Investors need to scour their portfolios for concentration risk and ensure they are diversified away from the mega-cap tech stocks that have led the market, according to Cathie Wood.

For an extended period of time, a small band of stocks – typically US mega-cap companies in the technology space and related sectors – have dominated the market and become a mainstay of growth portfolios.

This is reflected in the rise of the so-called Magnificent Seven (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla), all of which have a link to the artificial intelligence (AI) revolution.

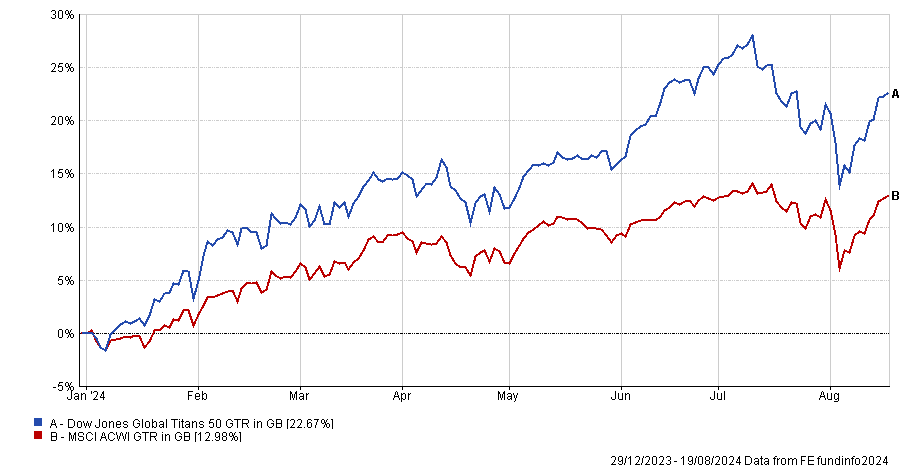

Performance of global 'titans' vs wider index in 2024

Source: FE Analytics. Total return in sterling.

As the chart above shows, mega-caps are outperforming the wider global equity index in 2024 so far but they were hit much harder by the summer slump. FE Analytics shows the Dow Jones Global Titans 50 index dropped 11% between 11 July and 5 Aug, compared with a dip of just 7% in the MSCI AC World.

Several contributing factors have been cited on the causes of the recent market volatility, including the unwinding of the Japanese carry trade, worries about a recession in the US, the Federal Reserve holding off on rate cuts and expensive valuations among mega-cap tech names.

Wood, chief investment officer at ARK Invest, said: “It appears that significant capital from the yen carry trade had been used to pile into mega-cap stocks, which may now be experiencing a correction in light of these macro developments. We encourage investors to reassess portfolio concentration risk and consider ways to diversify exposure.

“While these types of sell-offs are sparked by market fear and risks to consensus positions, they often create pockets of opportunity. Historically, these condensed bouts of volatility lead to a market rotation that can favour a broadening out away from the contributors of this volatility.”

Expanding on this, she argued that the sell-off on Monday 5 August was one of the most volatile events in recent market history. The Vix – known as the ‘fear index’ – jumped up to 65 points, which is its fourth highest level in the past 40 years.

She compared this with several other volatile periods from financial history: ‘portfolio insurance’ failing on Black Monday in October 1987, Lehman Brothers going under in 2008 and Covid hitting in 2020.

Each of these cases of condensed, short-term volatility sparked investment opportunities, Wood argued. For example, the sell-offs in 1987 and 2020 created significant buying opportunities in the stocks hardest hit in those downturns.

“In our view, the spike in the Vix on 5 August stems from conditions resembling both 1987 and 2008. On Black Monday in 1987, portfolio insurance failed because those relying on it tried to cash out at the same time, much like those relying on the carry trade with Japan today,” she continued.

“Delivering consistent returns over many years, the yen carry trade probably was leveraged and is hurting macro-oriented strategies disproportionately today. Like 1987, and unlike 2008, its impact could be limited.”

