An initial rate cut, France’s tumultuous election and recent equity market volatility have changed the fortunes of many European funds.

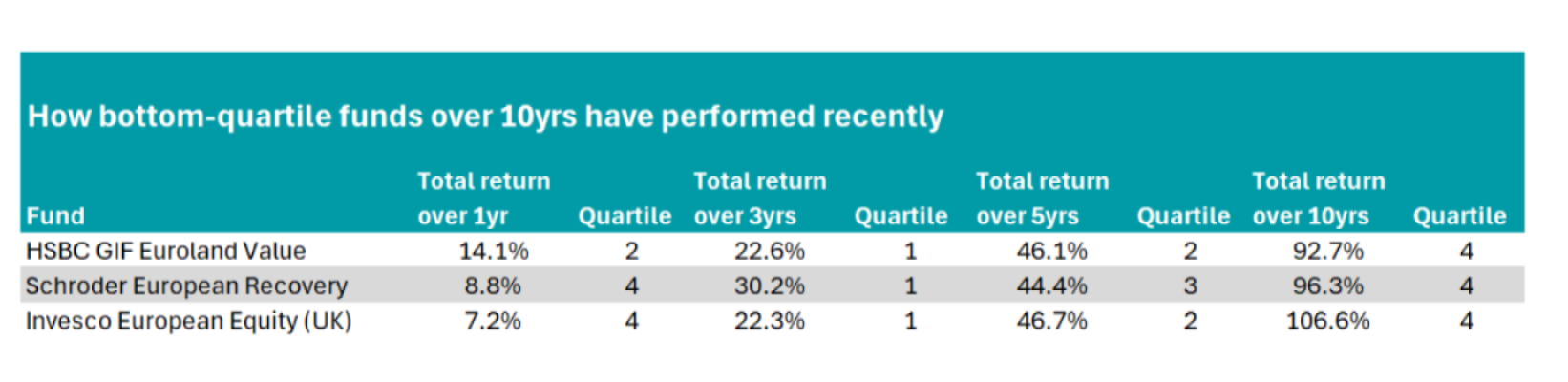

Schroder European Recovery, Invesco European Equity and HSBC GIF Euroland Value have all rebounded from disappointing long-term performance to achieve top-quartile returns more recently.

In this series, Trustnet looks at the funds that have been bottom-quartile performers in their peer groups over 10 years but have risen to the top 25% over the past three years. Below, we focus on the IA Europe Excluding UK sector.

How the bottom-quartile European ex-UK funds over 10 years have performed more recently

Source: FE Analytics

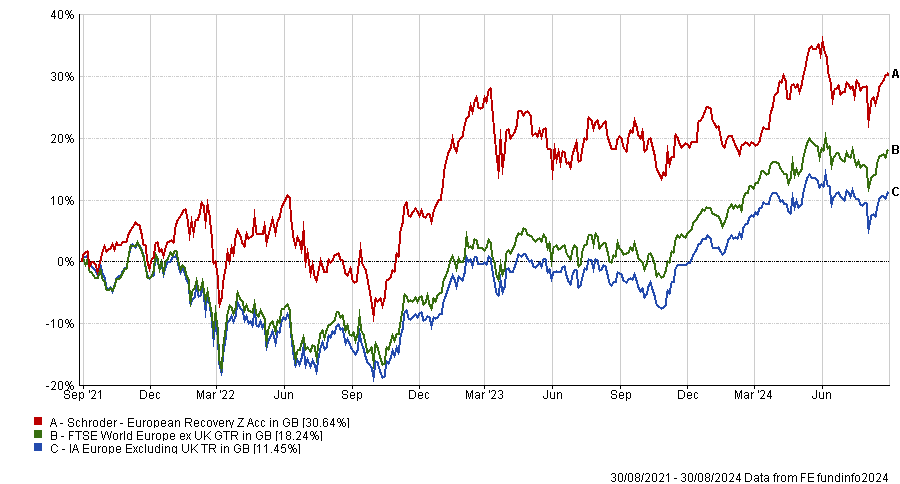

The Schroder European Recovery fund, co-managed by Andrew Evans and Andrew Lyddon since 2018, is one such example of a fund that has gone from ‘zero to hero’ over three years.

