With the end of the summer holidays and the return to school nearly here, parents all over the UK will be considering the cost of childcare for the year, which currently averages around £14,836 per child.

In the UK, working adults earning less than £100,000 per year can receive a tax-free allowance of up to £2,000 per child, with parents of three- to four-year-olds entitled to anywhere between 15 and 30 hours of free childcare per term.

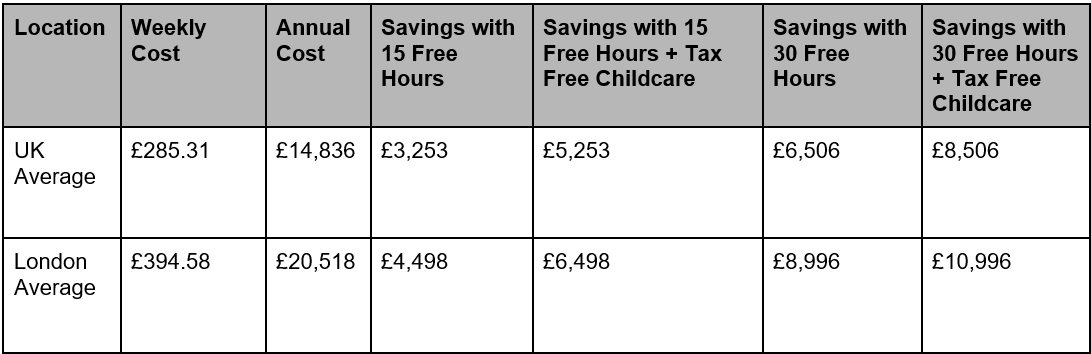

According to recent research by the team at Moneyfarm, by taking advantage of these forms of monetary support, the average UK adult could save up to £8,500 on childcare per year. This represents more than half of the total annual cost of childcare in the UK.

In London, the savings amount is even higher, rising to a potential £11,000 for applicable parents.

What free hours and Tax-free childcare can save you in childcare costs:

Source - Moneyfarm

While the government does plan to extend the eligibility for the 30 free hours of childcare by September 2025, it will still not be enough for many parents.

Indeed, parents face a conflict between securing this allowance and saving for the future, with these allowances denied if either parent has a net income of over £100,000.

Carina Chambers, pensions technical expert at Moneyfarm, said: “With the cost of childcare already at eye-watering levels, finding ways to make sure you keep every penny offered to you by the current system is simply a no-brainer”.

One way to get under the £100,000 price bracket is to invest in a pension. By contributing some of their salary to a pension, working parents can reduce their adjusted net income to under £100,000, qualifying them for monetary support on childcare, while ensuring they are building their retirement pot.

This, Chambers said, is a “win-win situation”, because it allows working-age adults to invest more for their retirement and relieves some of the tensions of the UK’s high childcare costs.

This interaction between pension investment and childcare costs is a great example of how proper pension planning can ensure people get the most out of their retirement.

Earlier pension contributions will also help people maximise the benefit of an individual’s £12,570 personal tax allowance, which is reduced by £1 for every £2 earned above £100,000 a year.

While this may seem like a relatively small change, it would significantly improve people’s confidence that they will be able to retire comfortably, without sacrificing the ability to provide for their children.

Maximising your retirement

Putting more into a pension is crucial. As well as lowering taxes in the short term, all savers should consider topping up their retirement pot as the cost of living keeps rising. The recent HL Savings and Resilience Barometer suggested that a couple would need around £36,840 per year for a moderate retirement.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown (HL), added: “Even boosting contributions by relatively small amounts over the years can have a big impact on how much you end up with.”

However, it is not all plain sailing when it comes to preparing for your retirement, and more still needs to be done to make a comfortable retirement more feasible.

Many working-age adults remain pessimistic about their pensions, with St James Place finding that nearly 26% of working adults feel they do not have the correct retirement plan to leave anything substantial to their families.

Equally, many current pensioners hold regrets over their retirement, with HL finding that almost four in 10 pensioners hold retirement regrets, with nearly 10% wishing they had begun contributing to their pensioners sooner.

Morrissey said: “No one wants to reach retirement rueing missed opportunities to boost a pension pot, and yet almost four in ten of us do. By far the most common regret is not having planned far enough in advance.”

Claire Trott, director for retirement and holistic planning at St James Place (SJP), added that planning ahead could also allow people to pass on their savings in the form of inheritance – another important calculation that should not be ignored.

“To secure a legacy for loved ones, it’s more important than ever to establish a robust financial plan early on. This will allow greater opportunity to build wealth over time, without making unnecessary sacrifices along the way and putting off retirement indefinitely,” she said.