The Bank of England (BoE) cut rates to 5% from 5.25% today, following in the footsteps of the European Central Bank, and against the US Federal Reserve, which opted to keep rates higher for longer yesterday, although a September cut is on the cards.

Myriad asset classes are likely to benefit from rate cuts, from small-cap equities to strategic bond funds. Conversely, lower interest rates will push down yields from cash savings accounts and money market funds, and could put sterling under pressure.

Below, experts consider which sectors will prosper during the cutting cycle.

Equities

Stock markets have anticipated and welcomed today’s BoE pivot, said Tom Stevenson, investment director at Fidelity International. “In the past week, the FTSE 100 has risen by 2.6% to within a whisker of its all-time high of 8,446, struck in May.”

Although the Monetary Policy Committee signalled that cuts will be “few and far between”, Martin Currie’s chief investment officer Michael Browne is “more optimistic” about monetary easing. The bank’s hawkish stance “will prove to be unsustainable, in particular if the chancellor delivers a fiscally neutral budget on 30 October,” he said.

Therefore, Martin Currie prefers interest rate sensitive sectors, such as housebuilders, real estate, utilities and green energy.

Hugh Gimber, global market strategist at JP Morgan Asset Management, favours utilities and financials. Due to their long-term predictable cash flows, the valuations of utilities improve when the discount rate is lowered, he explained. Utilities are also benefitting from government spending to prepare electricity grids for increased demand linked to artificial intelligence.

The impact of rate cuts on banks is somewhat ambiguous, Gimber noted. Banks’ profit margins were bolstered by rising rates, but in a cutting cycle, corporate defaults should be contained as borrowing costs fall and refinancing becomes easier. The recent earnings season has shown the strength of banks’ profitability, particularly in Europe, he added.

Domestic small- and mid-caps should also benefit from an improvement in consumer spending and sentiment, said Laura Foll, co-fund manager at Henderson Opportunities Trust, Lowland and Law Debenture.

Gimber however was sceptical about the rotation into small-caps. The reasons why rates are coming down will determine which asset classes do well, he said. In a scenario where inflation has fallen but growth is holding up, rate cuts will be more gradual, and indeed, he expects the BoE to cut once per quarter. If growth falters, however, then central banks will cut rates faster.

The strong rally in US small-caps last month indicates that the market expects growth to persist but the Fed to cut rates imminently and rapidly. “You can’t have everything at the same time,” he explained. “You can’t have rates being slashed and the economy holding up fine. Markets are getting a bit ahead of themselves.”

Fixed income

While bond yields are still high, Colin Finlayson, a fixed income investment manager at Aegon Asset Management, believes investors have a “once in a cycle opportunity now to enter the market”.

He recommended that investors who are underweight fixed income consider increasing their exposure via strategic bond funds. “By having the ability to invest across the fixed income universe and having active management of interest rate risk, this type of strategy can help capture the upside potential available but do so while better balancing risks that the bond market brings,” he explained.

April LaRusse, head of investment specialists at Insight Investment, agreed that a declining interest rate environment should be positive for returns in fixed income.

“Markets are already anticipating rates will fall but there is always the possibility of surprise with rate cuts coming in faster or central banks deciding to do more than is priced in,” she noted.

“Fixed income has the yield, potential for return, risk profile and staying power that many are seeking. We are in a new golden age of bond investing.”

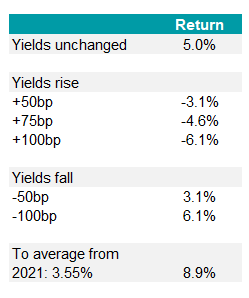

The table below summarises the returns Insight expects a US core bond portfolio to deliver in four scenarios: yields remain unchanged and central banks keep rates on hold; yields rise; yields fall as rates are cut; and yields return to their average levels since 2021. Total returns look attractive in most of these scenarios; yields would have to rise by 75-100 basis points for core bonds to lose money.

Total returns from a US core bond portfolio in relation to yields

Source: Insight Investments

Gimber is also bullish on bonds, which offer diversification against a slump in the global economy as well as income. “You are being paid to wait for something to go awry in the economy,” he said.

Short-dated bonds are most sensitive to central bank rate changes. One to three-year gilts, in particular, could benefit given that prices rise when yields fall, said Daniele Antonucci, chief investment officer of Quintet Private Bank. Within its balanced portfolios, Quintet has increased its exposure to gilts after being underweight for some time.

Other market participants have done likewise, said David Katimbo-Mugwanya, head of fixed income at EdenTree Investment Management. “Shorter-dated bond yields have recently declined faster than those on longer-duration counterparts further out on the curve, indicating that the long-awaited shift came as no surprise to market participants.”

The start of an interest rate cutting cycle should be supportive for gilts across the curve, added David Zahn, head of European fixed income at Franklin Templeton, who is maintaining a long duration position in gilts.

Conversely, Emma Moriarty, a portfolio manager at CG Asset Management, is staying away from long-dated gilts, which she believes are mispriced. If the Labour government increases gilt issuance to plug the “fiscal black hole”, that would exert upward pressure on gilt yields, she explained.

Currency markets

The BoE’s announcement put pressure on the pound today following a strong year so far for sterling. Van Luu, global head of solutions strategy for fixed income and currencies at Russell Investments, said sterling was “vulnerable to a short-term correction” after investors had built up significant long positions in the currency.

Zahn disagreed, saying that the impact on sterling should be “rather muted” given that the BoE is moving in line with the ECB and the Fed is expected to cut soon.

Tim Graf, head of macro strategy, EMEA at State Street Global Markets, also expects any follow-on weakness in sterling to be limited. “Institutions we track in our flow metrics have been strong buyers of the pound in recent weeks,” he said.