This fund holds an FE fundinfo Crown Rating of four. It has £323m in assets under management (AUM) and has experienced a remarkable turnaround, going from the bottom quartile in the long term to the fifth-best portfolio in its sector. The fund returned 30.6% for the three years ending 30 August 2024, versus 11.5% for its average sector peer.

Performance of fund vs sector and benchmark over 3yrs

Source: FE Analytics

Much of this progress is owed to a strong 2022, in which it was the sixth-best performing fund overall. This is particularly impressive given that 2022 was a poor year for the sector, with only 10% of funds generating returns greater than 1% that year. Schroder Recovery returned 6.6% in 2022, while its average sector peer suffered losses of 9%.

Nevertheless, it has not been entirely plain sailing for the fund across the three years. Despite strong performance in 2022, it dropped to the third quartile in 2023 and was bottom quartile for volatility across the period, effectively making it a high-risk investment.

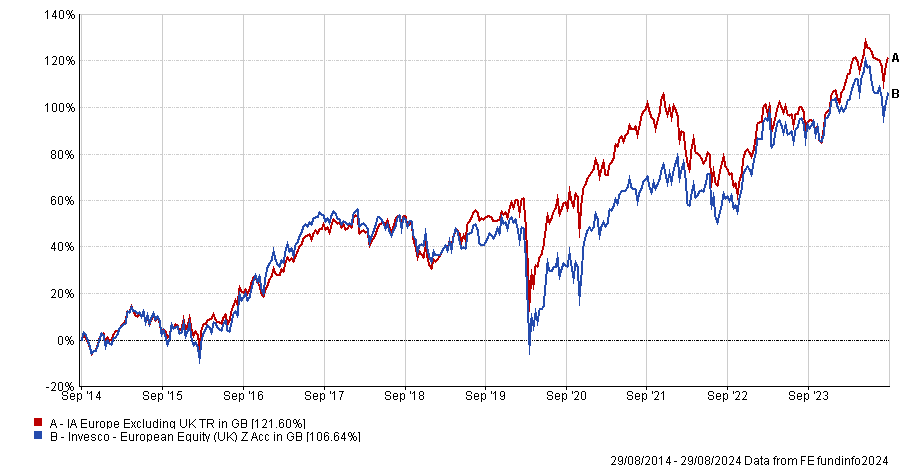

Next up is the £1.4bn Invesco European Equity fund, headed by James Rutland and John Surplice as of 2020. Over three years, this fund has seen a strong but more moderate rise than its Schroder competitor, but still rose from bottom to first quartile, up by nearly 22.3%.

Once again, this is the result of an impressive 2022, in which it ranked within the top 10 performers of the wider sector, and one of a handful of portfolios which saw a rise in value. In 2022, the fund returned 2.08%, one of just 13 funds to achieve positive returns that year.

Performance of fund vs sector and benchmark over 10 yrs

Source: FE Analytics

Additionally, the fund had more positive periods of growth and fewer negative periods than most of the sector, ranking within the top quartile for each category.

However, across one year, it dropped to the bottom 10 funds in terms of performance, despite a solid second-quartile position in 2023. Strong performances in 2023 and 2022 have largely enabled the fund to maintain its first quartile ranking over the wider period.

Finally, we have the £182.8m HSBC GIF Euroland Value fund, managed by Samir Essafri and Jeanne Follet. This has undergone a similarly impressive rise, moving from the bottom 10 funds in the sector over 10 years to a respectable first-quartile ranking over three, with returns of almost 23%.

Once again this was owed to a relatively impressive 2022. Despite making a modest loss of 2% that year, it lost comparatively less than most of its peer group.

Second-quartile performance in 2021 and 2022 propped the fund up and enabled it to see impressive relative returns. The fund has also performed quite well so far this year and has returned to the top 25% of the peer group.

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Nevertheless, with a top quartile maximum drawdown of -16.51%, one of the largest in the whole sector, its record has not been perfect, and it has proven to be an extremely volatile fund.

Previously in this series, we have looked at the UK Smaller Companies, UK Equity Income, emerging markets, IA Global and Global Equity Income, and the UK All Companies sectors.