Fears that the US is headed for a recession sparkled a sell-off in global equities in early August and prompted fund managers and investors to assess the cyclical risk within their portfolios.

Evenlode Investment Management has developed a novel way to cap the cyclical risk within its Global Income strategy through risk-based position sizing (as opposed to a conviction-based approach).

Every stock is given a range of scores varying from A to E for different risk factors. Once the scores are in, the investment team debates the long-term fundamental risks for each business and sets a bespoke maximum position size.

Companies are allocated scores for the strength of their competitive advantages, the outlook and growth prospects for their specific industry, balance sheet leverage and cyclicality, among other factors. Risks can offset each other, for instance if a company scores poorly due to high cyclical risk, it needs to have a very strong balance sheet and net cash.

Kuehne+Nagel, one of the largest freight forwarders in the world, is highly correlated to global trade and scored a D for cyclicality. Evenlode’s maximum position size is about 2.5% of the portfolio to reflect Kuehne+Nagel's cyclical risks, said investment analyst Rob Strachan.

“If that company is looking very cheap on a valuation basis, if we had a conviction-based approach, we may be temped to have a large position in that company and then the portfolio would be exposed to some cyclical fundamental risks,” he explained.

Three-quarters of the Evenlode Global Income fund is held in companies scoring A or B for economic sensitivity, but there is some limited room for slightly more cyclical companies such as Kuehne+Nagel.

Every single stock in the fund must score an A or B for the strength of its moat – in other words, its competitive advantages – while companies scoring below a C for industry outlook and pricing power do not make it into the portfolio.

Derivatives exchange CME Group, in which the fund recently invested, is an example of a business with a durable moat. It dominates certain large asset classes such as US interest rate derivatives and derivatives for the S&P 500 index and its valuation is “quite reasonable”, Strachan said.

“CME scores an A for moat and pricing power, its strong scale-based cost advantages conferring a formidable competitive edge in derivatives trading. It receives a C for economic and operational sensitivity, given the volatility of its markets and the fixed-cost nature of its business," he explained.

Microsoft is a top scorer across the board so merits a 7% cap on position size. It achieved an A for its economic moat given that its Azure cloud business and Microsoft Office suite both have high switching costs. It also scored an A for pricing power and the long-term industry outlook, with global IT infrastructure spending set to increase.

Nonetheless, even though cyclical risk has been front and centre for investors in recent weeks, Evenlode did not make any changes to its portfolio in reaction to August’s volatility. Strachan said when he came into the office on 5 August and looked at his screens, the global equity market sell-off was merely “a point of interest”.

“We’re bottom-up investors looking for companies that can earn a higher return on capital over a very long time period,” he continued. “These are real companies doing real things in real life.” Share prices fluctuated but “fundamentally nothing changed about the businesses that we own”.

Meanwhile, the Evenlode Global Income fund has initiated new positions in Deutsche Börse and Pernod Ricard this year.

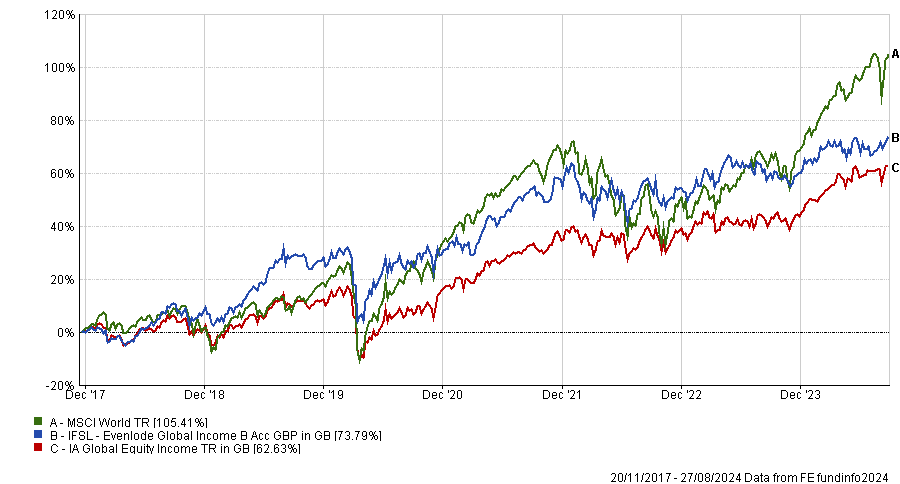

Performance of fund vs sector and benchmark since inception

Source: FE Analytics

Deutsche Börse is a well-diversified business with a dominant position in European interest rate derivatives, Strachan explained. It also houses a substantial international bond custody business, which is a duopoly, and offers software solutions to the financial services industry where there are high switching costs.

Portfolio manager Ben Peters said he added Diageo to the portfolio last year, then sold some of that position to fund an investment in Pernod Ricard this year to diversify the fund’s exposure to spirits brands.

Both stocks benefitted from higher demand for spirits to drink at home during Covid but have been weak performers recently, although he thinks their long-term growth prospects are strong.

Strachan added: “We would prefer businesses to not take on excess debt, as this increases the risk of damage in a downside scenario. Pernod Ricard scores a D for balance sheet, this reflects its 3x leverage ratio (net debt position compared to gross cash flow generated).

"It is critical to consider whether a business can bear the debt, and we reflect the risks associated with leverage in the maximum position size. For Pernod, this risk is mitigated by the defensive nature of the business. Much like people, no company is perfect and that is reflected in the risk factors.”