When markets move, its often wise to sit tight and resist the temptation of moving portfolios, going back to the adage that investing is about ‘time in the market, not timing the market’.

But while investors are asking themselves what's causing stocks to sell off and whether this represents a buying opportunity, some multi-asset managers have acted quickly, using their ability to invest across asset classes to make slight adjustments to their portfolios to take advantage of the current volatility.

In particular, they have been tweaking their fixed-income positions, but there are different opinions as to what works best from now on.

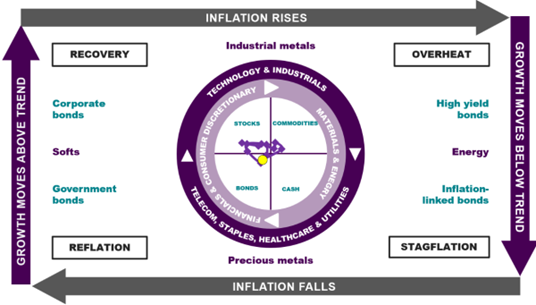

Hiroki Hashimoto, senior fund manager within Royal London Asset Management’s multi-asset team, said markets moved from an “overheat” position to a more bond-friendly “reflation” phase, as the chart below shows, but it remained “close to crosshairs”.

Investment phases

Source: Royal London Asset Management

“As a result, we have gradually become more positive on bonds of late and remain negative on commodities, except for gold. Given the seasonally volatile summer period, a cautious stance makes sense for now in our view,” he said.

“It’s possible that investor nervousness on the US recession risk is overdone despite bond investors starting to price in emergency intra-meeting rate cuts by the Fed. We are not yet at the levels to consider turning more positive on equities, though we wouldn’t be surprised if we get there soon especially if the US recession risk is overdone.”

According to Tom Sollis, multi-asset portfolio manager at Russell Investments, the aggressiveness of the market movement has been “quite surprising” and reflective of a potential overreaction, as well as a “stretched positioning of many market participants”.

Taking a different approach than Hashimoto’s, the main action taken by the Russell team has been to trim duration across portfolios slightly, given the large moves and the significant US/UK/EU rate cuts now priced in.

“We have been trimming our interest rate-sensitive fixed income exposures (government bonds, investment-grade credit) across portfolios, taking some profits,” Sollis said.

“We think the market could be overreacting, but it is important to not over-react or take too many actions in portfolios, and to continue being guided by our investment process. We will be watching closely our sentiment indicator to see if opportunities are coming out of this.”

This is not what Darius McDermott, managing director at Chelsea Financial Services, would recommend, however, who said that investors can get better bang for their buck by backing government bonds.

"This is precisely when you should be buying government bonds. They always do well during serious, risk-off market sell-offs, whether it's the financial crisis or the Covid-19 pandemic,” he said.

“There is a good risk-reward on that trade because, if US yields come down, investors would see a large capital gain on that duration of 20-year bonds. On the other hand, corporate bonds are overvalued given the heightened risk of economic recession and historically tight spreads.”

In fact Emma Moriarty, portfolio manager at CG Asset Management, remained defensive with a focus on inflation protection by maintaining a long duration and cutting corporate bonds.

“Index-linked government bonds represent 40% of our portfolios. Within this, the largest exposure is to US Treasury Inflation-Protected Securities (TIPS, duration nine years), designed to provide portfolio insurance against a US equity market correction,” she said.

“We have actively reduced our exposure to corporate credit (approximately 7% of the portfolio, duration two years) on the basis that credit spreads have narrowed to a point that is not reflective of wider systemic risk and we are not confident that valuations in the underlying government yield curve are appropriate.”

Regarding risk assets, Moriarty’s strategy is to focused on UK equities, which remain capped at 32% of the portfolio despite the “attractive” valuations of listed infrastructure and renewables.

“We remain alert to the reality that an ongoing US equity market correction will also impact the UK,” she said.

For Sam Buckingham, investment manager at abrdn Managed Portfolio Services, it is too early to definitively label the equity sell-off as an overreaction.

The current cautious sentiment, influenced by heightened geopolitical risks and the usual summertime dip in liquidity, has been particularly “unhelpful”, he said, amplifying market responses.

His reaction so far has been to adopt a wait-and-see approach and avoid knee-jerk decisions that could end up being detrimental to performance.

“The probability of a recession has risen, but the extent remains uncertain. Therefore, we opted against immediate adjustments,” he said.

“Whilst we have an overweight position to duration, our approach to portfolio construction means we ensure the magnitude of our active tilts are measured. As such, we are comfortable retaining this overweight position for now.”

John Husselbee, head of the Liontrust multi-asset team, also took a step back.

“It is true that volatility can present buying opportunities but time in the market is preferred to timing the market. History has shown that while investors will experience market dips and volatility from time to time, these events won’t stop the long-term positive performance of markets,” he concluded.