China could face a Japan-style ‘lost decade’ due to its current infrastructure and real estate problems, according to veteran stock picker Mark Mobius.

Discussing all things emerging markets on the Schroder Value Perspectives podcast, the renowned investor said these issues have been “a real disaster” for the economy and for those investors who put money into pointless projects.

“One of the things we noticed when we were travelling around China: every city had these ‘ghost town’ areas. It is amazing. There are 50 or 60-storey buildings that are empty – and not one, not two, but 10, 20, 30 such buildings,” he said.

“Obviously, these things are not going to be inhabited – a lot of them will have to be blown up, torn down or whatever. So yes, it is really going to be a drag on growth.”

The proof is already out there to see. The scandal started in 2017, according to John Plassard, senior investment specialist at Mirabaud Group, with property prices down between 10% and 20% since, depending on the region.

And it is showing no signs of slowing. New house prices in 70 Chinese cities fell by 4.9% year-on-year in July 2024, following a 4.5% fall the previous month, the 13th consecutive month of declines and the fastest pace since June 2015.

Bubbles in the housing markets are more critical than bubbles in the stock markets but are also less frequent. House price falls occur on average every 20 years and last around four years, with average price falls of around 30%, according to studies by the International Monetary Fund. Meanwhile, stock market collapses occur on average every 13 years and last 2.5 years.

“Property crises generally last longer and result in greater economic losses than stock market crises,” said Plassard.

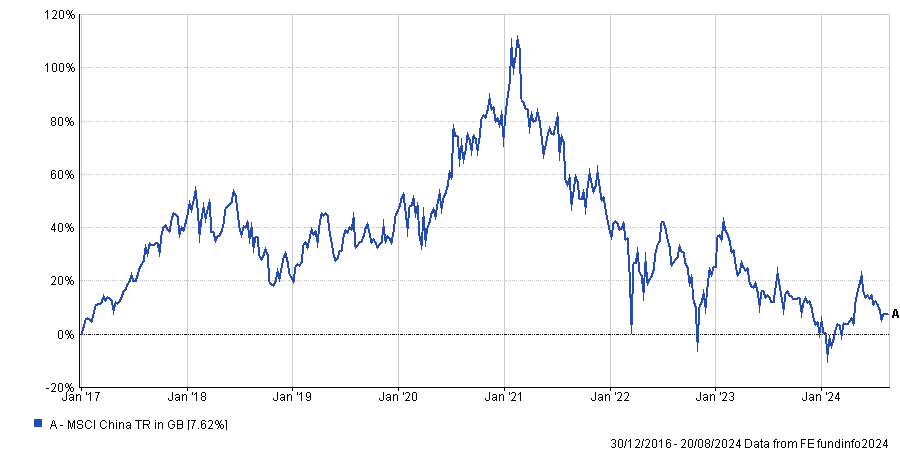

This has had a knock-on effect to the stock market, with the MSCI China up just 7.6% since the start of 2017 and down 8.7% since the June of that year.

Performance of index since January 2017

Source: FE Analytics

Mobius said this is because the market is driven predominantly by domestic investors, who “don’t have confidence” that the market will rise anytime soon. While this will “change eventually” there is no guarantee it will happen in the short term.

Plassard was more bullish, noting that the Chinese property crisis has lasted longer than the historical average, suggesting there is “reason to hope that the worst is behind us”.

The property sector is one factor that leads Mobius to believe the growth expectations for the Chinese economy are too high. He said forecasts of between 6 and 8% growth were “impossible” given the size of the country.

“You cannot expect an economy that is, in some people’s opinion, the size of the US market to be growing even at 5%,” he said. Instead, the economy should be compared with the US, which is growing at around 3-4% as a more likely target.

He pointed to the “incredible amount of investment” that has already taken place to improve the country’s roads and highways, rail network and other infrastructure.

“Now I’m not saying there is no room for more – but the growth numbers in the past were really because of this incredible infrastructure spending, which has now declined for obvious reasons – because they have enough roads and so forth,” he said.

Yet investors should not fear a structural decline in China, said Mobius, despite the property sector issues hanging overhead and the relative lack of infrastructure spending. “You can still have a very vibrant economy and very competitive companies in China,” he noted.

He used an example of a jewellery show in Hong Kong, where gems and jewellery pieces were sold for, in some cases, tens of thousands of dollars.

“But then I went to the China pavilion – the area where all the Chinese manufacturers are selling – and I couldn’t believe some of the prices. They were so low,” said Mobius.

“I couldn’t figure out how they could be producing this jewellery at those prices – but there’s an example of where you have this incredible productivity and creativity in China, which is not going to be lost anytime soon.”

He is also unconcerned by the government’s intervention on technology. While the Chinese Communist Party has been hands-on with regulation, Mobius said it would have to strike more of a balance moving forward.

“The reality is the private sector is able to do things that government is unable to. At the end of the day, there has to be some degree of partnership,” he said.

“If you look at the US, there is no way some of the technologies [such as semiconductors] would have developed in the US without government funding and government help. And I think the same thing is true in China.”