Savers have the chance to snap up inflation-beating deals today, but they must act quickly before central banks continue their rate-cutting cycles.

The Consumer Price Index (CPI) reading in today’s news registered an uptick to 2.2% in headline inflation in July, however 1,558 savings accounts available beat this rate, giving savers the chance to counter inflation’s corrosive action on their purchasing power.

This is the first time this has happened in at least two years – in August 2023 and 2022 there were no deals that could beat the previous month’s CPI readings (6.8% in July 2023 and 10.1% in July 2022).

Moneyfactscompare’s Caitlyn Eastell encouraged savers to secure an inflation-beating deal now, as some of the top savings rates have dropped below 5%.

“It is crucial savers keep on top of the changing market and make the switch to ensure they are not getting a raw deal, especially as we have seen some of the top rate deals drop below 5%. It would not be too surprising to see more providers adjusting their rates in reaction,” she said.

“Since the previous inflation announcement, fixed rates have faced further reductions, so it may be wise for savers to begin considering locking into an interest rate while the majority continue to pay competitive returns.”

Longer-term rates have suffered the most, while shorter-term savers are continuing to be incentivised with higher top rates, despite some drops.

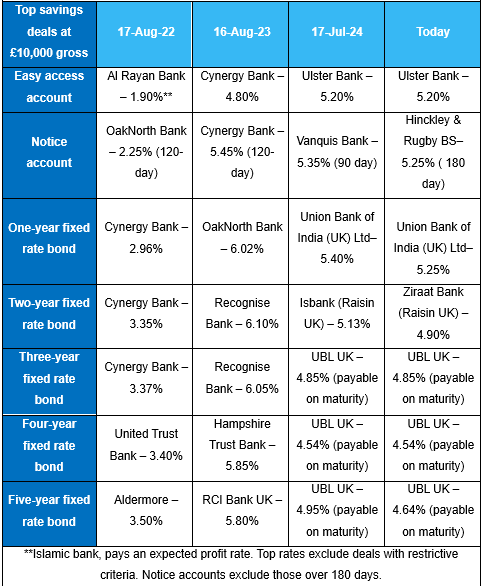

Savings market analysis

Source: MoneyfactsCompare

The best easy-access account available today based on a £10,000 lump sum, is Ulster Bank’s Loyalty Saver, which pays a variable 5.20% yearly, but is only available to new and existing current account customers.

Principality Banking Society offers a bonus rate for 12 months on its Online Triple Access account, paying 5.00% yearly (also variable). For savers who want unlimited access to their cash, Monument Bank pays 4.91% variable every month via Raisin UK.

Fixed-rate deals are only marginally better. The Union Bank of India is the best-payer for one- and two-year maturity accounts, offering 5.25% and 4.80%, respectively. Locking money away for even longer won’t help either, with the best five-year rate available coming in at 4.55% with Al Rayan Bank’s Deposit account, available through Raisin UK.

One area of the market to see improvements has been ISAs, Eastell noted, with new market-leading rates across the board that now match the return of their non-ISA counterparts.

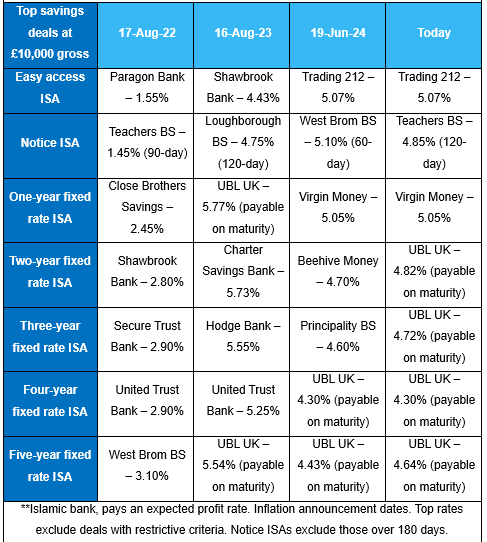

ISA market analysis

Source: MoneyfactsCompare

Virgin Money has a one-year cash ISA paying 5.05%, Nottingham Building Society’s two-year rate is 4.73% and, at 4.26%, the best five-year fixed-rate cash ISA is UBL’s.

On the other hand, notice accounts have seen a dip in top rates month-on-month and now pay below 5%, which may be bad news for consumers looking to maximise their tax-free savings.

“This may not be wholly unexpected, and it would be sensible to expect more reductions to variable rate products alongside the Bank of England’s decision to drop interest rates at the beginning of the month,” said Eastell.

“During this time, it is crucial that savers do not grow complacent with their pots and switch accounts when attractive deals appear to ensure that inflation does not erode their cash.”