market trends that may direct US investment strategies in the coming months, more than the election.

Despite year-on-year growth for the S&P 500 reaching as high as 9.7% in the past three months, much of this growth owed to the strong returns of four of the ‘Magnificent Seven’ companies. If their contribution was removed, predicted earning growth would fall to just 5.7% year-on-year.

While double-digit growth is predicted for the rest of the S&P 500 during the fourth quarter, this is indicative that broader participation in earnings growth is still needed.

Hooper said: “This confirms my general view that no alarm bells are ringing yet, but cracks are starting to form in the US economy, and the Fed needs to act sooner rather than later.”

Overemphasising the election’s impact then, risks obscuring these wider market trends.