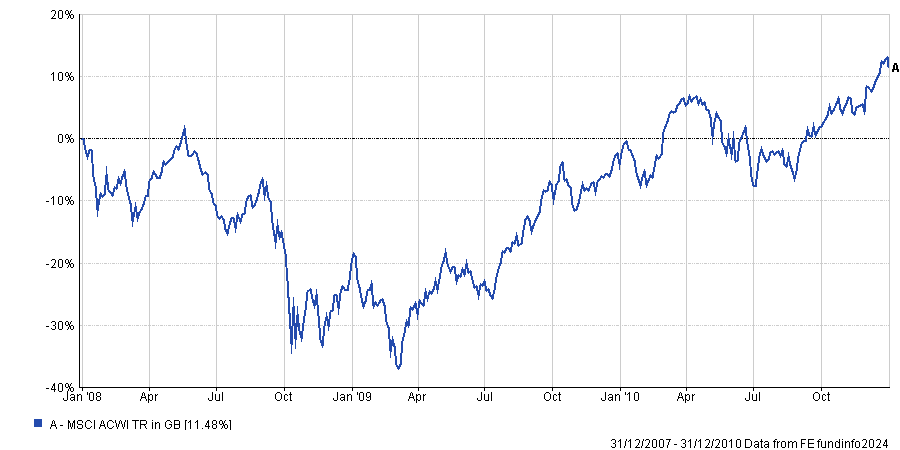

Performance of global equities in 2008-10

Source: FE Analytics. Total return in sterling.

After the Vix spiked in 2008, it took another six months for the wider equity market to bottom out. The volatility of the global financial crisis reflects the vast amount of leverage in systemically important financial institutions.

“Inventorying risk globally was painful and resulted in a great recession, and the financial sector was under enormous pressure,” Wood added. “That said, it created an incredible buying opportunity months later and led to a longstanding bull market, especially for technology and innovation-oriented companies.”

In the case of 2020, the global lockdown in response to the Covid pandemic created a “short but profound” investment opportunity, in which innovation solved many of the problems that arose and boosted stock markets.

ARK Invest is known for its focus on disruptive innovation stocks, or companies working on transformative technologies in areas such as AI, robotics, public blockchains and energy storage.

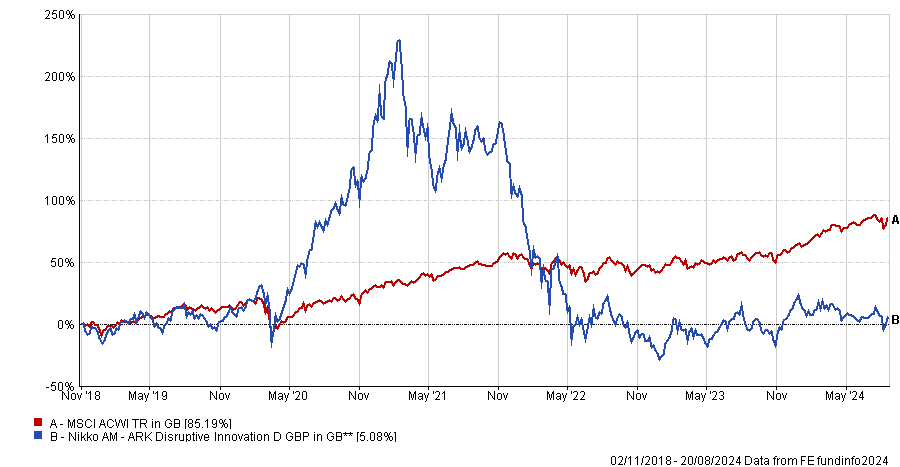

Wood expects this area to benefit as investors move away from the mega-caps into related areas, although – as evidenced by the volatility experienced by Nikko AM ARK Disruptive Innovation fund – she cautions that this might not be a smooth ride.

Performance of fund vs global equities since launch

Source: FE Analytics. Total return in sterling.

“In our view, clients should diversify risk in their portfolios away from concentrated, consensus bets, which tend to benefit performance following a market shock. The markets may broaden out in both a ‘catch-up’ scenario, and – more topically – a ‘catch-down’ scenario that we have observed over the past week,” she said.

“In our view, disruptive innovation will be susceptible to volatility in this climate given its relatively high beta nature, but may benefit from the shift of inflation to disinflation, technological tailwinds, a more receptive Fed, and the general broadening out.”