Investors face a “serious dilemma” over how to save for retirement, according to Dzmitry Lipski, head of fund research at interactive investor (ii).

Conventional wisdom suggests moving a pension further down the risk scale the closer one approaches to 65 years of age (or sooner if retiring early), taking on more fixed income and ditching riskier assets such as equities.

But investors with limited assets “may find it difficult to build a portfolio that provides a comfortable retirement without fear of running out of money”, said Lipski.

Part of the problem is we are living longer. Someone retiring at 65 can still expect to live another 20 years or more, suggesting the need to keep growing their retirement pot.

Considering these risks, he noted that there is a place for both equities and bonds in any pension portfolio. Investors should also attempt to marry up income-producing investments with those that can provide capital growth.

Below he highlights the key areas within a pension portfolio and outlines funds that are suitable for each.

Fixed income

At present, investors have a real opportunity to make the most of high yields, with the Bank of England Base rate around 5% while both two and 10-year gilts are yielding 3.8%.

However, bonds have been out of favour recently. The main argument has been that they have tended to trend in the same direction as equities – a reversal of conventional wisdom which dictates bonds and stocks should have an inverse relationship (one falls when the other rises and vice versa).

In 2024 this traditional negative correlation has returned, meaning investors can once again use the bonds/stocks balance to provide a diversified portfolio, Lipski said.

With inflation cooling and central banks starting to cut interest rates, investors could consider investing in short-dated, high-quality government and corporate bonds “given the attractive yields offered”, he noted.

Therefore, global and strategic bond funds may make sense given their flexibility to invest across the fixed income landscape.

In terms of fund picks, Jupiter Strategic Bond got the nod in this area. Managed by “highly experienced managers” Ariel Bezalel and Harry Richards, the £2.3bn fund can “go anywhere” and the process includes both specific selection and macroeconomic calls.

At present, around 60% of the portfolio is invested in corporate bonds and over 20% is in government bonds.

“Given the fund’s flexibility and focus on downside protection, this makes it a strong core option for investors within a well-diversified portfolio,” he concluded.

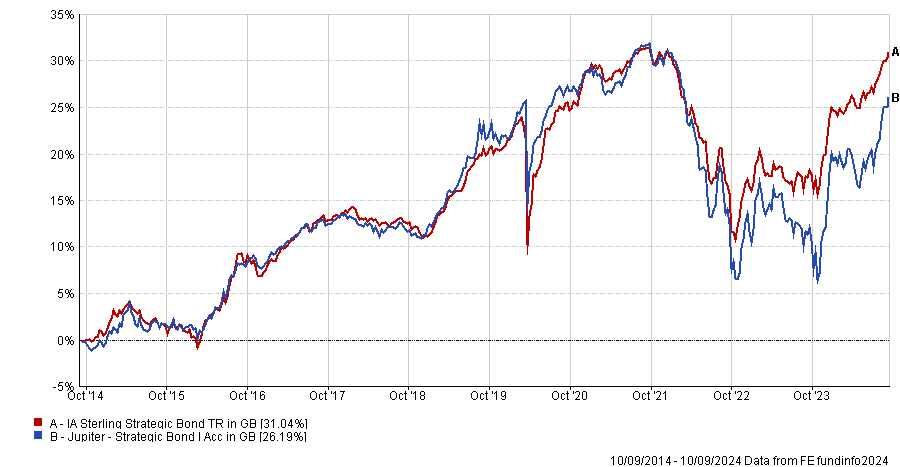

The current yield is a little over 5%, which Lipski said was “attractive”, and it has come into its own over the past 12 months, up 12.9%. However, performance has been weaker over longer periods, as the below chart shows.

Performance of fund vs sector over 10yrs

Source: FE Analytics

Equity income

Next up is the riskiest part of the portfolio: stocks. Here Lipski highlighted two options – one focused solely on the UK and the other taking a more global approach.

Up first is Artemis Income, which aims to provide investors with a steady and growing income along with capital growth over the longer term.

The portfolio is “well diversified”, he said, with between 50 and 70 holdings. Managers Adrian Frost, Nick Shenton, and Andy Marsh look for stable, well-established businesses with the financial strength to pay solid dividends to shareholders.

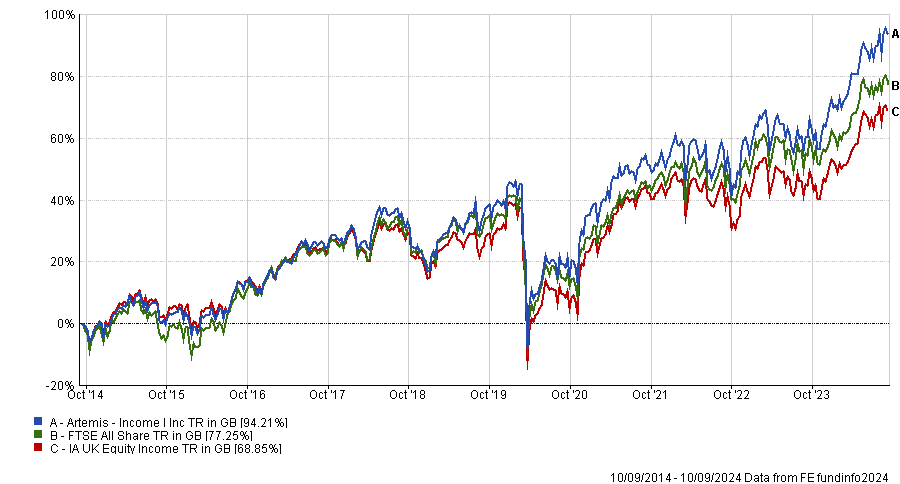

It has been a top-quartile performer in the IA UK Equity Income sector over one, three, five and 10 years, as the below chart shows.

“The fund provides a solid, core UK large-cap equity income exposure for investors, and the current yield is almost 4%.”

Performance of fund vs sector and benchmark over 10ys

Source: FE Analytics

Meanwhile, from a global perspective, Fidelity Global Dividend is the choice. It has a yield target of at least 125% of that on the MSCI All Country World Index, but aims to deliver both income and capital growth over the longer term by investing in “high-quality mega-cap companies”.

“Manager Daniel Roberts adopts a conservative strategy, focusing on companies with clear business models, healthy cash flows and minimal debt.”

Like the Artemis fund above, it has made top-quartile returns in its IA Global Equity Income sector over one and 10 years, although it has slipped to the second quartile over three and five years.

The multi-asset approach

Investing at present can be daunting, with much uncertainty ahead in the form of the US election and the potential for central bank mistakes in their fight to combat inflation.

For investors who don’t want to manage their equity and bond allocations individually (or for those seeking further downside protection), multi-asset strategies will take care of the weightings for investors.

Capital Gearing Trust is one such option as it aims to preserve capital over any 12-month period and to deliver returns above inflation over the longer term, marrying potential short-term risks with long-term rewards.

“Rather than using exotic strategies or derivatives, the trust’s approach to avoiding drawdowns has been to hold a highly diversified portfolio of assets with some to be negatively correlated to risk assets,” said Lipski.

Managed by Peter Spiller since 1982, the trust has proven its worth as a “preserver of wealth in bear markets”. Returns look middling over the short and medium term, with the fund lagging during bull markets, but it rose to the top of the IT Flexible Investment sector in both 2020 and 2018 when peers made losses.

“This trust is a good fit as a core holding due to its defensive stance and high levels of diversification,” said Lipski.