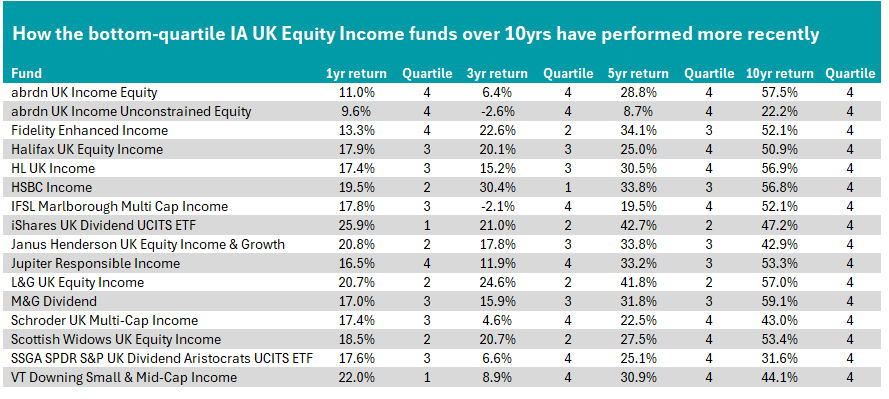

Only one fund in the bottom quartile of the IA UK Equity Income sector over the long run has managed to make a top-quartile return in the past three years, according to data from FE Analytics: HSBC Income.

Co-managed by Paul Denham and Ed Gurung since 2021 and 2023 respectively, the fund has blossomed under their leadership, returning 30.4% in the past three years.

However, it has not been enough to arrest the fund’s disappointing long-term performance, as it remains in the bottom quartile of the sector over 10 years. In fact, the fund failed to make above-average returns in every calendar year from 2014 to 2022.

Since then, performance has turned around thanks to the strong gains from top holdings Shell (9.1% of the portfolio) and BP (5.8%), which have blossomed as the oil price rose on the back of global supply chain issues and sanctions on Russian exports following its invasion of Ukraine.

It also has large positions in parent banking giant HSBC alongside Barclays and NatWest, which have all done well in the era of rising interest rates.

The £113m fund, which was launched in 2013, has been given an FE fundinfo Crown Rating of four for its recent three-year performance. Impressively, the fund has achieved its recent gains with first-quartile volatility over the period of 10.59%, as well as one of the lowest maximum drawdowns (9%) – the most an investor could have lost if buying and selling at the worst possible times.

Source: FE Analytics

In this series, Trustnet looks at the funds that have been in the bottom 25% of their peer group for performance over 10 years but have risen to the top quartile over the past three years.

In the IA UK Equity Income sector, investors have to open the scope of the research to come up with more than one name. If widening the search to include funds that have moved into the second quartile over three years, four more portfolios make the list.

Fidelity Enhanced Income, managed by David Jehan and Rupert Gifford, is one such fund. It aims to deliver a yield of 50% more than the FTSE All Share index, using derivatives to enhance income.

In a decade where income has been out of favour, this strategy has struggled but came to the fore in 2022 when higher rates tanked the prospects of growth companies.

Despite its long-term weakness, analysts at Square Mile Investment Consulting & Research have a ‘Positive Prospect’ rating on the fund.

The £217m fund's underlying equity portfolio is run by Rupert Gifford, who takes a “cautious” approach that was developed by his predecessor Michael Clark.

He “identifies steady companies, which have tended to cope well with difficult economic conditions”, Square Mile's analysts said, which is “unlikely to produce startling returns” but “has proven particularly resilient during more troubled market periods”.

Jehan works on the options overlay strategy, which they described as “complex” but noted that it has “proven successful at delivering additional income”.

“The combination of these two elements, we think is an appealing proposition for investors who have an income requirement. However, unitholders must recognise that what is gained on the swings is likely to be lost on the roundabouts,” they concluded.

Other active funds achieving this lower threshold for returns were David Jackson and Stuart Briscoe’s £188m L&G UK Equity Income fund and Scottish Widows UK Equity Income, headed by Mei Huang.

The £880m iShares UK Dividend UCITS ETF, which tracks the FTSE UK Dividend + index, also made a second-quartile return over three years. It was also one of two funds to make top-quartile gains over one year.

The other was VT Downing Small & Mid-Cap Income. It is managed by Josh McCathie, who invests in 30-50 companies outside of the FTSE 100.

This strategy has suffered a double headwind for much of the past decade, with both income and (in particular) mid- and small-caps proving to be out of favour with investors.

It has been a boom-or-bust proposition in recent years, in the top 25% of the sector in 2021 and again so far in 2024, but registered bottom-quartile returns in 2022 and 2023.

Previously in this series, we have looked at the emerging markets, IA Global and Global Equity Income, and the UK All Companies sectors.