Global equity and sustainability funds dominated the latest ‘Spot the Dog’ report by Bestinvest, which names and shames the ‘dog’ funds that lagged behind a relevant benchmark by over 5% for the past three years as well as in each individual year.

Since the last report, the doghouse got smaller, as 14 funds redeemed themselves, but the tally is still a staggering 137, remaining significantly higher than the 56 funds flagged only a year ago.

There were two main reasons for this, according to Jason Hollands, managing director of Bestinvest. First, one-fifth of all dog funds were sent to the kennel because of the surge in oil and gas prices since 2021.

“The high number of funds badged variously as sustainable or responsible is in part down to the stellar performance of oil and gas stocks in 2021-22, as the alternative and renewable energy market fell out of favour,” he said.

Performance of indices over 3yrs

Source: FE Analytics

The second culprit was the market’s concentration in artificial intelligence (AI) and technology names.

“When you consider the Magnificent Seven now represents a third of the US S&P 500 Index by market capitalisation and 22% of the MSCI World Index, it helps to explain why global fund managers not fully weighted to this extremely concentrated band of influential stocks struggled to consistently beat the markets.”

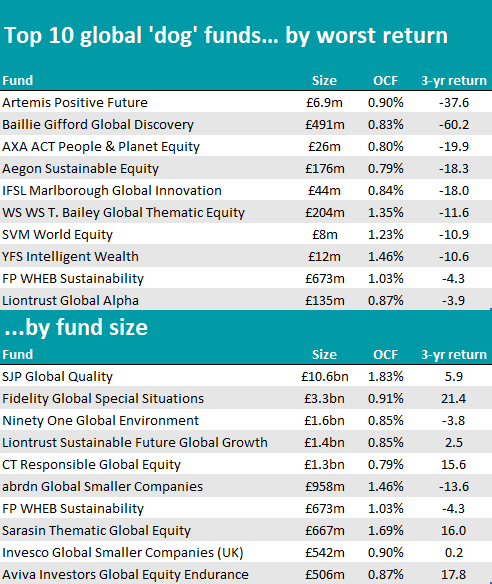

This meant that global equity funds dominated the latest list with 44 names – 43 in the IA Global sector and one, Premier Miton Global Sustainable Optimum Income, in the IA Global Income sector.

Source: Bestinvest

St. James’s Place Global Quality was the largest of the lot, and while quality companies have been out of favour, “that is not to excuse this perennially underperforming pooch, a frequent visitor to the doghouse,” said Hollands.

Despite its continuous poor performance, the fund charges a whopping 1.83%, making it the most expensive fund in the dog house.

But it was not the only behemoth in the list, with the report identifying 10 Great Danes – funds over £1bn –, accounting for £26.8bn of investors’ money in underperforming assets.

“Half of them were in the global sector, highlighting how some investors have their money with managers whose investment approach is deeply out of step with a market that has been narrowly led by a small cluster of giant companies benefitting from AI mania.”

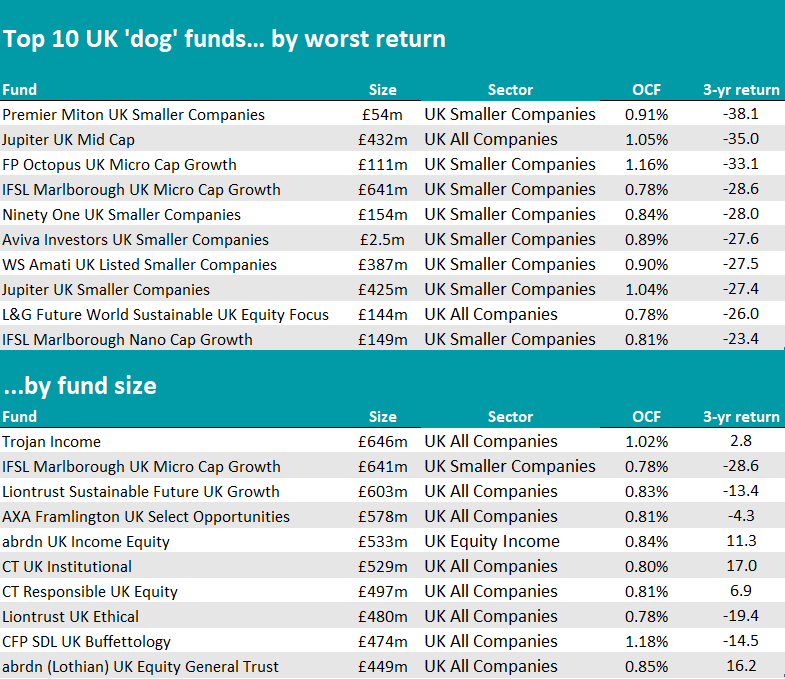

The picture wasn’t much different for the 44 dog funds across the UK All Companies, UK Equity Income and UK Smaller Companies sectors, where about a quarter was comprised of ethical and sustainable funds.

Source: Bestinvest

Trojan Income stood out as the largest dog in the UK pack, with its “naturally defensive positioning leaving it struggling as markets have risen”, Hollands explained.

Equity income strategies recovered in 2024, but that wasn’t enough to save the Premier Miton UK Multi‑Cap Income and VT Downing Small & Mid‑Cap Income funds from the list. Both have a small-cap bias compared to their peers.

Hollands called time for “some doggy discipline” for abrdn UK Income Equity, abrdn UK Income Unconstrained Equity and HL Select UK Income Shares, all of which have kept their dog status since last year with reasons for underperformance that were “less clear”.

UK small-cap funds were extremely challenged until very recently, but some inclusions were not explicable to Hollands.

“Jupiter UK Smaller Companies and Royal London UK Smaller Companies are large funds from companies that should be doing better,” he said.

“Amati is a specialist smaller companies boutique with previously strong performance, so the WS Amati UK Listed Smaller Companies is a surprise inclusion.”

Surprising inclusions from the last edition didn’t materialise this time, as both Terry Smith’s Fundsmith Equity and Nick Train’s WS Lindsell Train UK Equity dropped off the list.

Hollands concluded: “Funds can stumble for a myriad of different reasons, from poor decision making or a run of bad luck to instability in the team, or because the fund has a style or process no longer favoured by recent market trends.

“Identifying whether a fund is struggling with short-term challenges that will later pass, or more deep-rooted issues with long-term consequences is vital for investors considering whether to remove an investment from their portfolio.”