From mid-July onwards, property has had one of its best runs since the pandemic. Its upswing coincided with a sell-off in global equity markets, proving the diversification credentials that real estate can bring to a portfolio.

UK property performed particularly well last month. The IT Property UK Residential was the best performing investment trust sector in August, up 7.5% for the month, while IT Property UK Healthcare took third place, returning 4%. Meanwhile in the open-ended fund universe, the IA Property Other sector topped the table, with average returns of 2.4%.

European property has also rebounded despite the region’s political and economic woes, said Chris Metcalfe, chief investment officer of IBOSS. He believes European real estate was a “star performer” because valuations were bouncing back after being “beaten up”.

IBOSS, which increased its global property exposure back in February, was well-placed to benefit from the recent rally and expects the strong run to continue.

“Given the current market dynamics and the historical resilience of property, we see continued growth potential in the property sector and are optimistic about its role in a diversified investment strategy,” the CIO said.

IBOSS was significantly underweight property in 2022 and 2023 but February 2024 was “an attractive entry point”.

“Property values had suffered due to the negative post-pandemic landscape and had to cope with the fastest and steepest rise in interest rates in a generation,” Metcalfe explained. “Pretty much everything was a headwind to property.”

Yet all that is changing this year, with interest rates coming down and valuations looking compelling. IBOSS’ medium risk portfolio now has a 6% allocation to property and Metcalfe expects to increase that to 7% in the coming months.

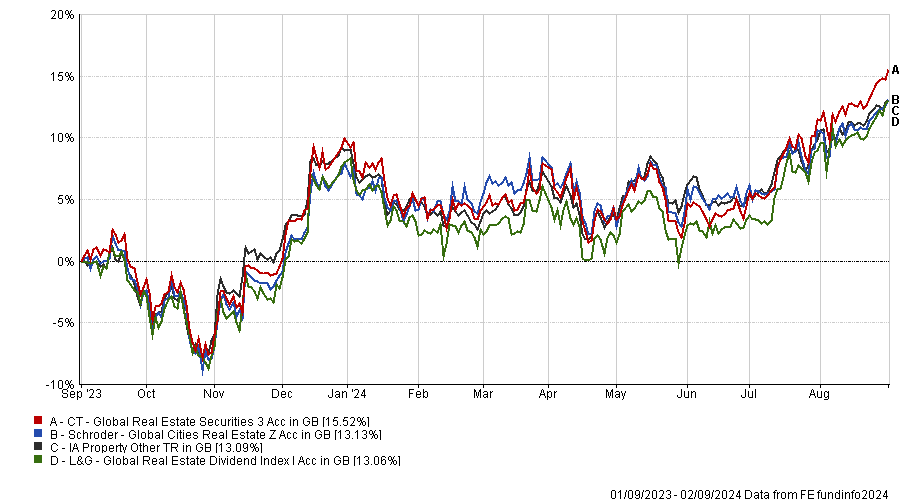

The discretionary fund manager currently holds three property funds: Schroder Global Cities Real Estate, CT Global Real Estate Securities and L&G Global Real Estate Dividend Index.

Performance of funds vs sector over 1yr

Source: FE Analytics

The passive L&G fund provides broad market exposure cheaply, Metcalfe said. However, he “slightly” prefers to use active managers in this space to take advantage of idiosyncratic opportunities and for their potential to outperform.

Almost two thirds (63%) of active global property managers have beaten their benchmarks over the past five years, he said. “There are not many sectors where you can say that.”

He chose Schroder Global Cities Real Estate for Schroders’ extensive resources, experience and “pedigree” in property, as well as this fund’s consistently strong track record.

Meanwhile, CT Global Real Estate Securities has a “reasonable” allocation to Asian markets, whereas many property funds focus solely on developed markets, he said. The Asia portion of the fund is managed passively, whereas the European and North American segments are actively managed by the experienced Marcus Phayre-Mudge.

“Combining passive and active approaches within one fund provides broad and diverse market coverage in a sector where maintaining sufficiently diversified assets can be more challenging,” Metcalfe explained.

IBOSS is investing in property for its diversification benefits as well as its return potential, even though the correlation between real estate, equities and bonds changes over time.

“There are periods where property closely correlates with either equities or bonds and periods where all correlations break down. This variability means that property can play an important role in a diversified portfolio, provided that the assets are not overvalued relative to their historical performance and other investment opportunities,” he noted.

Tyndall Investment Management has also increased its exposure to property recently by adding to its existing real estate investment trust (REIT) positions selectively.

Joe Holland, assistant investment manager, said: “At the vanguard of an interest rate cutting cycle and with high single-digit yields the norm in the investment trust sector, this is perhaps a good time to revisit allocations.”

Nonetheless, Tyndall is remaining cautious with any trusts that face refinancing issues, which would cause their cost of debt rise, potentially changing the investment case.

“Over the past few years, REITs such as Urban Logistics and Target Healthcare have performed relatively robustly on a net asset value (NAV) total return basis, offering positive returns over a five-year period despite the challenging environment for property investment,” Holland stated.

“However, share prices have gone down and then sideways. As a result, they now trade on discounts of 25% and 29% respectively, which we see as attractive in this improving economic environment as the Bank of England begins to cut interest rates.”

Other attractions of property include the yield and a degree of income protection against inflation, said John Husselbee, head of the Liontrust multi-asset team, which has a neutral stance on real estate.

He warned investors, however, that several types of property are facing “uncertainty in a post-Covid world”. “The anticipated demise of the office and high street retail sectors could be overstated but current pressures on tenants will have long-term repercussions,” he said.

“We tend to favour more specialist parts of the property market enjoying structural growth, such as healthcare, logistics and digital infrastructure. Property and infrastructure securities are often found to be trading at deep discounts to their NAVs.”