Inflation affects all investors, whether they be in retirement or planning for the future. It is the minimal hurdle rate that all savings need to beat for the value of a cash pot to be worth more in the future than it is today.

As such, it is crucial to forecast the expected long-term rate of inflation so that investors can put their money to work accordingly.

Richard Champion, co-chief investment officer at Canaccord Genuity Wealth Management, said his firm is using a marker of 2.5% as the long-run average for UK inflation over the next decade.

This is higher than it would have been a decade ago when he said most experts were modelling their returns on inflation of 2%.

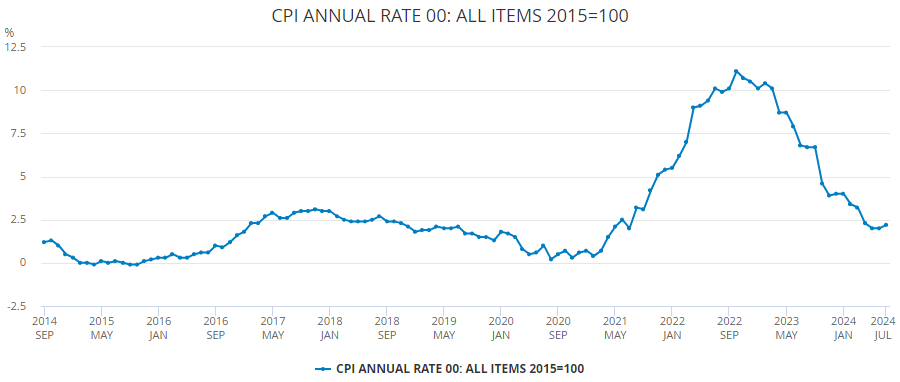

However, this undershot the reality. Following the rampant inflation between 2021 and 2023, the 10-year inflation average shot up to 2.8%, despite being subdued for much of the period. This gives him hope that 2.5% “isn’t a crazy number”.

UK CPI

Source: Office for National Statistics

Starting now, with inflation trending back to the 2% target coveted by central banks, Champion said there are reasons to believe that the Federal Reserve, Bank of England and others may have to accept a higher rate of inflation for some time to come.

“We think central banks will become more tolerant of 2-3% inflation than they have been before and there will be some evidence of that in the next few months as they cut rates even though inflation hasn’t got below 2%,” he said.

There are three main factors behind a higher long-term rate of inflation over the next decade than had been forecast for the previous one, according to the Canaccord Genuity co-CIO.

“It is not so popular at the moment but the greening of the economy is implicitly inflationary in terms of [the improvements needed in] the energy grid and infrastructure,” he said.

Another is the ageing of populations around the world, which he said “has some inflationary impacts”, although Champion noted this was “quite controversial” as others believe the trend will be deflationary.

Lastly, the onshoring of industrial capacity and the end of globalisation will create inflation, as people and companies have decided to trade off paying a bit more for the security that comes with sourcing products and services in their home market.

One example would be the move away from China as a manufacturing hub, particularly for US companies, who fear further sanctions between the two countries could cause difficult-to-navigate red tape.

Inflation has come back to the zeitgeist ever since it peaked at above 10%. Although returns from both equity and bond markets have been “nominally similar” in the 2020s so far compared to the preceding decade, in real terms it has been much tougher.

“In the 2010s central banks were giving out money for free, showering us all with money we didn’t need and it was quite easy to get real returns even if nominal returns weren’t particularly dramatic,” he said.

“We have had quite similar nominal returns so far this decade but we’ve got negative real returns. From a planner’s point of view, it is crucial to get the real number out at the end.”

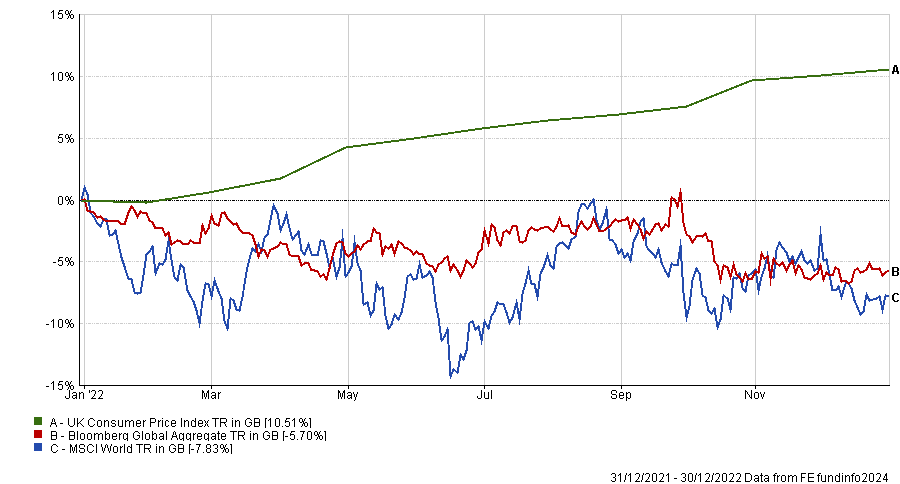

He pinpointed 2022 as an example. On average, global stocks lost 7.8% over the course of the year, while bonds were down 5.7%. In comparison, the UK Consumer Prices Index was up 10.5%.

Performance of indices in 2022

Source: FE Analytics

“People say it was a correction but in real terms it was a bear market,” he said.

Going forward, however, Champion said there are signs that things are getting much better for savers.

At the end of 2021 and into 2022, when inflation peaked, investors and savers had few options available to them.

“Equity markets were at incredibly high valuations and bonds were generating hardly any yield, so were expensive. It was difficult from a planning point of view to say ‘how can I generate clients real returns over the short and medium term’,” said Champion.

Now, however, there are better prospects. Stocks outside of the ‘Magnificent Seven’ US tech names “don’t look too expensive”, while bonds and other assets such as cash are yielding far more than his long-run average inflation expectations.