Changing interest rate expectations caused almost three in 10 investors to pull money out of equities in favour of cash over the past year, new research by the team at St James Place (SJP) has found.

In a survey of UK investors conducted just before the Bank of England (BoE) decision to cut interest rates, 23% of respondents said they planned to make additional investments in cash if interest rates remained high. By comparison, just 13% planned to increase their exposure to equities.

The BoEs decision to slash interest rates to 5% in August could be a crucial turning point, with lower interest rates set to make non-cash asset classes more attractive.

Since the report, markets have also been choppy, headlined by the recent dive on 5 August, although they have recovered since then.

Nina Stanojevic, senior investment specialist at SJP, said: “While recent market volatility may understandably be a cause for concern amongst investors, the current opportunity to 'buy the dip' and get back in the markets at a time when prices are relatively low, provides a good re-entry point for many.”

Indeed, according to SJP research, equities and bonds are likely to deliver far greater returns in current market conditions than cash. For example, the research found inflation will limit the value of increased cash exposure, which is particularly notable following inflation rising to 2.2% last week.

The firm found that cash delivered returns a mere 1% in excess over inflation over the past 50 years, but failed to do so across 5, 10, and 20-year periods.

By contrast, large-cap stocks consistently delivered excess returns over these periods, peaking at around 12% in excess returns over five years.

Stanojevic added: “This 'higher for longer' trend affects asset classes differently. While cash has been attractive with high rates, as our analysis shows, inflation erodes its value over time, potentially hindering long-term goals.”

Source: SJP. Stocks represented by Ibbotson SBBI US Large-Cap Stocks, Corporate Bonds by Ibbotson SBBI US Long-term (20-year) Corporate Bonds, Government bonds by Ibbotson SBBI US Long-term (20-year) Government Bonds, and Cash by Ibbotson SBBI US (30-day) Treasury Bills. Data - 31 May 1974 - 31 May 2024. Morningstar Direct, accessed via CFA institute

Additionally, SJP research found that cash also performed worse than both equities and global bonds in the long term.

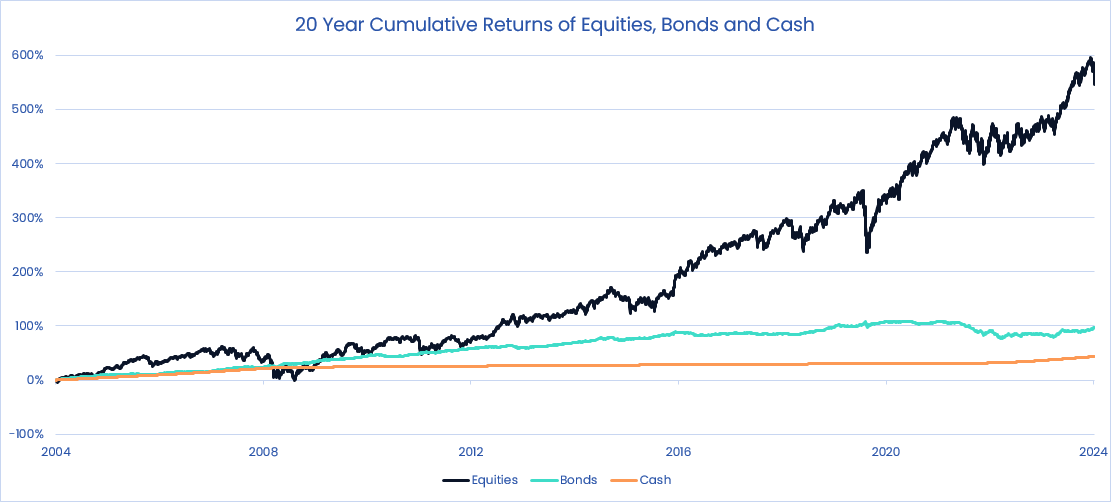

From 2004 to 2024, cash delivered cumulative returns of just 43%. By contrast, investment in global bonds delivered returns of nearly 96% while equities gained some 566%.

Source: Data to August 2024. FE fundinfo. Equities represented by MSCI ACWI, Bonds by Bloomberg Global Aggregate Bond Index, Cash by BoE base rate. Currency: GBP

Nevertheless, although cash is least likely to deliver large long-term returns, a recent article by Trustnet noted that savers can secure inflation-beating deals if they act quickly.

Indeed, there are currently more than 1,500 savings accounts which beat the current rate of inflation, such as Ulster Bank’s loyalty saver, which delivers a variable 5.2% interest yearly.

Those that do choose to invest instead of putting their money into cash savings should do so with some level of caution Stanojevic added.

“Ultimately, investing is for the long term and it’s important not to get too caught up in trying to time the market, and instead keep focused on your long-term goals,” she concluded.