Asset management giant Invesco has launched Europe’s first exchange-traded fund (ETF) tracking the MSCI World Equal Weight Index to capitalise on the popularity of passive funds.

This year there has been a marked rise in the money attracted by global equity ETFs, which accumulated more than $35bn in new assets over the year-to-date, making it second only to US equity for ETF flows in 2024 so far.

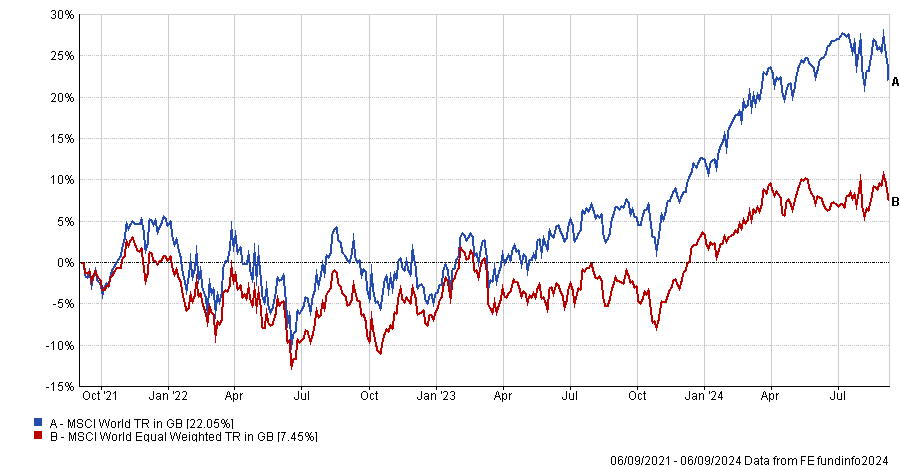

While the MSCI World Equal Weight Index has performed poorly compared to the wider MSCI World Index, as the below chart shows, analysts at Invesco said the ETF range could be attractive to investors concerned about global market volatility and the rise in concentration among some of the world’s biggest companies – notably the US ‘Magnificent Seven’.

Performance of the MSCI World Index vs MSCI World Equal Weight Index over 3yrs

Source: FE Analytics

Indeed, the MSCI World index has reached its highest concentration in more than 40 years, with the top 10 stocks now representing 25% of the total index, meaning that short-term volatility such as poor results from firms such as Nvidia can have outsized impacts on returns.

Gary Buxton, head of EMEA and APAC ETFs and indexed strategies at Invesco, said: “The sharp equity market sell-off in July – while relatively short-lived – provided a timely reminder of how quickly individual company fortunes and investor sentiment can change.”

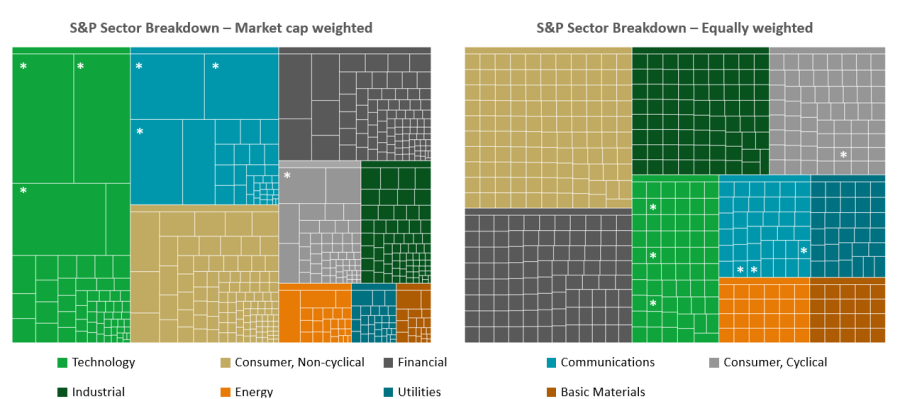

This overrepresentation of the top stocks can be seen in the composition of the S&P 500, which accounts for more than 70% of the MSCI World Index.

The charts below show two different depictions of the S&P 500, with the chart on the left showing the index divided by market cap, and the chart on the right showing the S&P 500 equally weighted, with each hold representing 0.2% per stock.

Breakdown of the S&P 500 by market cap and equal weights

Source: Liontrust, Bloomberg 31.07.24. *Representation of the ‘Magnificent Seven’

Analysts at Invesco added that this equal-weight approach would contribute to a more geographically balanced portfolio for investors, with the US allocation down to 42%.

Chris Mellor, head of EMEA equity ETF product management at Invesco, said: “That allows investors to capture increased exposure to Japan, the UK and other developed markets.”

The ETF joins Invesco’s existing S&P 500 Equal Weight and Nasdaq-100 Equal Weight UCITS ETFs.