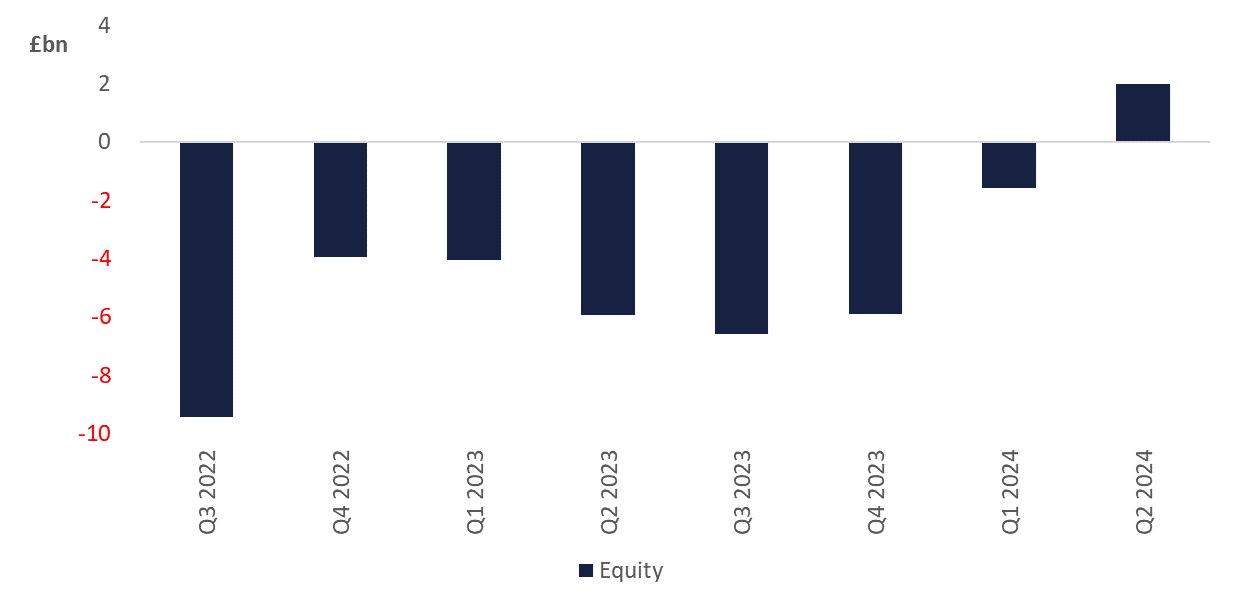

UK investor confidence steadily grew in the first half of 2024, according to data from the Investment Association (IA) , with money piling into equities in June.

Indeed, investors ploughed almost £1.2bn into the asset class in the final month of the year’s first half, taking the total inflows for the second quarter up to nearly £2bn.

Miranda Seath, director of market insights and fund sectors at the IA, said: “June has seen a return to inflow as investors opted to allocate capital back into equities. Investor confidence has been building throughout the second quarter of 2024 as inflation has calmed and, in the UK, we have seen the first base rate cut from the Bank of England since March 2020.”

The second quarter inflows made up for the £1.6bn in outflows between January and March and took the equity funds into net inflows for the first half of 2024.

The biggest beneficiaries in the second quarter were global equity funds, where inflows hit £2.7bn as investors opted for diversification.

This contrasts with the first quarter where the strong performance of the US and the ‘Magnificent Seven’ stocks attracted investors to put £1.5bn into North American funds – a rare bright spot in a difficult quarter for equity funds in general.

Overall, it means equity funds raked in a net £424m of investors’ money in the first half, which is significantly better than the same period last year, when they suffered net outflows of £10bn.

Quarterly Equity Flows

Source: Investment Association

Perhaps the biggest reason for this was passive funds, which took in some £2.6bn in June alone and £15.1bn over the first six months of the year. This money was “overwhelmingly” put into equity trackers, the report said.

However, recent market movements in the past few weeks on the back of “poorer than anticipated US employment data” have “highlighted the complexities of the macroeconomic environment”, said Seath.

Whether the money raised in the first half of 2024 stays in these equity funds remains to be seen, but she noted that, although the US economy impacts all major markets, “it is critical that investors remain focused on long-term goals rather than short-term market fluctuations”.

Another area where investors parked their cash recently was money market funds, which raked in £1.2bn in June alone. The IA Short-Term Money Market sector attracted the most new money of all over the course of the month. It takes the total net inflows for money market funds in the year to June to £1.8bn.

It was not all plain sailing for funds, however. IA data suggested the tide has begun to turn against certain asset classes, such as responsible investment funds, as nearly £1.4bn was pulled from these vehicles in the first half of the year.

Fixed-income funds have similarly struggled, with total inflow for the first half of the year dropping to just £58m. This was the result of an outflow of nearly £1.2bn from bonds in June, which wiped out the £1.1bn inflow to the asset class in April.