Equity fund inflows fell to £535m in August, a three-quarters drop compared to the previous month and the lowest level since November 2023, the latest fund flow index by Calastone has revealed.

The panic sell-off on 5 August rocked the funds industry as investors pulled £206m out of the market, then bought the dip in the following two weeks, adding approximately £800m, to then take profits again at the end of the month to the tune of a further £200m.

In aggregate, there were still sizable positive inflows, but this was nowhere near the levels of last month’s report.

For Edward Glyn, head of global markets at Calastone, “nerves have clearly been rattled”.

“Investors flinched when global markets convulsed in early August, pushing equity prices worldwide down sharply and hitting ‘Magnificent Seven’ tech names in the US especially hard,” he said. “Once markets rebounded, investors chose to sit on the sidelines in the second half of the month, clearly wary of renewed turbulence.”

All major sectors were affected with net inflows down 59% for emerging market funds, followed by Europe (-58%), North America (-50%) and global funds (-35%).

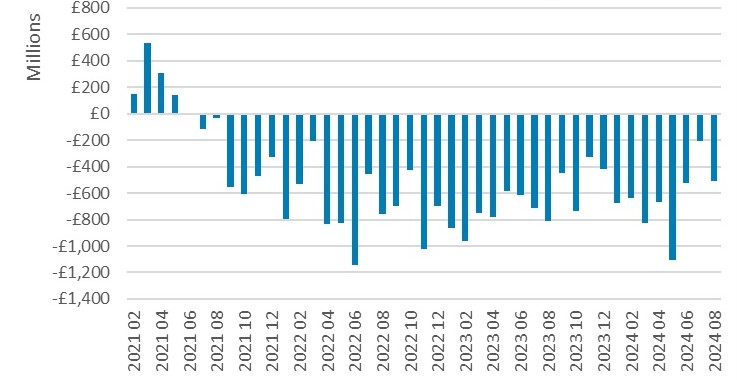

But it was UK funds that suffered the most. Investors pulled £510m from the domestic market last month, more than doubling July's figure, as the chart below shows.

However, this was still below the net selling average of £660m since outflows began in September 2021, which could give some investors some confidence.

Net flows of UK-focused equity funds

Source: Calastone

“Not only is the outflow less than the average for the past three years, but it was also less severe than might have been expected given the sharply reduced buying activity across other kinds of equity funds in August,” he said.

Yet he won’t be breaking out the champagne just yet, as the government’s “gloomy statements about the UK’s allegedly dire predicament are hardly going to boost confidence”.

But two months of better figures for fund flows “might herald the start of improving sentiment”.

Another surprise for Glyn was the negative sentiment towards fixed income, as bonds totalled a net £516m of outflows – their third-worst personal record after the Covid pandemic’s £3.6bn drop, and May 2024, when they dropped £643m.

This came despite “a sharp fall in US bond yields” as markets anticipated faster and steeper cuts in US interest rates, pushing US bond prices up while the bond market remained “broadly steady” in Europe and the UK.

It comes at a time when industry experts are recommending the exact opposite approach, including Vanguard’s head of portfolio construction Renzi Ricci, who recently told Trustnet that “it’s time to shift from overvalued equities into bonds”.

Instead, the elevated risk aversion has been pushing safe-haven money-market funds into the spotlight. Net purchases were £593m across the two Investment Association (IA) sectors, the highest level since August 2023.