Fund management has become more of a team effort, as investors have increasingly prioritised a fund’s structure and wider team over individual manager's leadership.

As a result, the industry's obsession with ‘star managers’ has largely fallen by the wayside, with young managers increasingly struggling to make a name for themselves.

Nevertheless, Paul Angell, head of investment research at AJ Bell, said that “the industry remains a people business” and noted that trust between fund buyers and managers remains crucial.

While genuine ‘rising star’ fund managers are rare; several young fund managers have already established themselves as exceptional within the wider sector.

Below, Angell identified three ‘rising stars’ of modern fund management: Jonathan Golan, Liam Nunn and Charlotte Yonge.

Golan is an FE fundinfo Alpha Manager, described by Angell as “perhaps the stand-out rising star in the industry”, serving as the sole manager of the £1.1bn Man GLG Sterling Corporate Bond fund, which was initially created in September 2021.

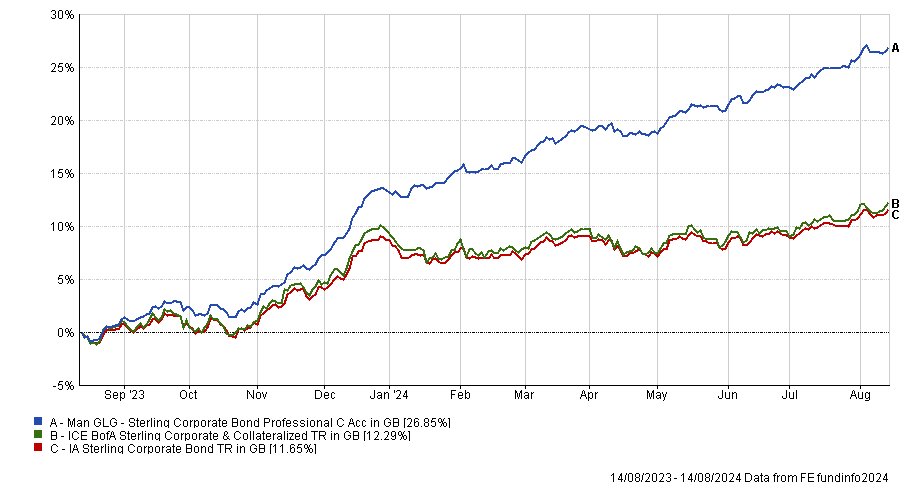

For a newcomer to the industry, the fund has an impressive record under Golan’s tenure. It has been the top-performing fund in the wider IA Sterling Corporate Bond sector over the past year.

Performance of the Fund vs the Sector and Benchmark over 1yr

Source – FE Analytics.

Golan practices a bottom-up approach to investing, focusing on smaller bonds that the team believes are undervalued, often using the sector’s maximum 20% allowance for high-yield bonds.

Having worked previously at Aviva and Schroders, Golan has a proven track record of success. He also manages several other successful funds at the firm, including the Man GLG Global Investment Grade Opportunities and Man GLG Dynamic Income funds.

Another young fund manager making a name for themselves is Liam Nunn, Co-manager of the £884m Schroder Global Recovery fund.

Under the leadership of Nunn and co-manager Nick Kirrage, the fund has performed commendably, with its assets under management (AUM) tripling since Nunn took over in 2019.

Over the past three years, the fund has ranked within the top quartile of its sector, outperforming the MSCI world index and the wider IA Global peer group. However, it has had comparatively weaker returns over the past year.

Performance of the Fund vs the Sector and Benchmark over 3yrs

Source – FE Analytics.

Angell said: “Nunn is a passionate value investor, thoroughly committed to the Schroder value team’s disciplined accounting-based process where they scour the cheapest 20% of global stocks, looking to avoid value traps.”

With five years of experience at the firm, Nunn now serves as part of the managerial team for several other funds, most notably the £1.1bn Schroder Global Sustainable Value Equity fund.

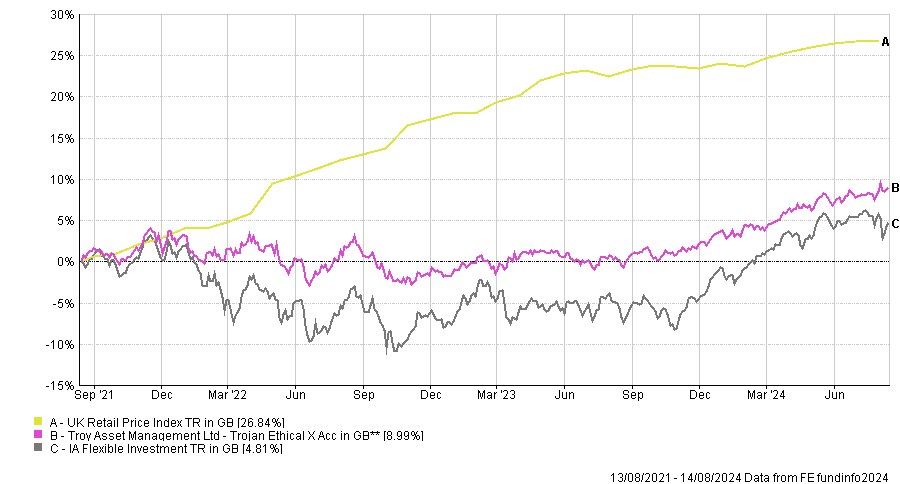

Finally, Angell highlighted Charlotte Yonge, manager of the Trojan Ethical fund, which has accrued £827m AUM since its launch in 2019.

Over the past three years, the fund has consistently beaten the IA Flexible Investment sector, generally ranking within the second quartile under Yonge’s leadership.

She pursues a more defensively managed, long-term growth strategy, aiming to preserve capital through investing in traditional asset classes such as equities, bonds and gold.

Performance of the fund vs the Sector and Benchmark over 3yrs

Source – FE Analytics.

Despite weaker performance in the past year, Yonge’s track record is still impressive with the fund delivering “steady capital growth and lower volatility than wider markets”.

Yonge also sits on the management team of several other funds at Troy, most notably, she currently serves as the deputy manager of the £5bn Trojan fund.

Ultimately, while the industry has shifted away from the obsession with ‘star managers’, it is not impossible for managers with the right combination of characteristics to thrive.

“A rising star manager blends that rare mix of youth, intelligence, confidence, opportunity and good fortune,” Andell concluded.